Oil pushed higher as equities rose and traders weighed the prospect of a Ukraine-Russia peace deal that could deflate political risk from an already well-supplied market.

West Texas Intermediate rose about 1.3% to settle near $59 per barrel, snapping a three day losing streak as crude ticks up following its biggest weekly loss since early October.

While oil followed other risk assets higher, traders awaited further news after Ukraine and its European allies signaled that key sticking points remained in US-brokered peace talks to end Russia’s invasion, even as senior officials hailed progress in winning more favorable terms for Kyiv.

“Something good just may be happening,” President Donald Trump wrote in a Truth Social post about the talks.

An end to the hostiltites would also take some risk premium out of the market.

“Oil markets are moving in sympathy with equities and awaiting on more news of the Ukraine/Russia talks” said Dennis Kissler, senior vice president for trading at BOK Financial. He expects continued choppy trading and some short covering into the holiday period.

Crude has slumped this year, with futures on course for a fourth monthly loss in November, in what would be the longest losing run since 2023. The decline has been driven by expanded global output, including from OPEC+, with the International Energy Agency forecasting a record surplus for 2026. Traders are monitoring whether a deal on Ukraine will materialize, and if sanctions on Russia will be lifted — developments that could inject more supply.

“We should expect a nervous oil market ahead of Thanksgiving on Thursday,” said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management. “Several factors point to a peace agreement or possibly a ceasefire moving closer over the weekend, which supports further price declines this week.”

Ukraine President Volodymyr Zelenskiy said Monday that talks had reached a “critical moment” as he indicated that discussions over territory and sovereignty would prove difficult.

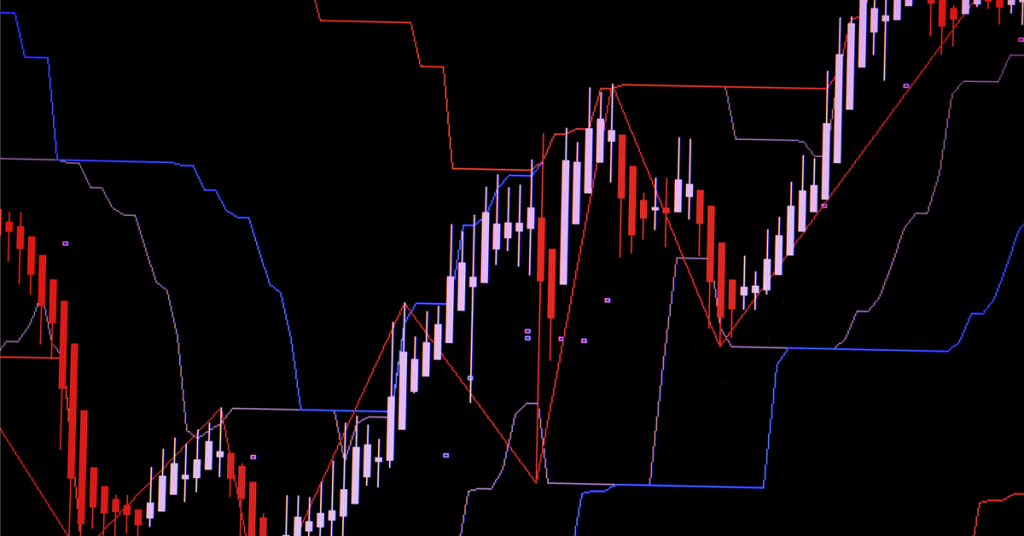

Oil Prices

WTI for January delivery was up 1.3% to settle at $58.84 a barrel in New York.

Brent for January settlement rose 1.3% to $63.37 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

element

var scriptTag = document.createElement(‘script’);

scriptTag.src = url;

scriptTag.async = true;

scriptTag.onload = implementationCode;

scriptTag.onreadystatechange = implementationCode;

location.appendChild(scriptTag);

};

var div = document.getElementById(‘rigzonelogo’);

div.innerHTML += ” +

‘‘ +

”;

var initJobSearch = function () {

//console.log(“call back”);

}

var addMetaPixel = function () {

if (-1 > -1 || -1 > -1) {

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

} else if (0 > -1 && 70 > -1)

{

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

}

}

// function gtmFunctionForLayout()

// {

//loadJS(“https://www.googletagmanager.com/gtag/js?id=G-K6ZDLWV6VX”, initJobSearch, document.body);

//}

// window.onload = (e => {

// setTimeout(

// function () {

// document.addEventListener(“DOMContentLoaded”, function () {

// // Select all anchor elements with class ‘ui-tabs-anchor’

// const anchors = document.querySelectorAll(‘a .ui-tabs-anchor’);

// // Loop through each anchor and remove the role attribute if it is set to “presentation”

// anchors.forEach(anchor => {

// if (anchor.getAttribute(‘role’) === ‘presentation’) {

// anchor.removeAttribute(‘role’);

// }

// });

// });

// }

// , 200);

//});