Electric vehicle sales in the US reached a new milestone in the third quarter of 2025. Beyond that, the future is uncertain for almost every player in this market, except one.

With federal incentives for EVs falling away, the US market must survive on its own merits. Who wins and who survives will depend largely on who has the scale and sales volume to make their businesses profitable.

Tesla has already reached scale and is comfortably profitable. Most other operators in the US EV market aren’t there yet.

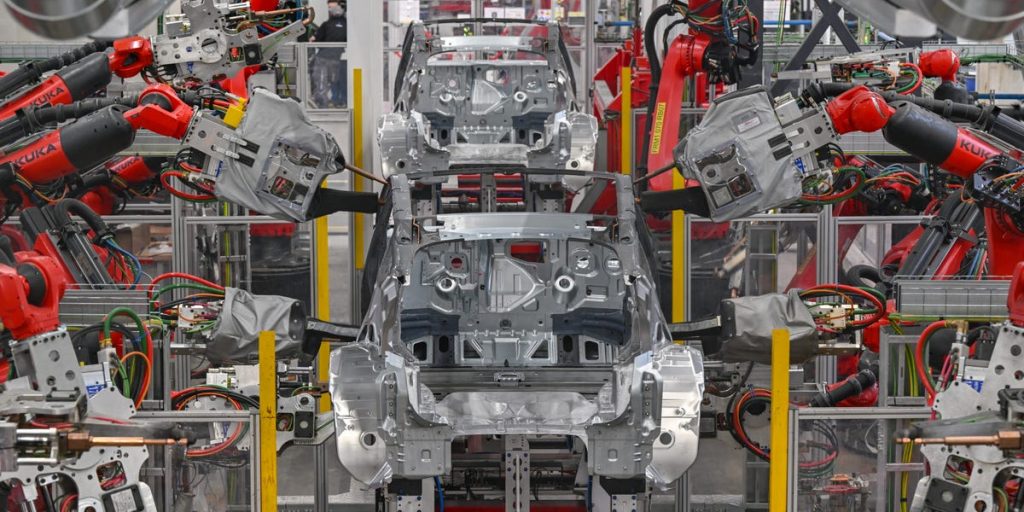

“In the volume-driven business of automotive manufacturing, low volume is the enemy; EV profitability remains a distant dream for nearly every automaker,” Cox Automotive, an industry data provider, warned recently in its latest EV market report.

A record 437,487 EVs were sold in the US in the third quarter, according to estimates from Cox’s Kelley Blue Book. That marks a 30% year-over-year surge this quarter, underscoring the growing mainstream appeal of EVs.

Yet beneath the headline growth lies a harsh economic truth: without massive scale, most automakers are still losing money on their electric ambitions in the US.

Tesla remains the exception. Even as its market share slipped to 41% from 49% the previous year, it continues to dominate the US EV landscape. The Model Y and Model 3 alone accounted for more than 168,000 units sold in the third quarter, dwarfing competitors.

By contrast, only nine out of roughly 90 EV models sold more than 10,000 units in the US in the quarter. Most electric vehicles struggle to move more than 6,000 units a quarter, according to Cox data. That volume is probably too low to achieve economies of scale in manufacturing, supply chains, and software integration.

Major brands, including Mercedes, Toyota, and Nissan, saw flat or declining EV sales in the third quarter, despite consumers rushing to purchase ahead of incentives expiring on September 30.

Meanwhile, Volkswagen, General Motors, Honda, and Hyundai posted robust growth. While a promising sign, that may not be enough volume to turn their EV operations in the US into profitable businesses.

Related stories

For instance, Ford’s EV division lost $2.2 billion in the first half of 2025, despite an increase in sales. Rivian lost about $1.7 billion in the same period. In contrast, Tesla reported a profit of more than $1.5 billion in the first half of this year.

It’s no wonder that many legacy carmakers are backtracking on their EV plans. If they cannot reach a high-volume scale, they risk consistently losing money. At some point, they have to stop the bleeding.

In July, Mercedes stopped taking EV orders in the US. Stellantis has recently shelved some of its EV plans, along with Porsche and Honda. Even Ferrari, which has juicy profit margins, dialed down its EV plans.

With federal EV incentives now gone, analysts at Cox Automotive expect sales to decline in the fourth quarter and early 2026, testing whether the US market can sustain itself without government support.

This could reveal which carmakers have the stamina to suck up EV losses and try to reach scale in the US market. Tesla is already there. Very few other companies are even close.

“The training wheels are coming off,” said Cox Automotive’s director of industry insights Stephanie Valdez Streaty.

The next phase will reveal whether automakers can drive America’s EV market on fundamentals — cost efficiency, scale, and innovation — rather than incentives.

For now, Tesla stands alone as proof that, in this industry, volume equals survival.

Sign up for BI’s Tech Memo newsletter here. Reach out to me via email at abarr@businessinsider.com.