(Oil and Gas 360) – Energy Advisors released its 3Q A&D Special Report as a continuation of our thought leadership efforts.

According to Brian Lidsky, Director of Energy Advisors, “following a volatile 2Q for oil & gas prices, 3Q stabilized with spot oil up 2% to $65.78 and spot gas dipping 2% to $3.03. P/E selling slowed to just 15% of deal value, down from ~50% in the prior three quarters. Public E&Ps continue consolidating. Natural gas and PDP deals are gaining momentum. In an environment where all things AI are grabbing headlines, we’re seeing increasing participation from a broader buyer profile including hedge funds, asset managers and international investors seeking predictable cash flow, natural hedges, inflation protection and pricing upside.”

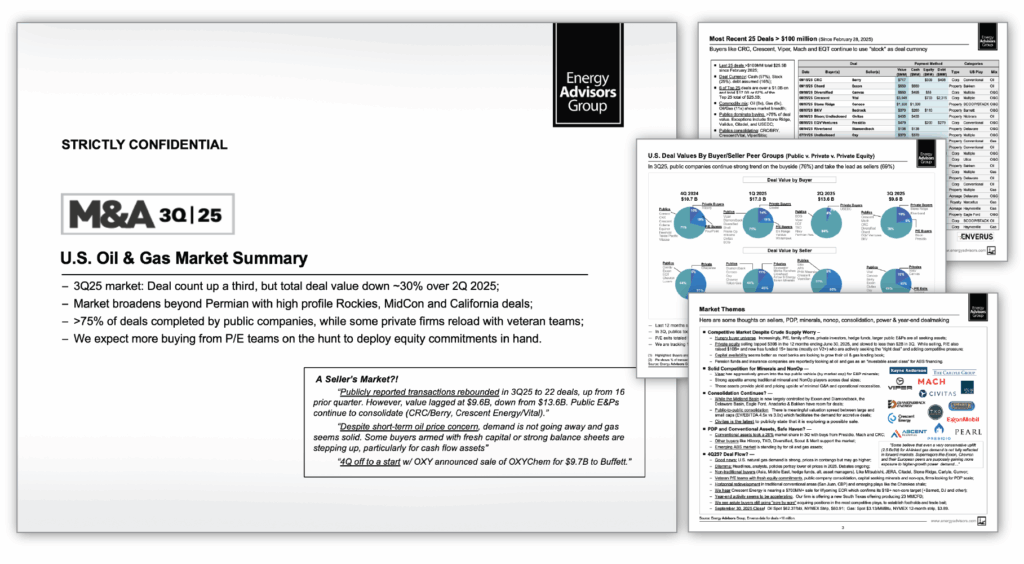

Deal Volume Up, Value Down

Using source data from Enverus, publicly reported transactions greater than $10MM rebounded to 22 deals, up from 16 in the previous quarter, but their combined value of $9.6B fell 30% from 2Q25’s $13.6B. These compare to average quarterly stats since 2020 of 23 deals per quarter and $17.1B per quarter (excl. three mega mergers – XOM/PXD, $64.5B, CVX/HESS, $60.0B, FANG/Endeavor, $26.0B).

Publics Dominate Buying, Private Equity Selling Cools

Public companies continue to dominate on the buyside—accounting for more than three-quarters of total activity with 3Q deals done by Crescent Energy, Mach, California Resources, Diversified, Chord and BKV.

Private equity selling activity cooled after selling $30+B in the 12 months ending June 30 —down to less than $2 B this quarter. Having raised $10+B in new capital, private equity has rebooted funding more than 15 veteran teams this year who are actively hunting for assets, adding to competitive pressure for buyers.

Mergers Continue and PDP Assets Gain Share

Driven by a valuation gap between large and small-cap E&Ps, the wave of public mergers marched ahead. In 3Q, Crescent Energy added the Permian as a third core (adding to Eagle Ford and Uinta) with a $3.05B all-stock acquisition of Vital Energy. In the wake of California’s reversal to encourage more drilling in Kern County, California Resources bought Berry Petroleum for $717MM. Both these deals were accretive on key metrics and accomplished via all stock (giving a 15% premium) and assumed debt.

Conventional and PDP assets took 26% of total deal value in 3Q. Diversified paid $500MM for an Anadarko bolt-on and Mach Natural Resources paid $1.3B in 2 deals entering San Juan gas and legacy Permian oil. Presidio, self -described as the “last, best steward for America’s oil and gas wells”, merged with EQV Ventures that, when completed, allows it to go public under ticker “FTW”, short for Fort Worth.

Looking Ahead

Energy Advisors Group expects healthy 4Q deal flow, fueled by strong natural gas fundamentals and strong appetite for PDP, minerals/NonOp and power-linked assets. Veteran P/E teams are on the hunt, and we expect to continue seeing more diverse deal geographies. The market remains focused on inventory quality and duration, cash flow, operational efficiencies, scale, and disciplined capital allocation.

4Q kicked off with OXY selling its OxyChem division to Buffett for $9.7B. We’re hearing Crescent Energy is nearing the sale of its Wyoming EOR assets and expect more news on its Barnett, DJ, and MidCon non-core assets as it looks to deliver on its $1B+ in non-core sales. Media is reporting a Civitas and SM Energy are talking a merger of equals, though others are also showing interest in Civitas. Baytex is reported exploring an Eagle Ford exit for up to $3B. Citadel is reportedly in talks to buy 150 MMcfpd of legacy Haynesville PDP from Comstock. Other large potential sellers include Haynesville names like Aethon and GEP Haynesville II and Utica names Antero and Ascent.

In a market where “content, context, and contrast” matter more than ever, 3Q25 confirmed that U.S. A&D markets are resilient and ever evolving.

About Energy Advisors oilandgas360.com contributor

Energy Advisors is a leading firm in oil and gas transaction advisory services and thought leadership having served the industry for over 35 years. We trace our roots back to PLS Inc which sold its listing service, research, and databases to DrillingInfo in 2018 and rebranded its advisory and marketing arm as Energy Advisors in 2019.

Contacts:

Brian Lidsky

Director of Research

713-600-0138

blidsky@energyadvisors.com

Blake Dornak

VP, Marketing

713-600-0123

bdornak@energyadvisors.com

The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of Oil & Gas 360. Please consult with a professional before making any decisions based on the information provided here. The information presented in this article is not intended as financial advice. Contact Energy Advisors for the full report. Please conduct your own research before making any investment decisions.