Oil prices wiped out earlier gains to dip by more than 2% in early U.S. trade on Tuesday amid renewed concerns that the trade war between the United States and China could slow global economy.

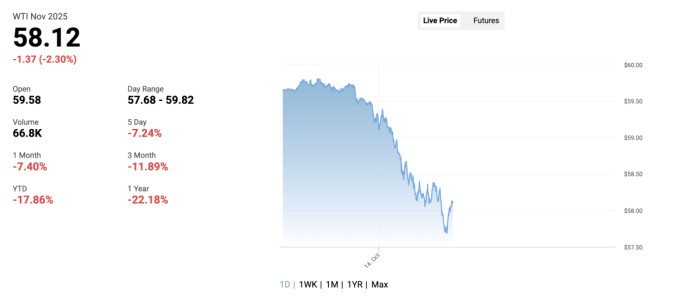

As of 7:21 a.m. EDT on Tuesday, the U.S. benchmark, WTI Crude, fell to the $58 per barrel threshold, down by 2.30% on the day at $58.12.

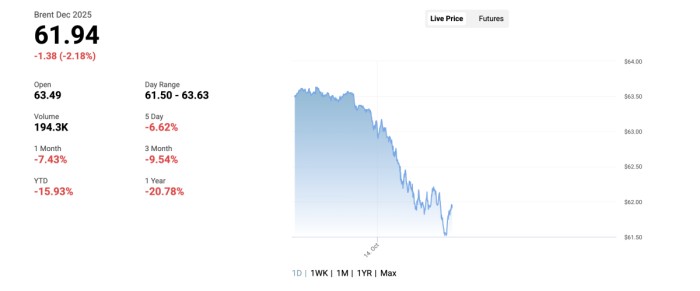

The international benchmark, Brent Crude, was trading below the $62 a barrel mark, and was down by 2.181% at $61.94.

Oil had stabilized in early Asian trade on Tuesday, as hopes of a diplomatic thaw between Washington and Beijing helped to cool bearish sentiment.

However, trade jitters later reverberated through the markets, after China sanctioned five U.S. subsidiaries of South Korean shipbuilder Hanwha Ocean.

“Hanwha’s subsidiaries in the U.S. have assisted and supported the U.S. government’s probes and measures against Chinese maritime, logistics and shipbuilding sectors. China is strongly dissatisfied and resolutely opposes it,” a spokesperson for China’s Commerce Ministry said in a Tuesday statement, as carried by CNBC.

The move from China means that Chinese entities and persons are prohibited from doing business with the sanctioned U.S. companies, effective immediately.

The trade escalation follows last week’s enhanced export controls that China imposed for rare earths and rare earth processing technology.

While President Trump still intends to meet with Chinese President Xi Jinping at a summit in South Korea later this month, the renewed tensions added to concerns about global economy and global oil demand. That’s on top of an expected record glut in the oil markets in the coming months.

“Crude oil is falling as risk appetite fades once again, led by renewed selling across U.S. equities amid persistent concerns over the trade war’s impact on corporate results, and not least growing concerns about an AI bubble,” Ole Hansen, Head of Commodity Strategy at Saxo Bank, said on Tuesday.

“At this stage, only an escalation involving Russia may prevent prices from sliding further towards key support levels, in Brent below $60.”

By Tsvetana Paraskova for Oilprice.com

More Top Reads From Oilprice.com: