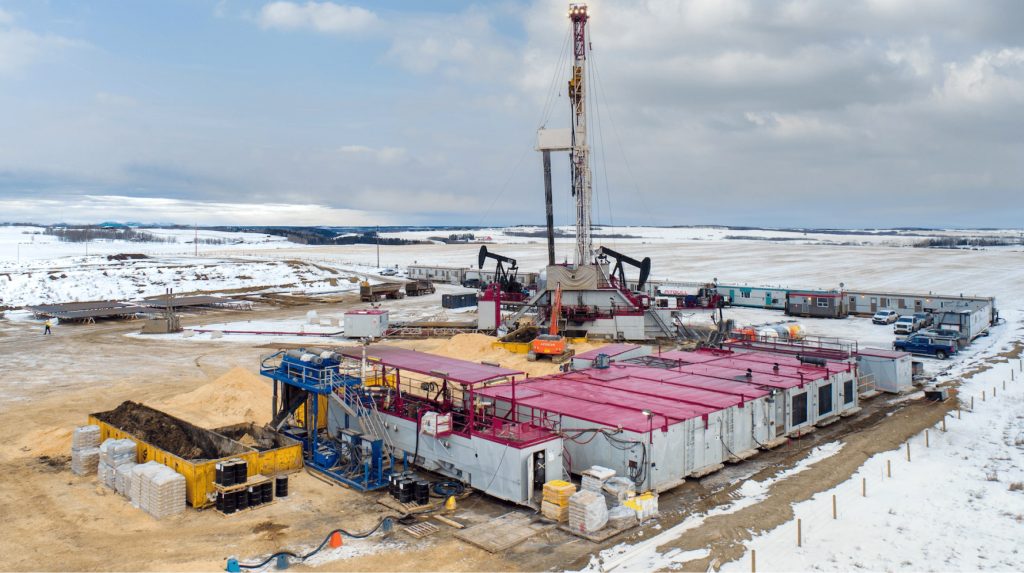

(WO) – VAALCO Energy has agreed to sell its non-core producing properties in Canada for approximately CAD $35 million (about USD $25.6 million), as the company continues to streamline its portfolio and focus capital on higher-return upstream opportunities.

The assets, which currently produce about 1,850 boed working interest, are expected to close within 30 days, subject to customary conditions. The transaction is effective Feb. 1, 2026.

VAALCO said the divestment supports its strategy of prioritizing core assets with active and planned drilling programs and stronger long-term growth potential. The Canadian properties have generated approximately CAD $82 million in operational cash flow since acquisition, with recent improvements in liquids production and drilling efficiency.

CEO George Maxwell said the company determined that the timing was right to monetize the non-core position and redeploy capital toward assets offering greater development upside. Proceeds from the sale are not expected to impact VAALCO’s borrowing base and will support continued investment in key producing regions.

The company said it remains focused on advancing large-scale drilling campaigns and development programs across its core portfolio, where it sees the strongest potential for future production and cash flow growth.