The key Russian oil port of Novorossiysk on the Black Sea suspended oil exports on Friday, following a major Ukrainian attack on the port overnight.

Friday, November 14, 2025

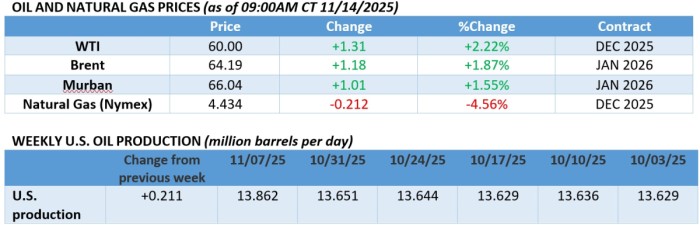

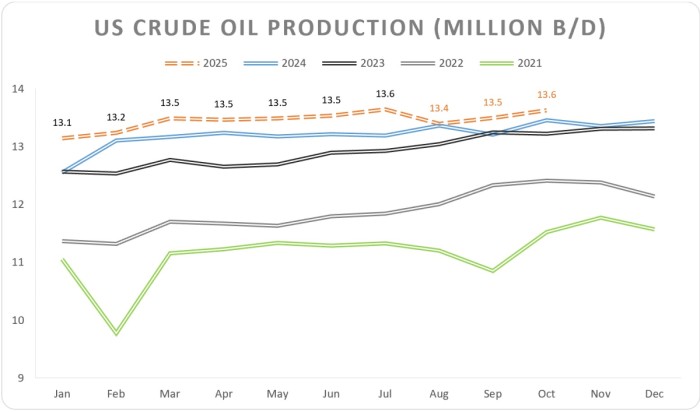

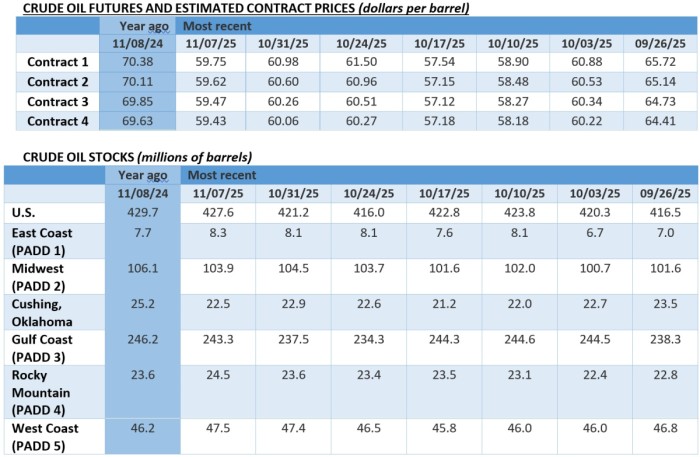

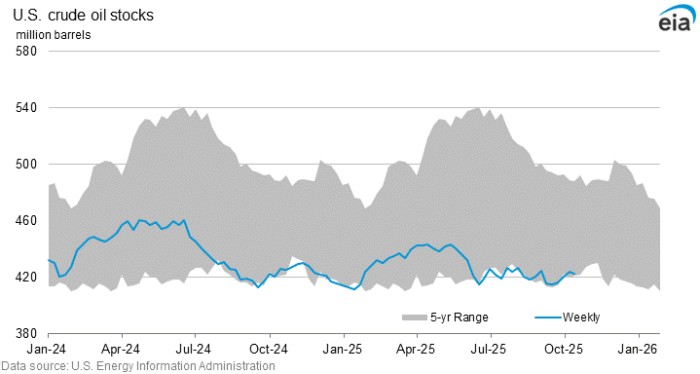

The Russia-Ukraine war rages on, with Ukraine’s drone attacks temporarily halting oil loadings in Russia’s largest Black Sea port, however, even such a high-impact event was only able to recoup the past days’ losses and reset ICE Brent at $64 per barrel. Oil bulls’ sentiment was dampened by this week’s monthly reports from the IEA and OPEC, particularly with the latter jumping on the 2026 oversupply bandwagon after months of predicting a supply deficit.

IEA Worsens 2026 Oversupply Outlook. The International Energy Agency revised its 2026 outlook by lifting supply growth to 2.5 million b/d and curbing demand growth to just 770,000 b/d, now expecting a whopping 4.1 million b/d surplus next year, equivalent to 4% of global crude demand.

Ukraine Drone Strikes Halt Black Sea Loadings. Russia’s largest Black Sea port of Novorossiysk temporarily suspended oil exports after an overnight drone attack by Ukraine that hit an oil depot and a docked ship, restricting some 2.2 million b/d of supply as the CPC terminal stopped loading, too.

Lukoil Assets Have a New Potential Buyer. US private equity firm Carlyle is reportedly considering buying the foreign assets of Russian oil major Lukoil (MCOX:LKOH), worth some $22 billion, planning to apply for a license from the Trump administration to buy the assets before beginning due diligence.

Colombia Announces Retreat from US Shale. Colombia’s government is moving ahead with its plan to sell assets owned by the state oil company Ecopetrol (NYSE:EC) in the US Permian Basin, just as the joint venture with Occidental Petroleum ramped up production to 116,000 boe/d, as of Q2 2025.

Related: Ukraine Intensifies Campaign Targeting Russia’s Vital Oil Lifeline

Greenland to Drill Its First Well in 2026. Greenland-focused upstream firm Greenland Energy will drill its first exploration well in the country, OPW-1, in the summer of 2026, marking the first appraisal of the Jameson Land Basin, believed to be an untapped multi-billion-barrel play.

Kurdish Crude Gets Stranded Off Egypt. A month pipeline flows were restarted in the Kirkuk-Ceyhan pipeline and crude oil from Iraqi Kurdistan started flowing to markets again, two laden tankers have been idle off the Egyptian coast for two weeks, signalling potential demand issues.

US Concludes Trump’s First SPR Purchase. The Trump administration has finalized its first purchase of crude for the US Strategic Petroleum Reserve, buying 900,000 barrels of sour crude from global trading giant Trafigura and US midstream firm Energy Transfer at an average price of $62 per barrel.

Nigeria Drops Fuel Import Tariff Drive. Nigeria’s government has scrapped its plans to impose a 15% import duty on all refined products, citing assurances of adequate supply during the year-end holidays, amidst retailer protests that it would leave them dependent on the Dangote refinery.

Maritime Incident Roils Middle East. The UK Maritime Trade Operations center warned of an incident off the UAE coast, reporting a sudden course deviation on a tanker (reported to be the Marshall Islands-flagged Talara) sailing towards Singapore after it had been approached by three small boats.

Chinese Power Generation Hits New Record. According to China’s statistics bureau NBS, electricity generation in October soared to an all-time high of 800.2 billion KWh, an 8% increase from a year ago due to an increase in heating demand amidst an unseasonably cold last month.

Canada Fast-Tracks Upcoming LNG Projects. The Canadian government proposed adding the upcoming 12 mtpa Ksi Lisims LNG terminal to the country’s Major Projects list, fast-tracking its regulatory approval process in a bid to ensure the Blackstone-backed project sees a long-anticipated FID next year.

Argentina Eases Rules to Bolster Mining Investment. Argentina’s Milei government is mulling changes to the country’s federal regulations by eliminating provisions that protect glacial formations in the ore-rich Andes mountain range, helping Glencore (LON:GLEN) launch its $10 billion El Pachon copper project.

Weak Chinese Data Sinks Copper Rally. China reported industrial output growth of 4.9% last month, the slowest pace in more than a year, putting an end to a four-session hot streak for copper futures as the three-month LME contract corrected downwards to $10,865 per metric tonne.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com