Aerial view of the La Isla salt flat, located at 3,950 meters above sea level near the border with Argentina in the Atacama Region, Chile, taken on May 16, 2024.

Rodrigo Arangua | Afp | Getty Images

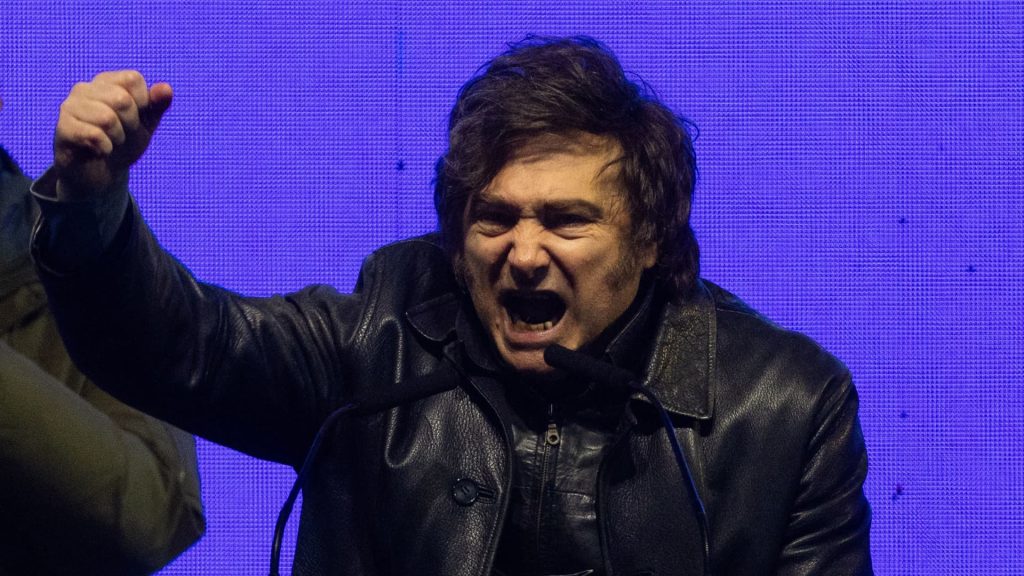

Argentina’s President Javier Milei is scrambling to unlock the South American country’s copper potential, seeking to capitalize on surging global demand amid a push toward electrification and renewable energy.

Milei, a self-described anarcho capitalist who won a shock election in 2023, has unveiled a series of tough reformist measures in an effort to stabilize the traditionally volatile economy and “Make Argentina Great Again.”

As part of this push, Milei’s administration hopes the mining sector can play a key role, particularly in regard to copper and lithium.

One of the libertarian president’s flagship policies has been to introduce the Large Investment Incentive Regime, or RIGI, a scheme designed to provide generous tax, trade and foreign exchange benefits to large-scale investors over a 30-year period.

To date, 20 projects worth just over $30 billion have sought entry into Argentina’s RIGI, according to global risk intelligence firm Verisk Maplecroft, three-quarters of which are in mining. Copper alone is estimated to represent $16 billion, more than all non-mining sectors combined.

Major players including BHP, Glencore and Rio Tinto are among those making bold bets on Argentina’s copper and lithium potential, with top executives from Glencore and Rio Tinto recently traveling to meet with Milei on a trip to Buenos Aires.

Javier Milei, President of Argentina, shakes hands with Jakob Stausholm, CEO of Rio Tinto Group, on the floor of the New York Stock Exchange during morning trading on September 23, 2024 in New York City.

Michael M. Santiago | Getty Images News | Getty Images

Ro Dhawan, CEO of the International Council on Mining and Metals (ICMM), a trade body representing roughly one-third of the global industry, described Argentina as “arguably the most exciting new copper story today.”

There are other countries and jurisdictions which may be more geologically rich, Dhawan said, but not one that sits at the intersection of a stable domestic political environment, and the provision of basic infrastructure and facilities and sufficient other investments complementary to the mining industry.

Among the most notable copper projects in Argentina is BHP and Lundin’s Vicuna joint venture.

Situated along the Chile-Argentina border, the Vicuna District is regarded as a geologically prospective region. Indeed, the deposits at Vicuna’s Josemaria and Filo del Sol mines are estimated to contain 13 million metric tons of measured copper and 25 million tons of inferred copper.

Policy consistency and social licence will determine whether this is Argentina’s mining moment or another mirage.

Mariano Machado

Americas principal analyst at Verisk Maplecroft

For ICMM’s Dhawan, the potential significance of BHP and Lundin’s Vicuna copper project is extraordinary.

“It’s of the same importance to copper as Western Australia was to iron ore — and I don’t say that lightly. It is a bold comparison to make but it is one that I do genuinely believe in,” Dhawan said.

A spokesperson for BHP and Lundin’s Vicuna copper project said last month that the two companies intend to apply to receive benefits under RIGI, Reuters reported.

A $47 billion opportunity

Argentina’s renewed mining focus comes as global copper demand is expected to skyrocket over the coming years, dramatically outstripping supply amid an artificial intelligence boom and a shift away from fossil fuels.

Analysts at consultancy CRU Group have estimated that the pipeline of Argentina’s potential copper projects could represent a roughly $47 billion opportunity for the economy through to 2040.

This cumulative impact is comparable to the record $44-billion bailout loan Argentina received from the International Monetary Fund.

A government spokesperson did not immediately respond to a request for comment when contacted by CNBC.

Asked whether Argentina’s long history of boom-and-bust economic cycles means Argentina’s copper dreams could crumble once again, ICMM’s Dhawan said: “Where doesn’t have that risk is the question I would ask?”

He added: “I just think that people have adjusted to a new normal expectation of quite significant volatility and that has almost worked in Argentina’s favor. I think two things have happened, I think Argentina’s stability has gone up and the world’s stability has gone down.”

Dhawan said it’s not possible to predict which way Argentina will go, but investors appear to be prepared for different political and economic scenarios and that sovereign risk has been priced in.

Argentina’s mining moment?

Mariano Machado, principal analyst for the Americas at Verisk Maplecroft, said that while Argentina does possess the minerals needed to reshape its export base, “policy consistency and social licence will determine whether this is Argentina’s mining moment or another mirage.”

“The country’s policy swings have kept investment below potential levels, and the government’s failure to persuade lawmakers from the opposition Union for the Homeland (UP) to vote for the RIGI means there is a risk that less private sector-friendly sectors will dispute its provisions if they make a comeback,” Machado told CNBC by email.

Salt mining operations on the salt flats of Salinas Grandes in northwest Argentina.

Vw Pics | Universal Images Group | Getty Images

“A new mining boom could also stoke anti-mining activism,” he added. “Issues around water, protection of glaciers and broader human rights underscore persistent challenges for companies to secure durable social licence to operate.”