• Apple to generate over 1 million MWh of clean energy annually in Australia by 2030.

• New Restore Fund investment to protect and restore 8,600 hectares of New Zealand forestland.

• Projects align with Apple’s goal to be carbon neutral across its full value chain by 2030.

Renewable Power for Apple Users

Apple has announced a major expansion of its renewable energy portfolio across Australia and New Zealand, deepening its commitment to carbon neutrality by 2030. The tech company said it is enabling an 80MW solar farm in Lancaster, Victoria, through a long-term agreement with European Energy — one of several projects expected to collectively generate more than 1 million megawatt-hours of clean electricity annually before the decade’s end.

The Lancaster facility, currently under construction, is expected to begin operations next year and feed power into Australia’s National Electricity Market. Apple said the project will help match all the electricity used to charge and power its devices with 100% clean energy by 2030.

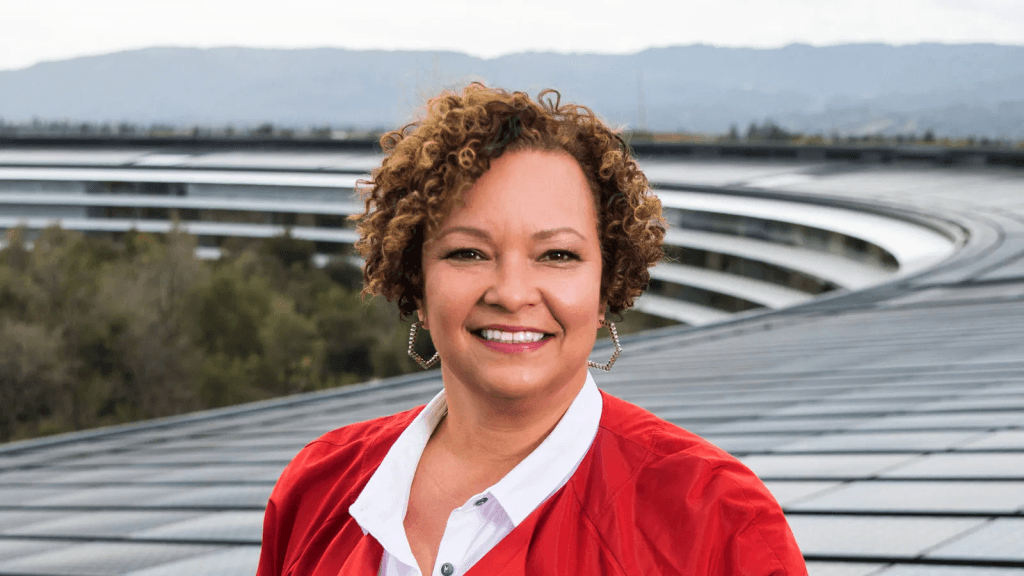

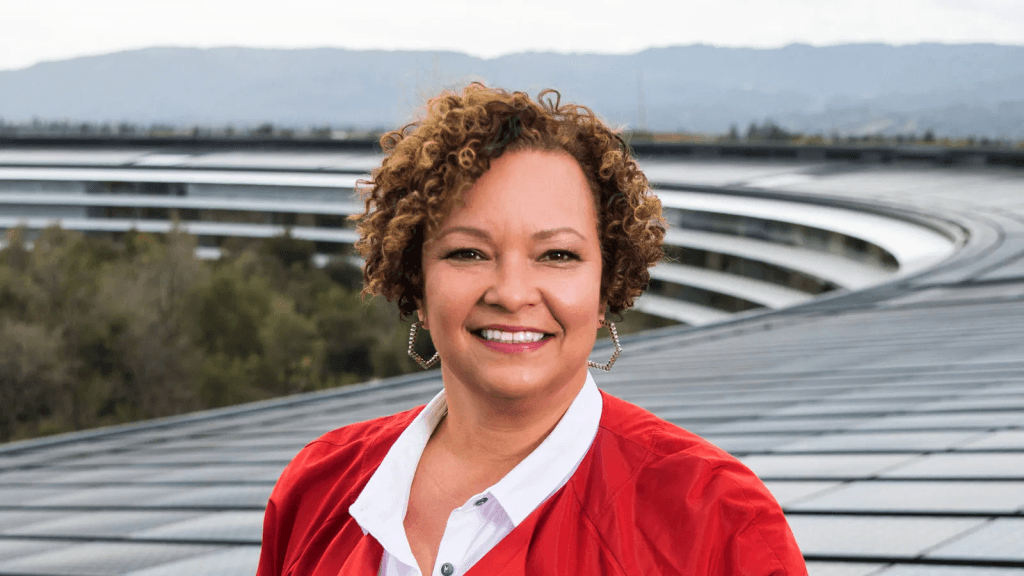

“By 2030, we want our users to know that all the energy it takes to charge their iPhone or power their Mac is matched with clean electricity,” said Lisa Jackson, Apple’s Vice President of Environment, Policy and Social Initiatives. “We’re proud to do our part to support Australia’s transition to a cleaner grid and drive positive impacts for communities and nature.”

The new investments expand Apple’s regional presence in clean energy, aligning its consumer-facing climate goals with grid-level decarbonisation. The company’s renewable energy sourcing strategy already includes partnerships across the U.S., China, and Europe, and now seeks to accelerate progress in the Asia-Pacific energy transition.

Scaling Nature-Based Carbon Removal

Alongside its Australian energy investment, Apple announced a new Restore Fund project in New Zealand in partnership with Climate Asset Management, targeting forest restoration and biodiversity protection. The initiative will protect and restore 8,600 hectares of forestland across four sites in the North Island and one in the South Island, managed to Forest Stewardship Council standards.

The project blends sustainable forestry with conservation, balancing commercial redwood plantations with 3,000 hectares of native forestland. It aims to enhance biodiversity, increase carbon sequestration, and generate long-term financial returns through responsible land management.

In Australia, the Restore Fund is already supporting a large-scale regenerative agriculture project in Queensland. There, 1,700 hectares of degraded sugarcane farmland south of Bundaberg are being converted into a macadamia orchard with more than 800,000 trees. The site, extending eight kilometres, integrates native habitat restoration and improved soil and water management practices.

A 100-hectare restoration area within the project is being developed in partnership with Indigenous conservation organisation W.Y.L.D., which reconnects youth with traditional landscapes. This area will serve as a biodiversity corridor linking two national parks, contributing to long-term ecological resilience.

RELATED ARTICLE: Apple Expands Renewable Energy Portfolio Across Europe

Apple’s Climate Governance and Financial Lens

Launched in 2021, Apple’s Restore Fund was designed to mobilise private capital toward scalable, high-quality nature-based carbon removal. Managed jointly with Climate Asset Management, the fund supports two project types: regenerative farming and forestry ventures that produce sustainable commodities, and ecosystem conservation projects that generate verified carbon credits.

These dual revenue models — combining carbon finance with real-asset returns — illustrate a shift in corporate climate finance strategies, particularly as global demand for credible carbon removals grows under tightening disclosure and accounting frameworks.

Apple said the Restore Fund plays a central role in achieving its 2030 target to be carbon neutral across its full footprint, including manufacturing supply chains and product use. The company aims to cut global emissions by 75% compared to 2015 levels, with more than 60% reduction already achieved. Remaining emissions are to be balanced through nature-based removal credits from projects like those in Australia and New Zealand.

Broader Implications for Corporate Climate Strategy

For investors and policymakers, Apple’s model illustrates how large corporations are extending decarbonisation efforts beyond direct operations into systemic energy and ecosystem transitions. By pairing infrastructure-scale renewables with verified restoration projects, Apple links its consumer energy matching goal to tangible regional climate benefits.

The approach also underscores a growing recognition that corporate net-zero claims depend on credible, traceable nature-based solutions supported by rigorous governance and science-based metrics. As markets for high-quality carbon removal credits mature, initiatives such as the Restore Fund are expected to shape emerging standards for nature-aligned corporate finance.

In Australia and New Zealand, Apple’s projects contribute not only to its own emissions targets but also to regional renewable generation capacity, biodiversity protection, and Indigenous-led land stewardship — key themes at the intersection of technology, climate, and natural capital investment globally.

Follow ESG News on LinkedIn