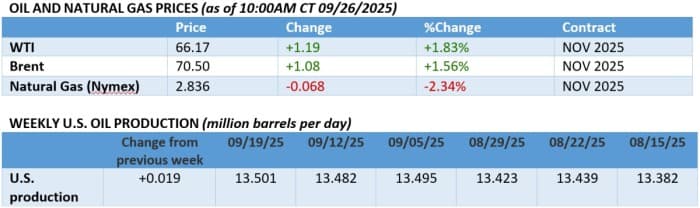

Oil saw a strong rally this week as attacks on Russian oil infrastructure and rising geopolitical risk continue to fuel the rally.

26 September, 2025

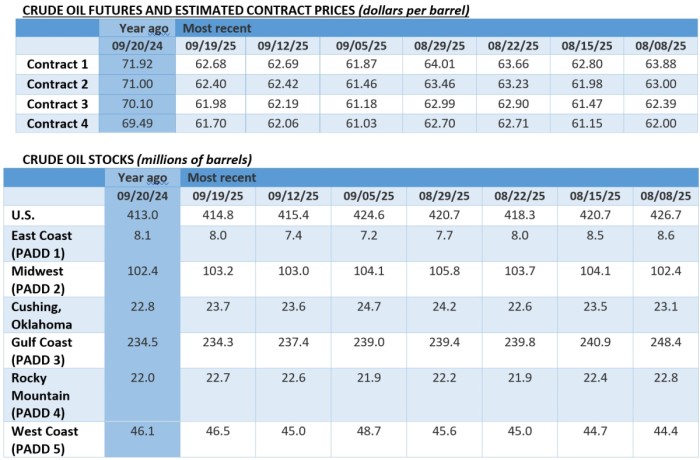

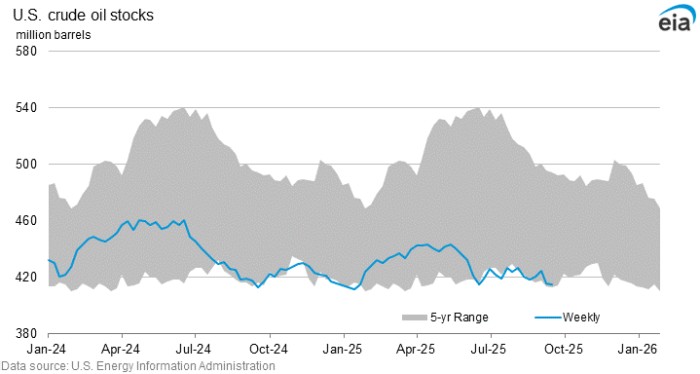

Moscow’s restrictions on fuel exports, including a full export ban on gasoline and a partial one on diesel, have lifted ICE Brent futures above $70 per barrel this week, further buoyed by market participants distrusting OPEC+’s unwinding of its 2.2 million b/d voluntary cuts, seeing only a fraction of promised barrels in the market. Iraq will be the key price indicator of the upcoming weeks, with the potential restart of oil flows via Turkey adding to Europe’s regional supply.

Iraq Doubles Down on Kurdish Restart. Having signalled the restart of Kurdish crude deliveries via the Kirkuk-Ceyhan pipeline earlier this week, Iraq’s federal government reached agreements in principle with 8 oil companies producing 90% of Kurdistan’s output, specifying that first oil will flow on Saturday.

Russia Extends Gasoline Export Ban. The Russian government extended its ban on gasoline exports until the end of 2025, seeking to keep all barrels at home following a barrage of Ukrainian drone strikes on refineries, whilst also introducing a ban on diesel exports for non-producers, i.e. trading middlemen.

Traders Continue Their Global Expansion. Having previously bought Italy’s Saras refinery and Sweden’s Preem, global trading house Vitol has expanded further into upstream, having finalized its purchase of a 30% stake in Cote d’Ivoire’s multi-billion-barrel Baleine field from Italy’s ENI (BIT:ENI) for $1.65 billion.

Trump Cancels $13 Billion in Renewable Funds. The US Department of Energy plans to cancel $13 billion in funds dedicated by the Biden administration to subsidize wind and solar parks as well as electric vehicles, coming a day after President Trump dismissed climate change as the ‘greatest con job’.

Oil Majors Scale Back 2026 Buybacks. French major TotalEnergies (NYSE:TTE) might have pioneered a new trend of downscaling its share buyback programme next year, with its board voting to restrict quarterly buybacks to $0.75-1.50 billion, down from previous pledges of $2 billion per quarter.

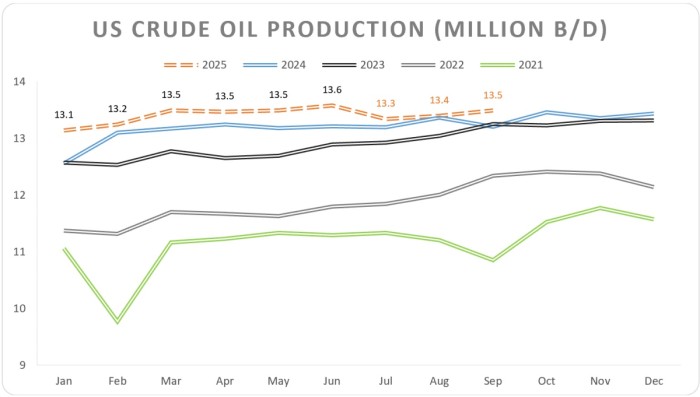

US Drillers Remain Sceptical. The latest Dallas Fed survey on oil and gas activity in key oil-producing states of the US has brought forward the ‘twilight of shale’ as executives voiced their frustration with Trump’s tariff policies, with the company outlook index falling from -6.4 in Q2 to -17.6 in Q3.

Canadian Gas Producers Curb Output. Record low natural gas prices in Canada, with Alberta’s benchmark AECO spot prices trading at an average of -$0.18 per MMbtu this week have prompted the country’s oil and gas companies to aggressively cut output, absent any incremental LNG offtake outlet.

Serbia’s Only Refinery Awaits Its Ordeal. The Trump administration will impose sanctions on Serbia’s Russian-owned oil company NIS from October 1, according to the country’s President Aleksandar Vucic, citing Gazprom Neft’s 44.9% stake in the company that operates the 100,000 b/d Pancevo refinery.

French Unions Look Forward to Week-Long Strikes. France’s largest industrial trade union CGT vowed to disrupt port operations and block ships from discharging until its salary demands are met, prompting terminal operator Elengy to invoke force majeure at three sites, temporarily halting cargo discharges.

BP Scales Back Its Renewable Ambition. Publishing its annual Energy Outlook, UK oil major BP (NYSE:BP) pared back its call of global crude demand peaking in 2025 at 102 million b/d, pushing peak oil out to 2030 (at 103.4 million b/d), blaming the change on weaker-than-assumed energy efficiency gains.

World’s Most Important Copper Mine Grinds to a Halt. US mining giant Freeport-McMoran (NYSE:FCX) declared force majeure at its Grasberg mine in Indonesia, one of the largest copper and gold mines globally, after a landslide blocked access to underground parts of it, trapping seven miners and killing two.

Russia to Build Four Nuclear Plants in Iran. Tehran has signed a $25 billion agreement with Russia’s state nuclear corporation Rosatom to build four nuclear power reactors in the country, with Iranian media suggesting the 5 GW capacity site would be located in the southeastern province of Hormozgan.

Europe Plans Tariffs on Chinese Steel. According to German newspaper Handelsblatt, the European Commission plans to impose tariffs of 25% to 50% on Chinese steel and related products over the upcoming weeks, even though Europe accounts for only 4% of China’s steel exports, as of end-2024.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com