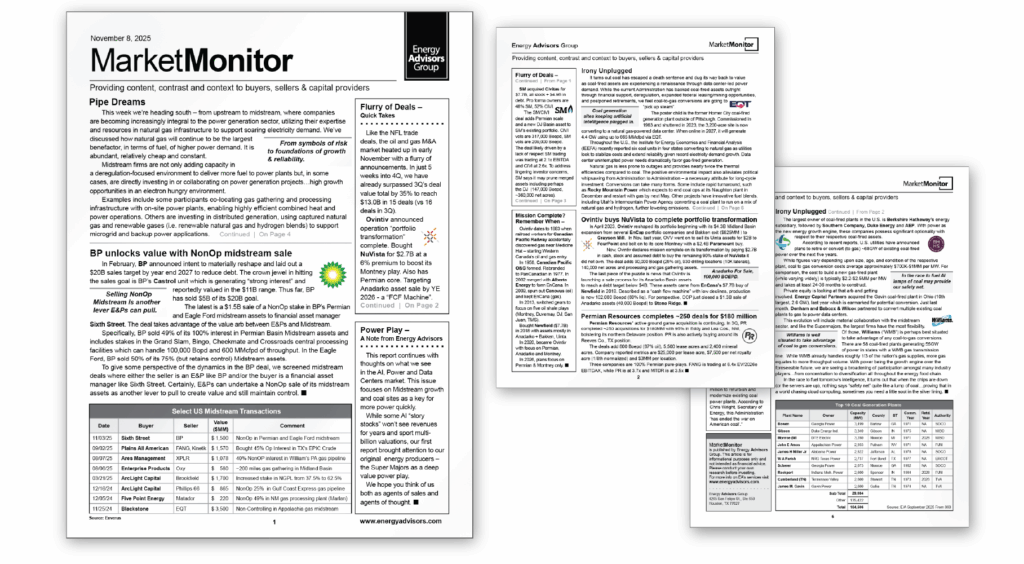

(Oil and Gas 360) – Energy Advisors recently released its latest edition of its MarketMonitor series, which continues the theme emphasizing the role of traditional energy companies in building out more power for AI and data centers. Some “story-metric” AI companies have multi-billion-dollar market caps and don’t generate any revenue… and likely won’t for many, many years.

Earlier, we laid the groundwork on the scale of AI’s power demands and highlighted natural gas as the overriding preferred generation in the U.S. It is abundant, relatively cheap, and constant. We wrote about what seems to be overlooked in the AI power grab – those with the longest histories of producing energy, the SuperMajors. Confirming our theme, this week Chevron announced its first power project in West Texas. Citing attractive returns, Chevron plans a massive 2.5GW (expandable to 5.0 GW) gas-fired power-gen project in West Texas. Critically, the equipment is already secured and planned startup is targeted in 2027.

Moving On From SuperMajors To Midstream and Coal

Pipe Dreams and Irony Unplugged

Our latest MarketMonitor reveals the midstream sector emerging as a central player in meeting the nation’s accelerating power needs. As electricity demand surges—midstream operators are extending well beyond their traditional role as fuel transporters and becoming direct contributors to power generation and grid stability. According to Brian Lidsky, Director of Energy Advisors, “midstream companies are quietly becoming the utility of power growth. These dependable yield-oriented companies are now layering a power-related growth engine.”

Midstream companies are responding by expanding capacity in deregulated markets and investing in power generation assets that strengthen their strategic positioning. Some operators are co-locating gathering systems with power plants to enable highly efficient combined heat and power operations, while others are pursuing distributed generation projects utilizing conventional gas, renewable natural gas, and hydrogen blends.

Gas-fired demand from AI data centers could add up to 3.3 Bcf/d of incremental load by 2030. Companies such as Williams, Energy Transfer, Kinder Morgan, and Enbridge have already begun allocating billions toward new or expanded gas-fired generation capacity. Williams—responsible for transporting roughly one-third of the nation’s natural gas—has allocated over 75% of its 2025 CAPEX to growth capital. Earlier this month, WMB announced plans to invest another $3 billion to enhance its gas-fired power generation capacity.

We also point to a revival of coal-fired infrastructure—not as coal plants, but as prime candidates for coal-to-gas conversions. With more than 68 GW of coal capacity set for retirement or conversion within five years, these sites offer existing transmission interconnects and acreage suited for rapid redevelopment. A flagship example is the former Homer City plant near Pittsburgh, now being converted into a 4.4-GW natural-gas-powered data center projected to come online in 2027. Private equity is also entering the space, targeting aging coal facilities for transformation into gas-powered assets that support data-center reliability.

A&D Accelerating (4Q already 35% ahead of 3Q total)

Our report also confirms a trend we wrote about in early October. With year-end approaching and oil and gas seeing increasing demand for decades to come, we’ve seen a burst of M&A activity. In just the first five weeks of Q4, more than $13 billion in transactions were announced—already 35% above the previous quarter’s total.

We write about BP’s sale of nonop interests in its Permian and Eagle Ford midstream assets, SM and Civitas merger, Ovintiv’s buy of NuVista (along with its planned Anadarko exit), multiple sales by Amplify and Cresent Energy and Permian Resources ground game (~250 deals for $180 million in 3Q).

About Energy Advisors oilandgas360.com contributor

Energy Advisors is a leading firm in oil and gas transaction advisory services and thought leadership having served the industry for over 35 years. We trace our roots back to PLS Inc which sold its listing service, research, and databases to DrillingInfo in 2018 and rebranded its advisory and marketing arm as Energy Advisors in 2019.

Contacts:

Brian Lidsky

Director of Research

713-600-0138

blidsky@energyadvisors.com

Blake Dornak

VP, Marketing

713-600-0123

bdornak@energyadvisors.com

The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of Oil & Gas 360. Please consult with a professional before making any decisions based on the information provided here. The information presented in this article is not intended as financial advice. Contact Energy Advisors for the full report. Please conduct your own research before making any investment decisions.