WASHINGTON (AP) — Two Federal Reserve officials expressed opposition Wednesday to another interest rate cut at the central bank’s next meeting in December, further muddying the outlook for the Fed’s next steps.

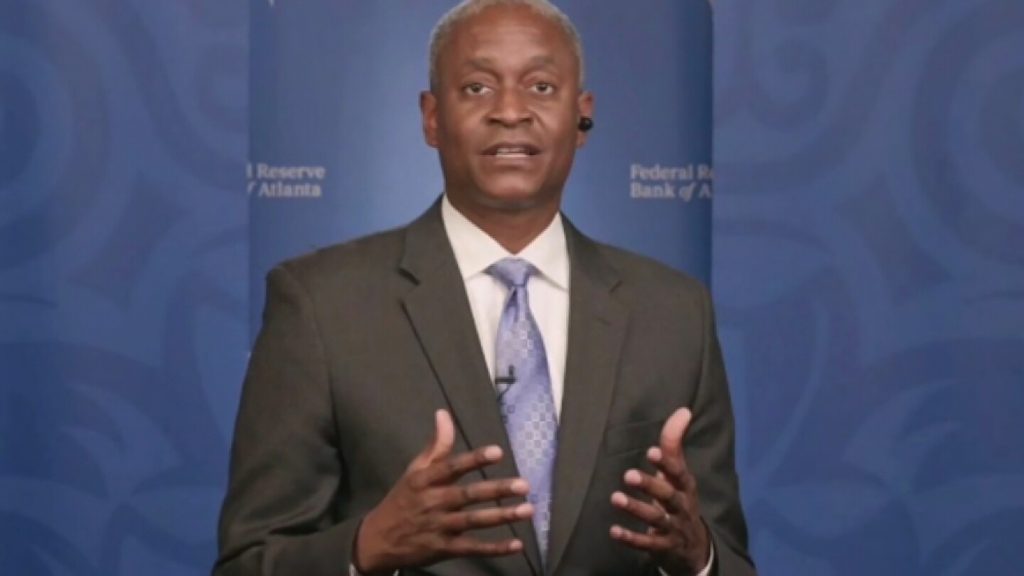

The remarks by Susan Collins, president of the Federal Reserve Bank of Boston, and Raphael Bostic, president of the Atlanta Fed, suggest that the central bank’s rate-setting committee could be tilting against what had been an expected third straight cut next month.

The officials cited several reasons for keeping rates unchanged, after a reduction in September and in October. They argued that inflation is stubbornly elevated and has been above the Fed’s 2% target for nearly five years, while the economy is resilient and doesn’t appear to need more rate cuts. The job market is stumbling, with hiring nearly at a standstill, but layoffs still seem muted, they said.

Another factor has been the government shutdown, which has cut off the economic data the Fed relies on to discern the economy’s path. On Wednesday White House spokeswoman Karoline Leavitt said that the jobs and inflation reports for October would likely never be released.

“Formulating an economic outlook is challenging — and the limited data compounds the difficulty,” Collins said in a speech in Boston.

“It will likely be appropriate to keep policy rates at the current level for some time … in this highly uncertain environment,” she added.

That is a shift from her previous speech in October, when she expressed support for at least one more rate cut.

Earlier Wednesday, Bostic said he remains concerned inflation is too high, and added that, “I … favor keeping the funds rate steady until we see clear evidence that inflation is again moving meaningfully toward its 2% target.” Bostic said earlier Wednesday that he will retire when his current term ends on Feb. 28, 2026.

Their remarks come at an unusually challenging time for the Fed, with the economy facing both weak hiring and elevated inflation. Typically, the Fed would reduce its rate to encourage borrowing, spending and job gains, while it would keep it unchanged — or even raise it — to combat inflation.

The 19 officials on the Fed’s rate-setting committee narrowly supported three rate cuts this year at their September meeting, but Chair Jerome Powell said at a news conference late last month that the committee remains divided and another cut in December was not a “foregone conclusion.”

David Seif, chief economist for developed markets at Nomura Securities, expects the Fed will skip a rate cut in December and won’t reduce borrowing costs again until March.

“There is a large segment of the Fed that is uncomfortable with a December cut,” Seif said.

Collins also said that additional reductions to the Fed’s rate could, by boosting the economy, accelerate inflation.

“Absent evidence of a notable labor market deterioration, I would be hesitant to ease policy further, especially given the limited information on inflation due to the government shutdown,” she said.

Bostic, meanwhile, said the Atlanta Fed’s surveys of businesses show that many companies intend to raise prices next year, a sign that inflation may not cool anytime soon.

“We cannot breezily assume inflationary pressures will quickly dissipate after a one-time bump in prices from new import duties,” Bostic said, referring to President Donald Trump’s tariffs. “Across all our information sources, I see little to no evidence that we should be sanguine about the forward trajectory of inflation.”

Some Fed officials, such as Fed governor Stephen Miran, have argued that the tariffs will only temporarily lift prices and outside those one-time increases, inflation is cooling.