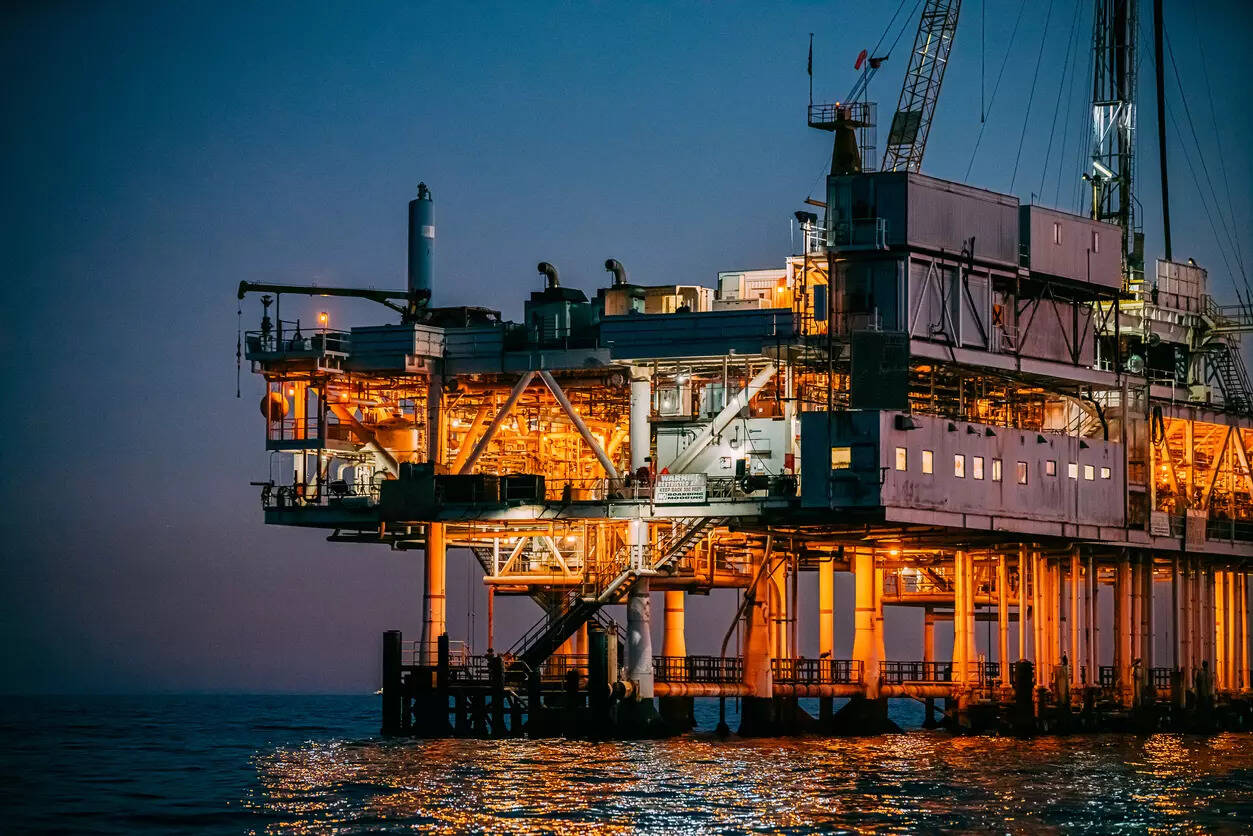

Oil prices edged higher on Monday as investors assessed the impact of Ukrainian drone attacks on Russian refineries, while U.S. President Donald Trump said he was prepared to impose sanctions on Russia if NATO nations stop buying Russian oil.

Brent crude futures rose 32 cents, or 0.5 per cent, to $67.31 a barrel by 0800 GMT while U.S. West Texas Intermediate crude was at $63.01 a barrel, also up 32 cents, or 0.5 per cent.

Ukraine launched a large attack with at least 361 drones targeting Russia overnight, sparking a brief fire at the vast Kirishi oil refinery in Russia’s northwest, Russian officials said on Sunday.

Both crude contracts gained more than 1 per cent last week as Ukraine stepped up attacks on Russian oil infrastructure, including the largest oil exporting terminal, Primorsk.

“The attack suggests a growing willingness to disrupt international oil markets, which has the potential to add upside pressure on oil prices,” JPMorgan analysts led by Natasha Kaneva said in a note, referring to the attack on Primorsk.

Primorsk has a capacity to load about 1 million barrels per day of crude, while the Kirishi refinery processes about 355,000 barrels per day of Russian crude, equal to 6.4 per cent of the country’s total.

“If we are seeing a strategic shift by Ukraine towards Russian oil exporting infrastructure – that brings upside risks to forecasts,” IG markets analyst Tony Sycamore said, despite ongoing concerns around oversupply as OPEC+ plans to ramp up output.

Pressure is mounting on Russia as U.S. President Trump said on Saturday that the U.S. was prepared to impose fresh energy sanctions on Russia, but only if all NATO nations ceased purchasing Russian oil and implemented similar measures.

Investors are also watching U.S.-China trade talks in Madrid that started on Sunday amid Washington’s demands that its allies place tariffs on imports from China over its purchases of Russian oil.

Last week, softer job-creation data and rising inflation in the U.S. raised concerns about economic growth in the world’s largest economy and oil consumer. (Reporting by Florence Tan; Editing by Muralikumar Anantharaman, Christian Schmollinger and Emelia Sithole-Matarise)