Capturing carbon dioxide before it can enter the atmosphere is already a mature and well-established process for sectors such as natural gas processing. If applied to power stations, steelworks, and cement plants, CCUS can ensure decarbonisation without deindustrialisation.

According to IDTechEx’s “Carbon Capture, Utilization, and Storage (CCUS) Markets 2026-2036: Technologies, Market Forecasts, and Players” report, amine solvent technologies offered by players such as Mitsubishi Heavy Industries, Shell, and SLB Capturi, are at the highest maturity for these post-combustion carbon capture applications.

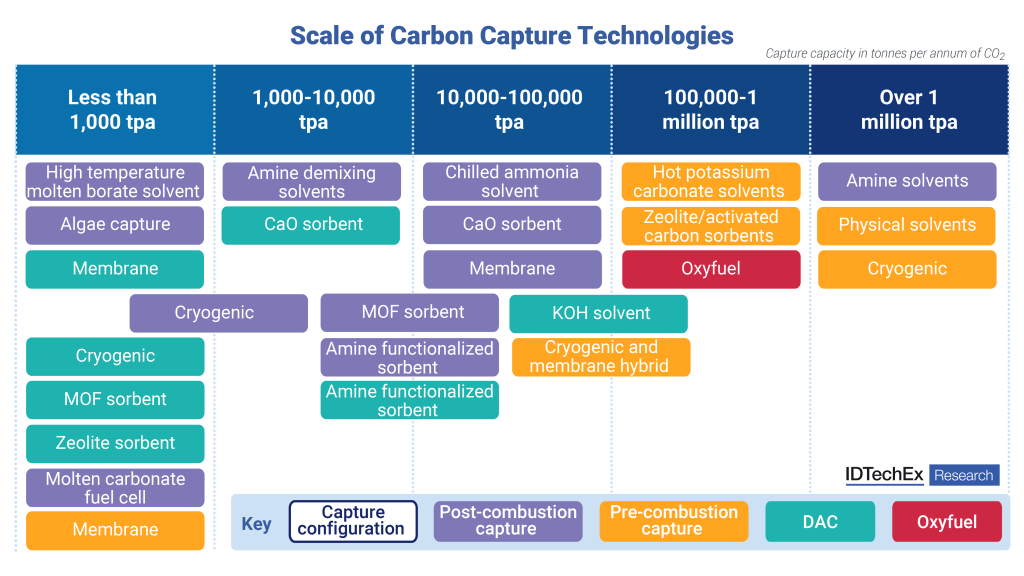

The current scale of carbon capture technologies for post-combustion capture, pre-combustion capture, DAC (direct air capture), and oxyfuel, as assessed by IDTechEx. Source: IDTechEx

Amine solvents dominate post-combustion capture

For the low CO2 partial pressures typical of flue gas in post-combustion capture, highly efficient separation methods are required for carbon capture. This can be provided by the strong chemical bonds formed between amine solvents and carbon dioxide, offering rapid absorption rates, good selectivity, and a high absorption capacity.

State-of-the-art amine solvents for post-combustion capture are advanced and often proprietary. These solvent blends may include sterically hindered amines – which lower the regeneration energy penalty by reducing the stability of the carbamate intermediate – and/or tertiary amines – which have a large carbon dioxide absorption capacity.

Innovations in amine solvents for carbon capture

Despite the maturity of amine solvents, further reductions in capture cost are still being pursued. Innovations that can improve energy efficiency are being investigated. For example, players such as ION Clean Energy and Pacific Northwest National Laboratory are developing water lean amine solvents. Conventional amine carbon capture solvents have a high water percentage to control the corrosivity and viscosity of amines. Therefore, by using solvents with lower specific heats instead of water, the capture process could be made more energy efficient.

Biphasic amine demixing solvents, being commercialised by Axens and CarbonOro, are another solution. After capture, the amine solvent separates into two phases. Only the CO2-rich phase is regenerated in the stripper column to reduce energy demand.

On the balance of plant side, improvements are being sought to improve mass transfer. Players such as Baker Hughes and Carbon Clean have developed rotating packed beds for the absorber columns. The underlying concept is that centrifugal force replaces gravity for gas/liquid contact, increasing mass transfer and reducing the equipment size and cost.

Alternative carbon capture technologies

Amine solvents have their downsides – such as large equipment size and hazardous chemical handling. There is significant interest in finding alternative carbon capture solutions. Promising emerging solvents include high temperature molten borates (developed by Mantel), chilled ammonia (developed by Baker Hughes), and carbonic anhydrase enzymes (developed by Saipem/Novozymes).

The report also includes non-solvent carbon capture technologies, including oxy-fuel, cryogenics, solid sorbents, and membranes. Start-ups in the gas separation membrane carbon capture space, such as MTR, Ardent, and Cool Planet Technologies, generally seek to commercialize advanced polymer materials like thin film composites and facilitated transport membranes.

Solid sorbents can offer advantages compared to solvents for carbon capture such as simpler operations and a lower regeneration energy penalty. For post-combustion capture, the highest maturity approaches are based on temperature swing adsorption using metal organic frameworks (MOFs) or solid sorbent calcium looping. However, these technologies have not yet been demonstrated at the megatonne per annum scale achieved by amine solvents.

Post-combustion capture market outlook

The report forecasts growth in CCUS by sector. While early interest in post-combustion capture was driven mostly by coal power plants, the expansion in post-combustion capture CCUS projects is now also expected to come from sectors such as cement, biomass power generation, and natural gas power generation.

Growth in cement sector CCUS will mostly be driven by Europe. The European Union ETS carbon market will become fully applied to the cement sector as the CBAM – which stands for carbon border adjustment mechanism – comes into place. This will ensure any imported cement is subject to the same carbon pricing as domestic production. Additionally, over US$1 billion from the EU Innovation Funds will be directed towards supporting cement sector CCUS projects.

For gas power generation, the rise of AI and data centers has driven headlines involving natural gas power generation coupled with carbon capture to deliver low-carbon high capacity factor power. Data centers are driving demand for new power generation, but ideally this needs to be low-carbon power to avoid AI having a negative environmental impact. Wind and solar power is intermittent, so cannot meet the continuous power demand of data centers alone.