Governments are continuing to create favourable CCUS policy environments through carbon pricing, tax credits, and subsidies in the pursuit of decarbonization without deindustrialization says the report. Noteworthy first-of-a-kind projects coming online recently include Northern Lights T&S and Stratos DAC.

The private sector is increasingly engaging with CCUS – with examples including oil and gas companies pivoting into providing CO2 transportation and storage services and data center hyperscalers creating markets for carbon credits from direct air capture (DAC) and biogenic CCUS (BECCS).

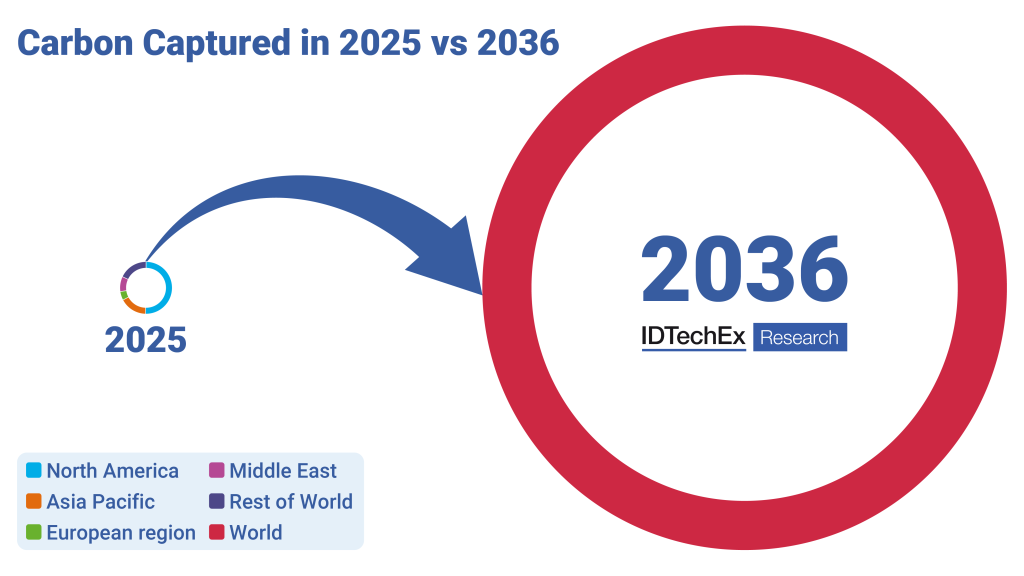

The report provides a comprehensive outlook of the emerging CCUS industry and carbon markets, with an in-depth analysis of the technological, economic, regulatory, and environmental aspects that are set to shape the CCUS industry over the next 10 years. The report also includes a 10-year granular forecast until 2036 for CCUS carbon capture capacity (segmented by CO2 end-point, point-source vs DAC, industrial sector, and region) alongside exclusive analysis, 60 interview-based company profiles, and coverage of 350+ companies.

Significant growth in CCUS forecasted by IDTechEx by 2036 with varying geographical trends. Source: IDTechEx

Typically, tax credits and/or government subsidies are still needed to bring new large-scale CCUS projects online. Important examples include the US 45Q tax credit (recently increased for CO2 utilisation following the Trump administration’s One Big Beautiful Bill) and the UK government announcing £20 billion in funding for industrial CCUS clusters.

Compliance carbon market mechanisms – such as carbon taxes and emissions trading schemes – are expected to ultimately enable CCUS long-term. As of 2025, nearly 30% of global CO2 emissions are covered by some form of carbon pricing, with the arrival of the European Union CBAM (carbon border adjustment mechanism) in 2026 triggering new carbon market developments.

Moreover, new partial chain CCUS hubs, clusters, and networks are set to deliver economies of scale and debottleneck CCUS development. By providing shared CO2 transportation and CO2 storage infrastructure, this new CCUS business model will streamline the CCUS project pipeline.

Point-source carbon capture innovations

Amine solvents for point-source carbon capture are technologically mature with major players in this space including Mitsubishi Heavy Industries, Shell, and SLB Capturi. Innovations to reduce the capture costs of amine solvents include demixing solvents and water-lean solvents. On the balance of plant side, development areas include advances to improve mass transfer in absorber/stripper columns.

Beyond amine solvents, emerging start-ups in the carbon capture space are pursuing a broad range of technologies including molten borate salts, facilitated transport membranes, molten carbonate fuel cells, sorbents such as MOFS (metal organic frameworks), and cryogenic approaches. These technologies ultimately aim to reduce the energy demand and costs of carbon capture.

CCUS development varies by region

The US is the world leader for CCUS, due its 45Q tax credit support and strong history of CO2-EOR (enhanced oil recovery). Other regions including Europe, China, Canada, and the UK will also be crucial for the global acceleration of CCUS. For example, the EU’s recent Net-Zero Industry Act mandates an annual CO2 permanent storage capacity of at least 50 million tonnes by 2030 across the EU.