In a significant endorsement of Intel’s turnaround process, Nvidia is making a $5 billion investment in another chipmaker.

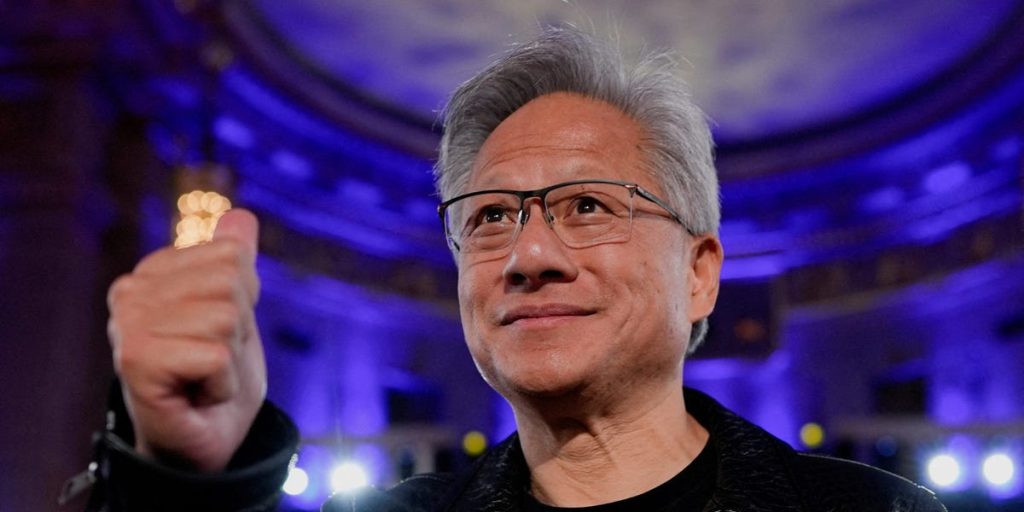

Intel has faced years of dwindling market share and revenues despite the US government’s intervention to help it build chip factories. On Thursday, it got perhaps the most impactful endorsement in the world of semiconductors — that of Nvidia CEO Jensen Huang.

“We’re delighted to have invested in Intel, and the return on that investment is going to be fantastic,” Huang said at a Thursday press conference.

As part of this partnership, Intel will incorporate Nvidia graphics processing unit (GPU) technology, used for powering AI applications, into its coming AI PC models. Nvidia will integrate Intel’s x86 central processing units (CPUs) — the traditional computer chips needed to run the more advanced AI chips — in its data centers.

“We’re going to become a very large customer of Intel CPUs,” said Huang.

Intel’s stock has climbed about 23% by the Thursday closing bell.

Nvidia CEO Jensen Huang’s blessing

The partnership comes just weeks after Intel found itself in the crosshairs of President Donald Trump’s administration. Trump called for Intel CEO Lip-Bu Tan’s immediate resignation in early August, citing conflicts of interest from his Chinese investments. Trump quickly reversed course after meeting with Tan.

Soon, investment announcements began rolling. In early August, SoftBank announced it was investing $2 billion in Intel via stock. A few weeks later, Trump announced the US government would be taking a 9.9% stake in the company — a move that has garnered head-scratches from business leaders, along with cheers and jeers from politicians.

Trump and Nvidia’s Huang have been spending more time together. Both men were in the UK on Wednesday when Huang announced a major AI data center project alongside the president’s state visit.

Some see political benefit for Nvidia in the Intel deal, too.

“Partnering with a US-backed Intel strengthens Nvidia’s alignment with Washington’s industrial policy, potentially reducing scrutiny around its China exposure,” wrote Brad Gastwirth, global head of research at Circular Technology.

Huang said Thursday the administration had no role in the deal, though it is supportive.

With Nvidia’s investment, Bernstein estimates it will own about 4% of Intel. The three deals will eventually bring Intel $16 billion in cash.

“Having Jensen’s blessing is priceless,” wrote Bernstein senior analyst Stacy Rasgon in a note to investors.

Related stories

What the investment in Intel entails

Tan said at Thursday’s event that the collaboration builds on the “core strengths” of both companies.

Huang’s investment in Intel allows Nvidia to address the personal computer market. Currently, it focuses on the desktop GPU market, which is prevalent in gaming, graphics, and scientific applications.

Nvidia has historically purchased CPUs from AMD and ARM. AMD’s stock fell moderately upon the news as the company competes with Intel in both data centers and consumer PCs.

Huang said that ARM’s business would not be affected. Wall Street analysts noted the potential for a small share loss for ARM and a slightly larger potential loss for AMD, though still likely incremental.

Intel’s foundry plans

Thursday’s announcement did not include news for Intel’s foundry business, a costly bet to manufacture chips domestically for other companies. At the Thursday press conference, the two executives side-stepped multiple questions about the potential for Nvidia to become a foundry customer of Intel.

“We’ve always evaluated Intel’s foundry technology, and we’re going to continue to do that,” said Huang. “But today, this announcement is squarely focused on these custom CPUs.”

The Bernstein analysts wrote that $5 billion won’t fix Intel’s struggles with building its foundry business.

“The root cause of Intel’s issue is its small scale, high cost, and poor execution of Intel Foundry,” the Bernstein analysts wrote.

What Wall Street says about the investment in Intel

Nvidia could gain from the increased influence over future generations of Intel product design as AI makes its way into personal computers, Gastwirth said.

And the deal with Nvidia could change the narrative for Intel, which has been losing share in its product sales, Rasgon said. Intel has also been conducting rolling layoffs for years.

“We note that no timeline has been given for future product roadmaps, however,” Rasgon wrote, adding that it would likely take “several years.”