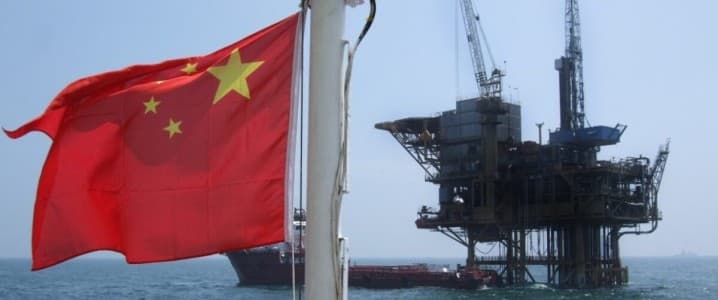

CNOOC Limited has launched oil production at the Wenchang 16-2 Oilfield Development Project in the northern part of the South China Sea, China’s top offshore oil and gas producer said on Thursday.

CNOOC, which specializes in offshore oil and gas developments in China and internationally, launched production of light crude from the project in the western Pearl River Mouth Basin, which sits at an average water depth of about 150 meters (492 ft).

The development of the project uses the existing facilities of the Wenchang Oilfields, as well as a new jacket platform integrating oil and gas production, offshore drilling, completion operations, and personnel accommodation.

CNOOC plans to commission as many as 15 development wells at Wenchang 16-2. The project will be gradually ramping up production, which is expected to reach a plateau of around 11,200 barrels of oil equivalent per day (boepd) in 2027.

In recent months, CNOOC has started up several oilfields offshore China, including output of heavy crude from the largest shallow lithological oilfield. The Kenli 10-2 Oilfields Development Project – launched in July – will see 79 development wells commissioned, including 33 cold recovery wells, 24 thermal recovery wells, 21 water injection wells, and 1 water source well.

Despite the new projects, CNOOC saw its first-half profit decline by 13% from a year earlier as record-high domestic and overseas oil and gas production couldn’t offset the decline in oil prices amid volatile and challenging markets.

The value of CNOOC’s oil and gas sales fell by 7%, as the international benchmark Brent oil prices averaged approximately $71 a barrel between January and June, down from an average of over $83 per barrel for the first half of 2024.

CNOOC’s net production was 384.6 million barrels of oil equivalent (boe), up by 6.1% on the year, as both domestic and international production topped previous record highs, thanks to several new projects coming online.

By Charles Kennedy for Oilprice.com

More Top Reads From Oilprice.com