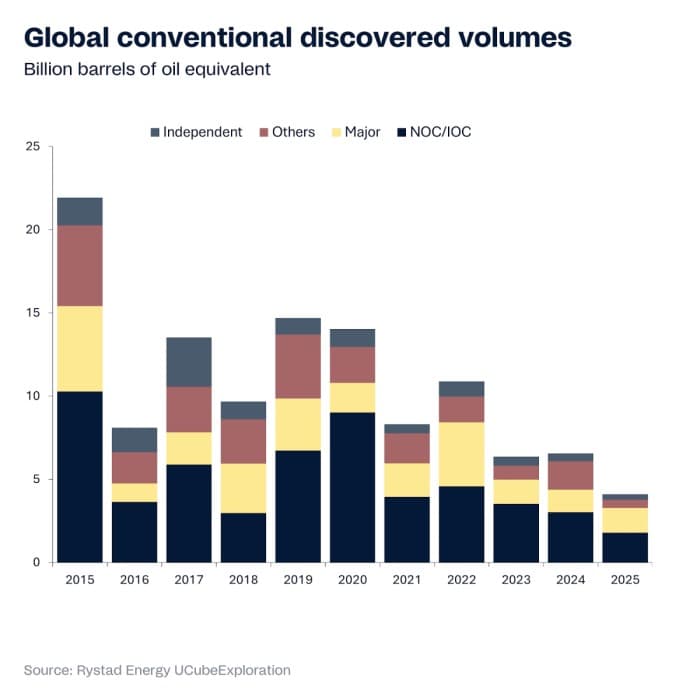

Annual conventional discovered volumes once averaged more than 20 billion barrels of oil equivalent (boe) per year in the early 2010s, but these have fallen to nearly one-third of that, with analysis by Rystad Energy showing global discoveries have averaged slightly over 8 billion boe annually since 2020 despite several standout frontier finds in Namibia, Suriname, and Guyana. Despairingly, the yearly average declines further to about 5.5 billion boe between 2023 and September this year. The contraction reflects a strategic change where the global exploration map of exploration and production (E&P) companies is defined less by sheer acreage and more by strategic precision. Supermajors and national oil companies (NOC) alike are narrowing focus on a handful of high-impact basins – Namibia’s Orange Basin, Suriname’s deepwater basin, and Brazil’s pre-salt basin – and infrastructurally rich near-field explorations, while divesting from marginal, mature, and low-return regions. These advantaged exploration campaigns blend advanced subsurface datasets, low-cost near-field tiebacks, implementation of digital technologies, and utilization of low-carbon infrastructures to balance risk with return.

This concentration of discoveries in a handful of countries or specific hotspots – Namibia, Guyana, Brazil, and Suriname, among others – highlights the narrowing geography of exploration success and the risk-taking appetite of global E&P companies. Frontier nations see this as an opportunity to lure and attract foreign investment via friendly fiscal terms to help generate revenues and build energy security, while continued appraisal of under-explored plays, such as ultra-deepwater or the untapped stratigraphic traps, offers mature-producing nations optionality for long-term growth and a way of arresting declines in production.

There has been a marked shift over the last decade in where these opportunities lie, underscored by two transformative, basin-opening events along the South Atlantic margin – and this has now been followed up with the Orange Basin off Namibia. The first was the rise of the pre-salt era, initiated by Petrobras’ discovery of the Tupi field (now Lula) in the Santos Basin offshore Brazil in 2006. This discovery redefined global exploration frontiers by demonstrating the industry’s ability to image and extract hydrocarbons beneath thick layers of salt that were once considered impenetrable. The breakthrough was as much technological as geological: improved seismic imaging, directional drilling, and subsea engineering unlocked a play type that had eluded explorers for decades. The second defining frontier emerged in Guyana and Suriname, where ExxonMobil’s 2015 Liza discovery in the Stabroek Block opened one of the most successful new petroleum provinces of the 21st century. The ExxonMobil-led consortium has unearthed an estimated 13 billion boe of recoverable resources offshore Guyana to date, spread across more than 30 discoveries, with another 2 billion boe from Suriname. The third and most recent frontier is now unfolding in Namibia’s Orange Basin, where discoveries over the past three years by Shell, TotalEnergies and Galp Energia have opened what many consider to be the most promising new petroleum province of this decade, serving as an ingredient that could accelerate the southern African country’s transformation into a major deepwater producer.

Both international oil majors and NOCs continue to play a pivotal role in sustaining global exploration and discovered volumes. Despite a decade-long decline in conventional discoveries, these two groups collectively account for most new resources found worldwide, reflecting their unique capabilities and strategic priorities. The peer group of six oil majors – ExxonMobil, TotalEnergies, Shell, Eni, BP and Chevron – accounts for about 22% of discovered volumes since 2015, according to Rystad Energy estimates. These organizations remain the primary drivers of frontier exploration, leveraging advanced subsurface imaging, digital analytics and capital strength to open new petroleum provinces, while setting new benchmarks for reducing lead times between discovery and development. Meanwhile, NOCs that have been heavily focused on exploring their domestic and regional basins are balancing national energy security with portfolio expansion. Companies such as Petrobras, ADNOC, and QatarEnergy are spearheading exploration efforts, not only to replace reserves but also to reinforce their roles as prominent international oil and gas players. Together, the majors and NOCs dominate the high-impact deepwater discoveries that continue to anchor global supply growth, while independents and smaller players contribute selectively. Hence, risk and potential reward play a crucial role in identifying global exploration hotspots and delineation of strategic high-impact prospects, while large-scale exploration extensively depends on those organizations with both deep technical expertise and long-term investment appetite.

Without sustained exploration, supply shortages and price volatility could threaten both energy security and the stability of the energy transition itself. Hence, as the world continues to use hydrocarbons despite moving toward attaining net zero and reducing its carbon footprint, one thing is clear: we cannot manage a decline in production without making new discoveries.

Palzor Shenga, Vice President – Upstream Research

Beneath the continuously shrinking discovery curve is a dramatic fall in exploration expenditure (expex), which now hovers around $50 billion to 60 billion per year – down from a peak of around $115 billion in 2013. The industry’s pivot reflects both external pressures – climate policies, investor scrutiny, and the need to maintain returns – and internal discipline born from past cycles of over-investment. However, as project pipelines continue to shrink, owing to a reduction in exploration activity and volumes found, exploration and new discoveries remain essential to maintain global oil and gas supply in line with long-term demand.

By Rystad Energy

More Top Reads From Oilprice.com: