Oil prices ended the week slightly lower as U.S. inventory builds and oversupply fears outweighed the Federal Reserve’s long-awaited interest rate cut.

Friday, September 19, 2025

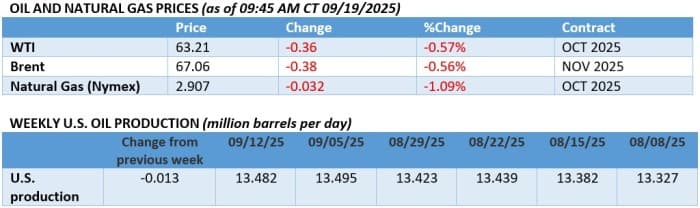

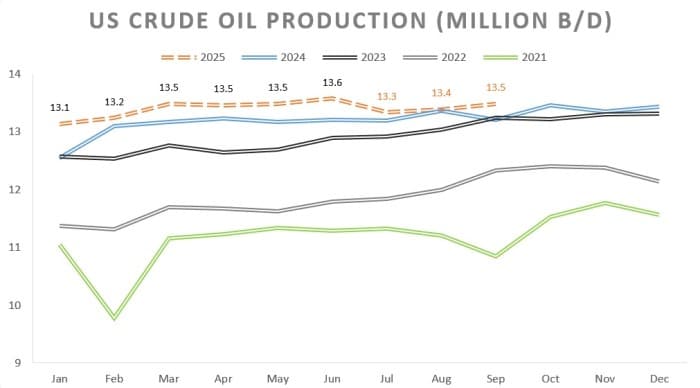

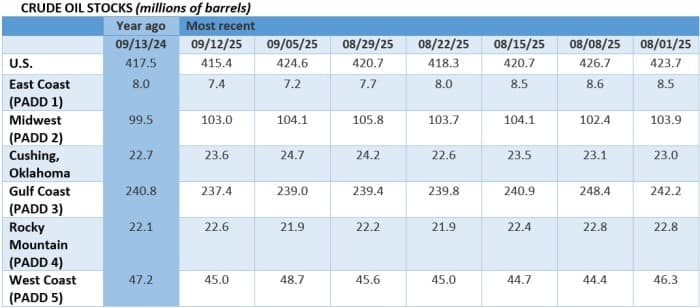

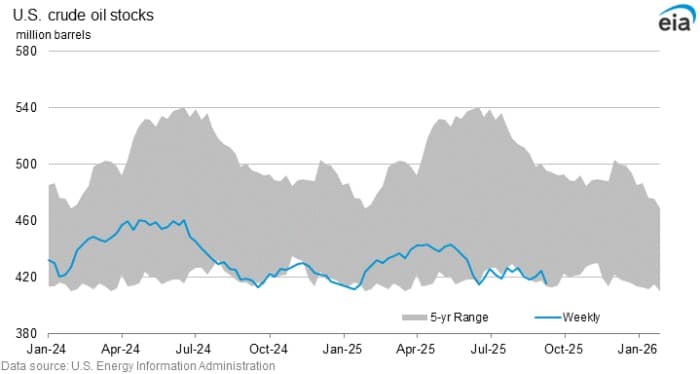

The long-anticipated US Federal Reserve interest rate cut has failed to deliver a new bullish boost to oil prices, as the news was quickly offset by larger-than-usual US inventory builds and recurring concerns about OPEC+ policy leading inevitably to oversupply next year. Oil prices are set for a minor week-over-week decline, with ICE Brent closing the week around $67 per barrel. Pricing in September has so far been extremely rangebound, moving within the $65.5-69.0 per barrel bandwidth all throughout the month.

OPEC+ to Discuss Members’ Production Capacity. OPEC+ delegates met this week in Vienna to discuss the methodology to assess members’ respective crude oil production capacities, seeking to use these readings as reference for 2027 production baselines to re-adjust quotas for countries in decline.

Brussels Mulls Quicker Phaseout of Russian LNG. The European Commission is discussing a proposal to expedite its own ban on imports of Russian liquefied natural gas, potentially even earlier than the initially assumed deadline of January 2028, with a ban on short-term contracts kicking in next June.

China Goes Hard on Trinidad Licensing Round. Trinidad and Tobago received only four bids for 26 blocks currently on auction, three of which were coming from China’s offshore explorer CNOOC (SHA:600938), hampering the Caribbean nation’s quest to halt years of continuous gas output decline.

Namibia Is Preparing for a Major Oil Boom. With an estimated 20 billion barrels offshore and a success rate rivaling Guyana’s oil boom, Namibia’s Orange Basin has seen massive discoveries led by some of the industry’s biggest names. Juniors like Oregen Energy (CSE: ORNG) are also carving out positions in this frontier, which could make Namibia one of the world’s top 10 oil producers by 2035.

US Major Plays Down Likelihood of Russia Return. US oil major ExxonMobil (NYSE:XOM) denied media rumours that it is considering a return to Russia’s Sakhalin-I project, pulling out of the country in 2022, saying that its talks with Russian officials were about recouping the lost $4.6 billion of investment.

Fatality Rocks Norway’s Only Refinery. Norwegian state oil firm Equinor (NYSE:EQNR) halted all non-essential activity at its 230,000 b/d Mongstad refinery after a fatal accident during lifting operations at the site, less than three months after the same plant was forced to halt output due to a power outage.

Global Traders Expand into Refining. Global trading houses Vitol and Glencore (LON:GLEN) are expected to make formal bids for the 50% stake of Chevron (NYSE:CVX) in Singapore’s second-largest refinery, the 290,000 b/d Jurong island plant that the US oil major has up until now jointly operated with PetroChina.

ADNOC Walks Away from Santos Acquisition. ADNOC, the national oil company of the United Arab Emirates, has withdrawn its $18.7 billion bid for Australian oil and gas producer Santos (ASX:STO) after months of disagreements over the firm’s valuation, marking the third failed bid in 7 years to buy it.

Japan Wants More of US Shale Gas. Japan’s leading utility company JERA is reportedly in advanced negotiations with Blackstone-backed GeoSouthern Energy and pipeline firm Williams Companies (NYSE:WMB) to buy $1.7 billion worth of natural gas producing assets in the Haynesville basin.

Liberia Eyes Exploration Boom with Major Deal. French oil major TotalEnergies (NYSE:TTE) has been awarded four exploration blocks off Liberia, covering about 12,700 km2 (3.1 million acres), as the African nation – still yet to have an oil discovery – seeks to copy the success of neighbouring Ivory Coast.

Sri Lanka Hopes for Chinese Refining Intervention. Sri Lanka expects China’s state oil company Sinopec (SHA:600028) to start the construction of the 200,000 b/d Hambantota refinery as soon as this year, having allocated the land for the $3.7 billion project, hoping that 20-30% of its output is kept at home.

Panama Canal Launches LPG Pipeline Tender. The Panama Canal Authority has opened bids for engineering firms to build a new $6 billion LPG pipeline connecting the Atlantic and Pacific Oceans, aiming for a 2 million b/d capacity to accommodate growing US propane and butane flows to Asia.

Congo Mulls Cobalt Export Ban Extension. The world’s largest producer of cobalt, the Democratic Republic of Congo, is considering an extension of its cobalt export ban by at least two months, enjoying high prices after COMEX futures rose 60% since the ban was introduced in February, now at $16 per lb.

Defying Sanctions Pressure, Russian Crude Gets More Expensive. The price of October-loading Urals, Russia’s benchmark medium sour grade, has strengthened over the past month to a $2 per barrel discount against Brent, up $1 per barrel from a month ago, reflecting a concurrent rise in freight prices.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com