India has sharply reduced purchases of Russian crude oil for December delivery, with five of the country’s largest refiners refraining from placing any orders, as US sanctions and ongoing trade negotiations with Washington reshape import strategies, reports Bloomberg.

People familiar with the matter told the news agency that Reliance Industries, Bharat Petroleum, Hindustan Petroleum, Mangalore Refinery and Petrochemicals, and HPCL-Mittal Energy have not booked any Russian cargoes for next month. Typically, deals for the following month are concluded by the 10th of the ongoing month.

The pullback follows US President Donald Trump’s decision to double tariffs on Indian imports to 50 per cent in August and impose sanctions last month on Russia’s top oil producers, Rosneft PJSC and Lukoil PJSC. India, the world’s third-largest oil importer, has in recent years become heavily reliant on discounted Russian barrels, prompting US criticism that the purchases were helping to fund Moscow’s war in Ukraine.

Trade negotiations influence import patterns

Officials said the move may also reflect New Delhi’s desire to maintain progress in its trade talks with Washington. Trump said earlier this week that both sides were “pretty close” to finalising a deal, with India expected to buy more US crude as part of the discussions.Only Indian Oil Corporation (IOC) and Nayara Energy, which is partly owned by Rosneft, have booked Russian cargoes for December. IOC has sourced from non-sanctioned sellers, while Nayara continues to rely solely on Russian supplies.

Traders have been offering non-sanctioned Russian cargoes at discounts of $3–4 a barrel, but Indian refiners have been reluctant to purchase them due to lengthy due diligence processes to verify the supply chain’s compliance with sanctions.

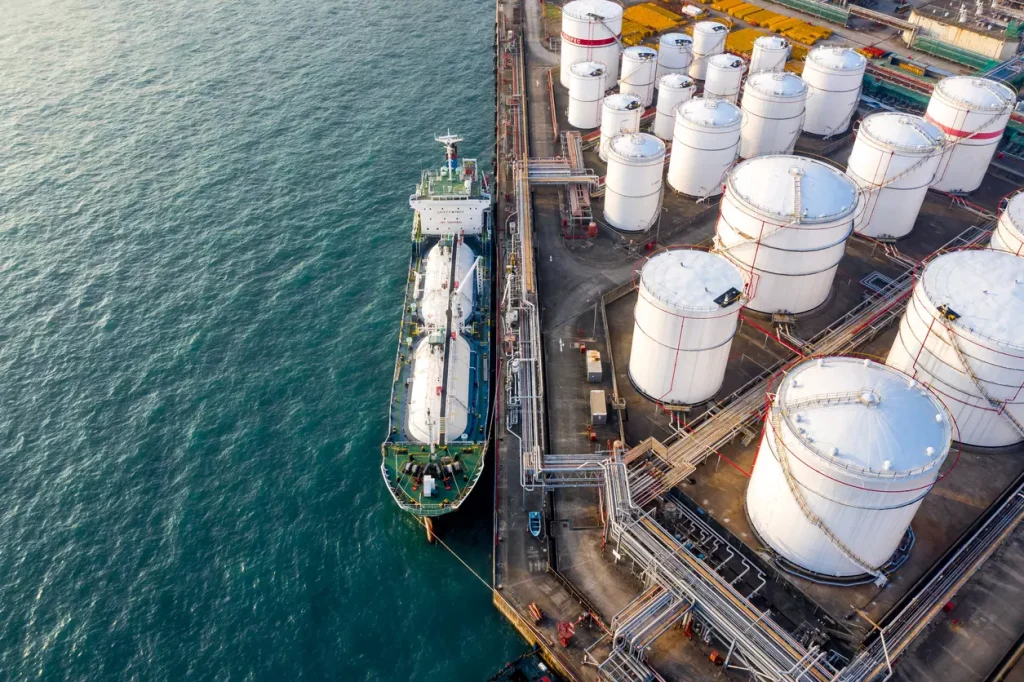

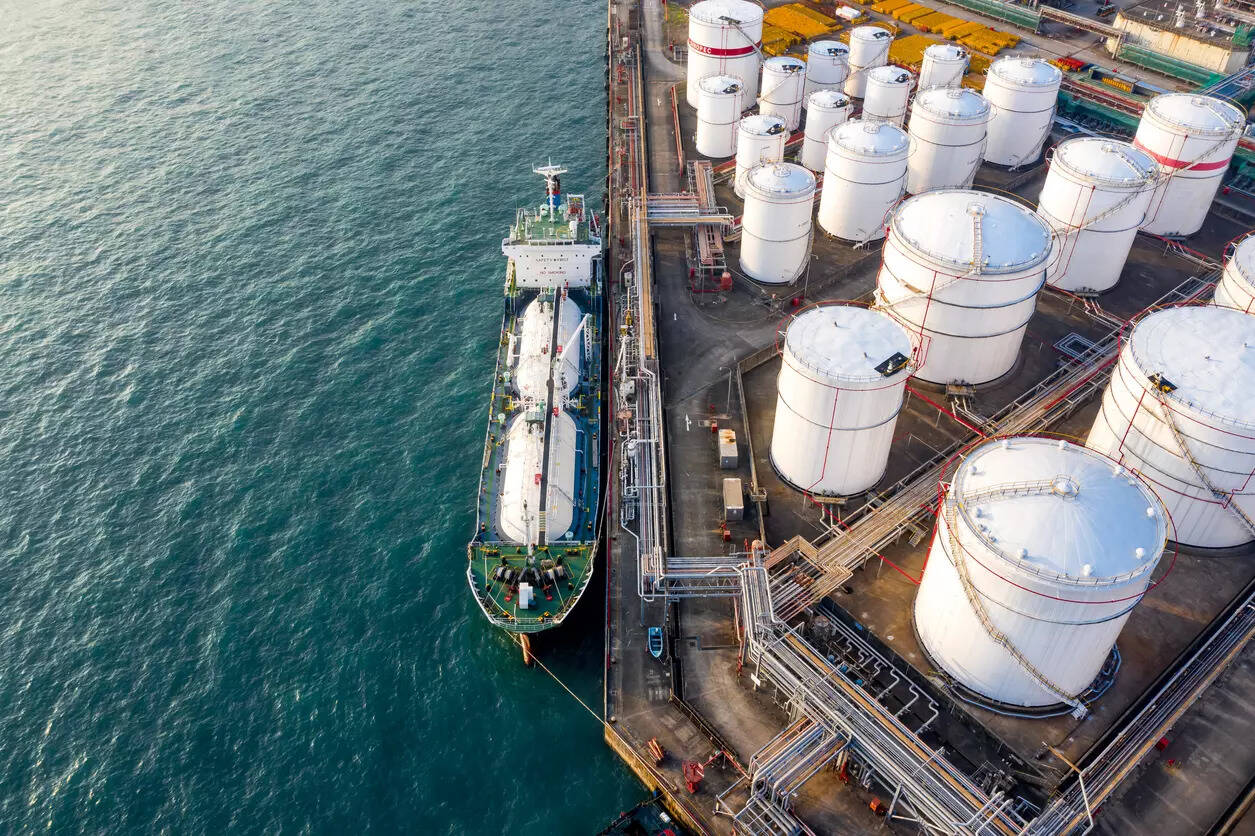

Refiners turn to US and Gulf suppliers

Russia accounted for 36 per cent of India’s crude imports so far this year, but refiners are now diversifying supplies. IOC has sought to buy up to 24 million barrels from the Americas for the January–March quarter, while Hindustan Petroleum recently procured 4 million barrels of US and Middle Eastern grades for January delivery.State-run refiners have also approached Saudi Aramco and Abu Dhabi National Oil Company (ADNOC) for additional supplies. Executives from both companies met Indian officials on the sidelines of an industry conference in Abu Dhabi last week. They assured steady crude availability, according to people briefed on the discussions.