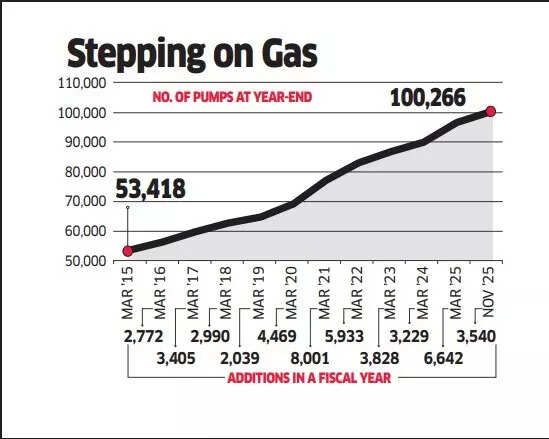

New Delhi: India’s petrol pump network has crossed the 100,000 mark, nearly doubling over the past decade as state-run oil companies rolled out outlets aggressively to serve a vehicle boom and push fuel access deeper into rural areas.

India now has the world’s third-largest fuel retail network, behind the US and China, which each operate 110,000-120,000 pumps across far larger geographies.

The expansion has largely resolved access constraints in rural and remote regions and improved customer service by intensifying competition, said B Ashok, former chairman of Indian Oil Corp.

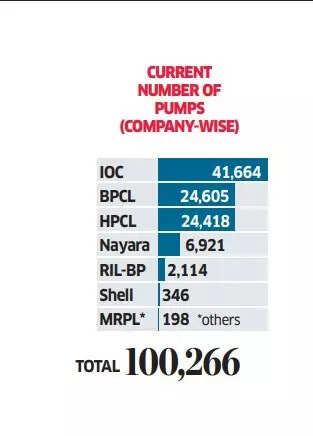

Private cos control less than 10 per cent

Rural outlets now account for 29 per cent of total pumps, up from 22 per cent a decade ago. The character of fuel stations too has changed: once limited to petrol and diesel, around one-third of outlets now offer alternative fuels, including CNG and EV charging.

Despite policy reforms over the past decade, the private sector controls less than 10 per cent of India’s pumps. Reliance Industries operates about 2,100 outlets, while Nayara Energy runs around 6,900. Persistent government influence over pump prices has constrained private investment. Some industry executives, however, question whether such rapid expansion is economically sustainable.

In April, Harish Mehta, then CEO of Reliance BP Mobility, said India had too many fuel stations, many of them unproductive. “I strongly believe that India is an overpopulated fuel retail country,” he said at a public event, citing Indonesia, which has only 9,000 fuel stations.

“There is a mad scramble for market share,” Ashok said. “Companies fear that if they don’t set up new pumps, competitors will, and eat into their market share. New outlets also add sales, helping offset volume losses at existing pumps due to rising competition.”

India’s petrol consumption has risen 110 per cent over the past decade, while diesel demand has grown 32 per cent, taking combined petrol and diesel volumes up by nearly 50 per cent. Average diesel sales per outlet are about double those of petrol.

That demand growth, however, has not been sufficient to support the pace of retail expansion, Ashok said. “There are many pumps selling unsustainably low volumes, but dealers are reluctant to shut them because of the prestige attached, especially in smaller towns and rural areas,” he said, adding that companies also face a complex process to close outlets.

The problem of economic unviability is visible outside cities, said Nitin Goyal, treasurer of the All India Petroleum Dealers Association (AIPDA). “The government needs to ensure a balance so older pumps remain viable,” he said.

Industry executives expect the retail network to plateau, arguing that India now has enough pumps to meet current and future fuel demand for many years. In the US, the number of fuel stations has declined over time as competition forced inefficient outlets to shut. “The US has a fully deregulated market, but in India pump prices are nearly identical. Still, outlets with unsustainably low volumes may eventually exit,” Goyal said.

The addition of gas and charging facilities is expected to boost revenues at fuel retail outlets as alternative fuel-powered vehicles gain traction, executives said, adding that the move will expand customer choice while improving the long-term sustainability of fuel stations.