Japan moves closer to restarting 8.2 GW Kashiwazaki-Kariwa nuclear plant, a critical step in cutting fossil fuel imports and stabilising power prices

Regional approval highlights political risk and community resistance that still shape nuclear governance nearly 15 years after Fukushima

TEPCO pledges $641 million in local investment as financial and social license becomes central to Japan’s nuclear revival

Japan has taken a decisive step toward restarting the world’s largest nuclear power plant after a regional assembly vote cleared the final political hurdle for Kashiwazaki-Kariwa to resume operations. The decision marks a turning point in the country’s energy strategy as it seeks to reduce dependence on imported fossil fuels and meet climate and energy security goals, while still grappling with deep public unease rooted in the 2011 Fukushima disaster.

Located roughly 220 kilometres northwest of Tokyo, Kashiwazaki-Kariwa was among 54 reactors taken offline after the earthquake and tsunami that crippled the Fukushima Daiichi plant in the worst nuclear accident since Chernobyl. Nearly 15 years later, Japan has restarted 14 of the 33 reactors still considered operable. Kashiwazaki-Kariwa would become the first nuclear facility restarted under the operator Tokyo Electric Power Co, the same utility that ran Fukushima Daiichi.

A Political Green Light With Conditions

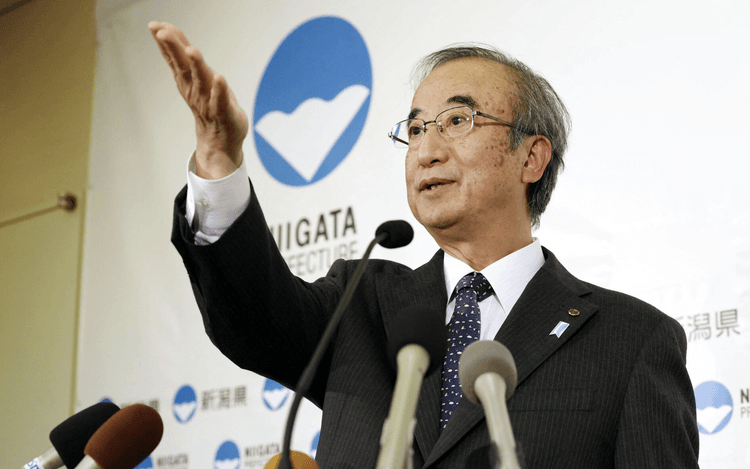

On Monday, Niigata prefecture’s assembly passed a vote of confidence in Governor Hideyo Hanazumi, who had formally backed the plant’s restart last month. The vote effectively removes the last regional barrier to resuming operations.

“This is a milestone, but this is not the end,” Hanazumi told reporters after the vote. “There is no end in terms of ensuring the safety of Niigata residents.”

While the outcome gives the central government and TEPCO momentum, the assembly’s final session of the year underscored persistent political and social divisions. Lawmakers opposing the restart argued that the approval process failed to reflect public sentiment in a prefecture that hosts one of the most symbolically sensitive assets in Japan’s energy system.

“This is nothing other than a political settlement that does not take into account the will of the Niigata residents,” one assembly member said as the vote was about to begin.

Community Resistance Remains Visible

Outside the assembly building, roughly 300 protesters gathered in winter conditions holding banners reading “No Nukes,” “We oppose the restart of Kashiwazaki-Kariwa” and “Support Fukushima.” For many residents, the vote reopened fears that have never fully receded since 2011.

“I am truly angry from the bottom of my heart,” said Kenichiro Ishiyama, a 77-year-old protester from Niigata city. “If something was to happen at the plant, we would be the ones to suffer the consequences.”

The protests reflect a broader challenge facing Japan’s nuclear strategy. While national policy increasingly frames nuclear energy as a low carbon baseload solution, local consent remains fragile, especially in regions that would bear the immediate consequences of any failure.

RELATED ARTICLE: Japan to Formulate New National Strategy for Green Transformation by 2040

Scale, Capacity And Energy Security

Kashiwazaki-Kariwa has a total capacity of 8.2 gigawatts, enough to supply electricity to several million households. Public broadcaster NHK reported that TEPCO is considering reactivating the first of the plant’s seven reactors as early as January 20. The initial restart would bring one 1.36 GW unit online next year, with another unit of the same capacity targeted for around 2030.

From a system perspective, even a partial restart would materially strengthen Japan’s power balance, particularly as global fuel markets remain volatile and the country remains heavily reliant on imported liquefied natural gas and coal.

TEPCO’s Commitments And Market Response

TEPCO has sought to bolster its case by pledging long-term financial support for the region. Earlier this year, the utility committed to inject 100 billion yen, about $641 million, into Niigata prefecture over the next decade to support local development and secure community backing.

“We remain firmly committed to never repeating such an accident and ensuring Niigata residents never experience anything similar,” said TEPCO spokesperson Masakatsu Takata, who declined to comment on the precise timing of the restart.

Financial markets reacted positively. TEPCO shares closed up 2 percent in afternoon trading in Tokyo, outperforming the Nikkei index, which gained 1.8 percent.

Why This Matters Beyond Japan

For global investors and policymakers, Kashiwazaki-Kariwa’s restart illustrates how nuclear energy is being re-evaluated as part of decarbonisation strategies, but only within tight governance and social constraints. Japan’s experience shows that climate-aligned energy policy does not end at regulatory approval. It extends into regional politics, corporate accountability and long-term trust rebuilding.

As countries reconsider nuclear power to meet net-zero targets, Japan’s cautious, contested path back to nuclear generation will remain a closely watched test case for balancing climate urgency with public consent.

Follow ESG News on LinkedIn