OpenAI isn’t trimming its sails.

In a pair of videos and an accompanying chart, top OpenAI executives made the case that the startup’s biggest risk might be not spending enough on securing future compute, even though the company has already committed roughly $1.4 trillion on data center projects over the next eight years and is, according to CEO Sam Altman, five years away from profitability.

“We want to be ahead of the curve,” OpenAI President Greg Brockman said in a video posted on X. “And the truth is, I don’t think we will be, no matter how ambitious we can dream of being right now. I think demand will far exceed what we can think of.”

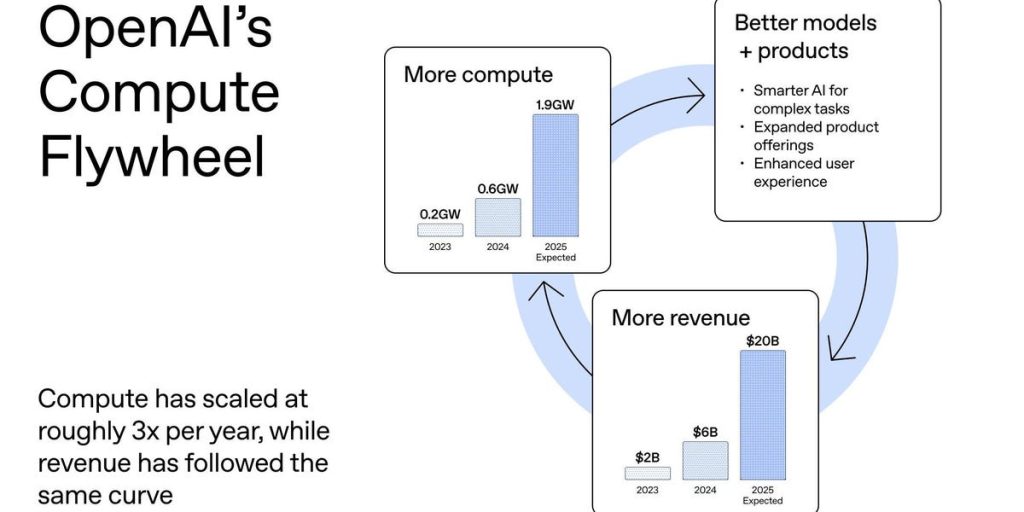

In the chart, OpenAI illustrated how “more compute” leads to “better products,” which in turn leads to “more revenue.”

Brockman and his fellow OpenAI executives have said for months that the dearth of compute available to OpenAI is holding the company back, forcing it to make tough trade-offs and delaying launches.

“When we look at our launch calendar, the single biggest blocker often becomes, ‘Ok, but where’s the compute going to come from for that?'”

As an example, Brockman said that when OpenAI launched its image generator in March, it had to make “some very painful decisions to take a bunch of compute from research” in order to meet demand for the service.

Ronnie Chatterji, a top economist in the Biden administration, said countries around the world, including China, are making big investments in AI infrastructure.

“People are worried about whether people are trying to do too much,” Chatterji said in a video OpenAI published on X. “I just encourage people to think about and consider, what if we’re not moving fast enough? What if we’re investing too little?”

OpenAI isn’t the only company wanting to go all in

Meta CEO Mark Zuckerberg said in September that the biggest risk for his company “is probably in not being aggressive enough.”

“If we end up misspending a couple of hundred billion dollars, I think that that is going to be very unfortunate, obviously,” Zuckerberg said on an episode of the “Access” podcast. “But what I’d say is I actually think the risk is higher on the other side.”

Anthropic CEO Dario Amodei, who led the development of GPT-2 and 3 at OpenAI before starting his rival company, recently said that part of the difficulty is that companies have to make bets years in advance on what the demand might be. Still, Amodei offered some veiled criticism of people in the industry who are “YOLOing,” which was viewed as a shot at Altman.

“I have to decide now, literally now, or in some cases a few months ago, how much compute I need to buy — to serve the models in early 2027 when I get to that revenue amount,” Amodei said during The New York Times’ DealBook Summit.

Unlike Meta, Google, and other hyperscalers, OpenAI doesn’t have a large dedicated revenue base to fall back on if its bets don’t pay off.

Last month, OpenAI CFO Sarah Friar sparked concerns when she spoke of a “government backstop” for data center spending. She later walked back those remarks, and Altman said OpenAI believed “taxpayers should not bail out companies that make bad business decisions.”

“If we get it wrong, that’s on us,” Altman wrote on X.