Li Auto and Sunwoda’s battery arm SEVB will set up a joint venture (JV) with equal capital contributions. The company has already been registered with the Shanghai Administration for Market Regulation and, according to public records, will focus on producing and selling lithium-ion batteries for electric vehicles.

36Kr has learned that the entity, legally registered in Shandong, will be used to manufacture Li Auto’s self-developed batteries, which could be installed in vehicles as early as next year.

A source told 36Kr that Li Auto classifies its battery collaboration with Contemporary Amperex Technology (CATL) as a co-development project. By contrast, its partnership with SEVB is regarded as a fully in-house initiative, since Li Auto leads the design of the product, processes, and materials.

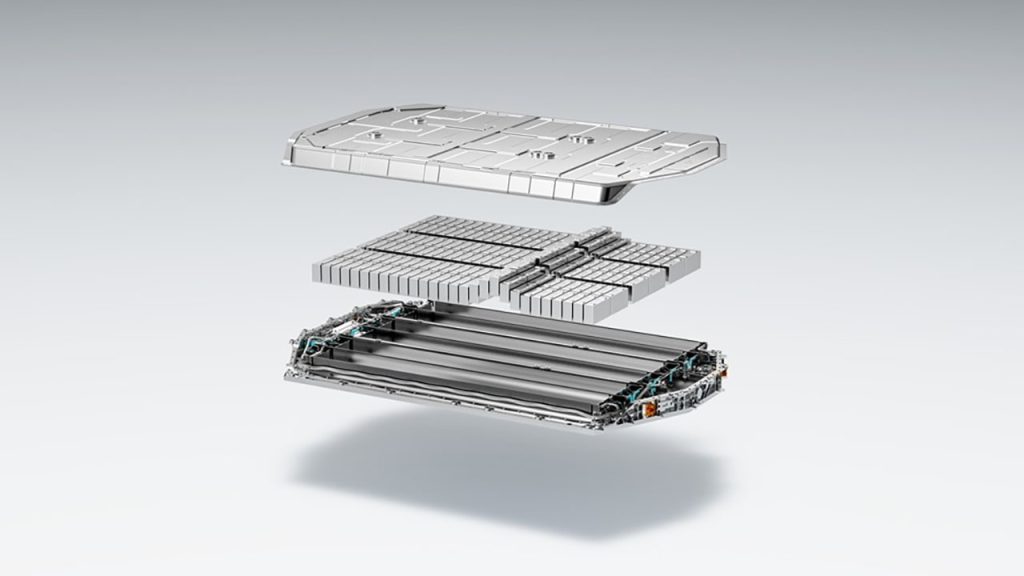

Li Auto has assembled a battery R&D team of more than 200 members. Industry insiders said president Ma Donghui closely tracks the project, reviewing progress roughly every two weeks. One source noted that the company is heavily focused on 5C ultrafast charging batteries, where it is deeply involved in chemistry, structural design, and battery management system (BMS) algorithms. “Li Auto and SEVB are pushing forward many battery R&D projects. For almost every one, after calculating the costs with SEVB, Li Auto decides to invest without hesitation,” the source said.

Analysts suggest that setting up a JV with SEVB strengthens the legitimacy of Li Auto’s self-developed battery, which can now officially carry the company’s brand label.

Chairman and CEO Li Xiang has previously outlined three categories of supply chain collaboration:

Self-developed and self-produced: Fits the company’s values and strategy, with no mature supplier available. Examples include range extenders, electric drive systems, and smart components.

Self-developed and outsourced: Fits the company’s values and strategy, but mature suppliers exist and can sometimes deliver higher quality.

External procurement: Does not fit the company’s values or strategy, but the market is mature enough, such as with bumpers and mirrors.

The new JV falls into the first category. Li Auto has created similar entities for other core parts, such as Huixiang for electric drives and Sike Semiconductor for silicon carbide components.

Although batteries are widely adopted, they remain one of the most expensive components in an EV, accounting for 30–35% of total cost. As a result, they are central to any supply chain strategy.

On the same day, Li Auto also announced a five-year strategic cooperation agreement with CATL. For Li Auto, diversifying partnerships is part of a broader strategy: once a carmaker reaches sufficient scale, controlling costs and securing supply requires working with multiple battery partners.

Seeking control over pricing and customization

For Li Auto, joint ventures are a proven way to manage supply chains, a method long used by traditional automakers. The company has already applied this approach effectively, establishing Huixiang with Inovance Automotive for electric drive systems and Sike Semiconductor with Sanan Semiconductor for silicon carbide chips.

The new JV follows the same logic: it gives Li Auto a customized, stable battery supply while lowering supplier investment risks.

Automakers often require bespoke components to differentiate their products, and Li Auto is no exception. For example, Hesai Technology developed ATL LiDAR (light detection and ranging) specifically for the Li i8.

Since ultrafast charging is central to Li Auto’s fully electric models, its need for customized batteries is even greater than its need for specialized LiDAR. But convincing CATL to commit exclusive R&D resources has proven difficult, as the supplier tends to spread new technologies across multiple clients to maximize returns. In this context, SEVB is the better partner for Li Auto’s customization strategy, helping the automaker cut procurement costs, diversify supply, and advance differentiated tech development.

How SEVB secures major clients

SEVB, originally a consumer battery manufacturer, later expanded into the EV battery market. According to its Hong Kong IPO prospectus, consumer batteries still generate more than half of its revenue.

Its formal partnership with Li Auto began in 2017. In 2022, Li Auto invested RMB 400 million (USD 56 million) in SEVB’s EV battery subsidiary, subscribing to RMB 204 million (USD 28.6 million) in shares. This gave Li Auto a 3.22% stake, making it both a customer and shareholder. Chen Hui, SEVB’s general manager of the division serving Li Auto, recalled that the automaker initially planned to invest RMB 200 million (USD 28 million), but CEO Li Xiang personally pushed to double the amount.

In 2023, SEVB set up a dedicated division for Li Auto with 1,300 employees. By June this year, that number had grown to 1,700. Li Auto also increased its procurement from SEVB to 30% of its battery supply.

Chen told 36Kr that SEVB integrated its manufacturing and inventory data into Li Auto’s Lianshan system by the end of 2023. This year, Li Auto’s vehicle data has been linked to SEVB’s systems, enabling the two companies to jointly develop a battery early-warning model.

This deepening integration paved the way for the JV. For SEVB, securing an alliance with a leading EV maker ensures stable demand. With equal ownership, it also shifts from being a supplier to a profit-sharing partner.

As of March, Li Auto contributed 5.8% of SEVB’s revenue, making it one of the company’s top five customers.

Currently, SEVB batteries are used in Li Auto’s L6, L7 Air, and L8 Air models. The upcoming i6 will source batteries from both SEVB and CATL. Following the JV, Li Auto may allocate more supply to SEVB, boosting shipments and improving margins in its EV battery business.

SEVB’s growth strategy in EV batteries combines competitive pricing with an ODM-style approach to secure large clients. Beyond Li Auto, it has formed JVs with Dongfeng Motor and Geely. According to 36Kr, it is also exploring similar partnerships with other automakers to capture a larger share of the expanding EV market.

kr-asia.com