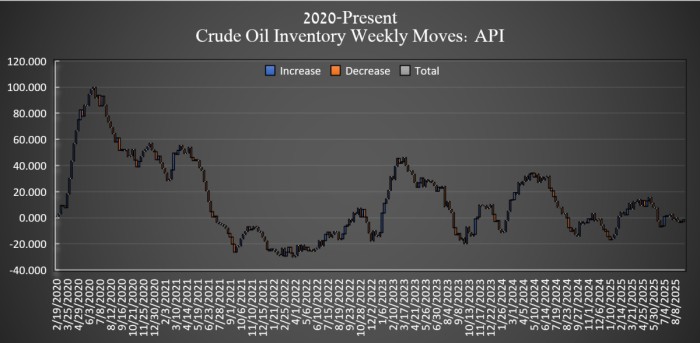

The American Petroleum Institute (API) estimated that crude oil inventories in the United States rose by 1.25 million barrels in the week ending August 29.

So far this year, crude oil inventories are up 8.7 million barrels, according to Oilprice calculations of API data.

Earlier this week, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 500,000 barrels to 405.2 million barrels in the week ending September 5.

At 10:05 am ET, Brent crude was trading up $0.92 (+1.39%) on the day, landing at $66.94—down roughly $0.60 per barrel from last week’s prices—after Israel’s bold move to attack Hamas leaders in Qatar, adding to the bullish sentiment that already existed in the markets from OPEC+ opting for a modest output increase of just 137,000 bpd in October, far below expectations and signaling supply restraint. Prices also received a boost from geopolitical tensions surrounding potential new sanctions on Russia’s oil supply. Oil prices began easing later in the afternoon, with Brent losing some of the gains to $66.42 at 4:20pm.

WTI was also trading up on the day, by $0.42 (+0.67%) at $62.68.

Gasoline inventories rose by 329,000 barrels in the week ending September 5, after falling by 4.577 million barrels in the week prior. As of last week, gasoline inventories were 2% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories rose significantly for the second week in a row, adding 1.5 million barrels, after rising by 3.687 million barrels in the week prior. Distillate inventories were already a massive 13% below the five-year average as of the week ending August 29, the latest EIA data shows.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com