OPEC+ is expected to reaffirm its decision to keep oil production steady through the first quarter of 2026 when key members meet on Sunday, despite rising geopolitical tensions and fresh uncertainty surrounding Venezuela, according to multiple delegates and industry sources.

The eight OPEC+ countries currently implementing voluntary production curbs — Saudi Arabia, Russia, the UAE, Iraq, Kuwait, Kazakhstan, Algeria, and Oman — agreed in November to pause planned output increases for January through March, citing seasonal demand weakness. Delegates say that stance remains intact, even after the shock U.S. capture of Venezuelan President Nicolas Maduro and a highly publicized rift between Saudi Arabia and the United Arab Emirates.

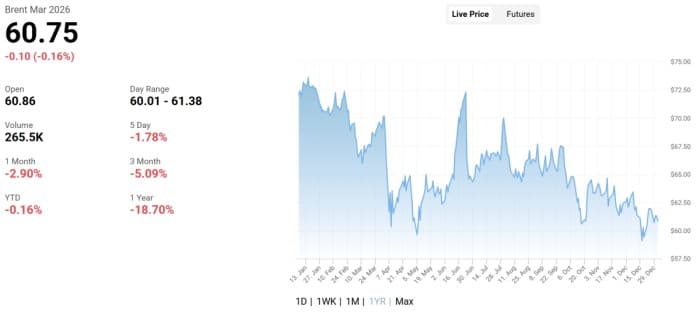

Oil prices fell more than 18% in 2025, marking their steepest annual decline since the pandemic, as supply growth from OPEC+ and non-OPEC producers collided with slowing demand and mounting forecasts of a sizable glut in 2026. Against that backdrop, analysts see little incentive for the group to loosen the taps further in the near term.

While Venezuela holds the world’s largest proven oil reserves, its current output accounts for less than 1% of global supply. U.S. President Donald Trump has said American oil companies could invest billions to rebuild the country’s energy infrastructure following Maduro’s capture, but analysts widely agree any material increase in Venezuelan production would take years to materialize. For now, OPEC+ delegates say developments in Caracas are unlikely to influence immediate supply policy, though they could become more relevant later in the year.

The meeting also comes amid rare public friction between Riyadh and Abu Dhabi over Yemen, where the two longtime allies have backed opposing factions. Recent Saudi-led airstrikes and the UAE’s subsequent decision to withdraw remaining forces have underscored the strain. Still, market watchers note that OPEC has historically maintained cohesion through far more severe political crises, from the Iran-Iraq war to sanctions on major producers.

For now, OPEC+ appears focused on price stability rather than geopolitics. Holding output steady through the first quarter is widely seen as the safest course as the group navigates oversupplied markets, fragile demand growth, and an increasingly volatile geopolitical landscape.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com