Oil dropped after four sessions of gains as investors waited for clearer signals on supplies and tracked the wider market fallout from US President Donald Trump’s attempt to oust a Federal Reserve governor.

West Texas Intermediate fell by 2.4%, the biggest loss since early August, to settle near $63 a barrel, remaining within the range of $62 to $65 that prices have been locked in most of this month. Crude’s dip on Tuesday reflected a wariness toward risk assets in wider markets, driven by Trump’s bid to remove the Fed’s Lisa Cook.

The Department of Homeland Security issued a notice Monday to double tariffs on all Indian imports as the US sought to penalize the country for buying Russian crude. The move — to take effect Wednesday — is billed as part of a broader effort by Trump to broker peace between Russia and Ukraine.

Still, Trump’s history of reneging on trade threats is leading many investors to discount the prospect that the higher tariffs will take effect. A similar sentiment is visible in the South Asian nation, where refiners plan to maintain the bulk of their purchases from Russia in the coming weeks.

Crude has traded in a narrow band for most of August, with traders assessing the effect of US levies as well as the longer-term consequences of major supply hikes from OPEC+. The International Energy Agency warned earlier this month that the global oil market was on track for a record surplus next year as demand growth slows while supplies swell, though markets have been firm over the summer.

Meanwhile, Trump praised oil prices “down close to $60 a barrel” at a Cabinet meeting Tuesday, adding the price will be “breaking that pretty soon.” He didn’t clarify which catalyst is set to push prices below $60.

Trading activity this week also was tapering off ahead of the Labor Day holiday weekend in the US, contributing to choppy moves.

“Oil prices remain in a tight range amid geopolitical volatility and relatively resilient fundamentals,” Barclays analyst Amarpreet Singh said in a note.

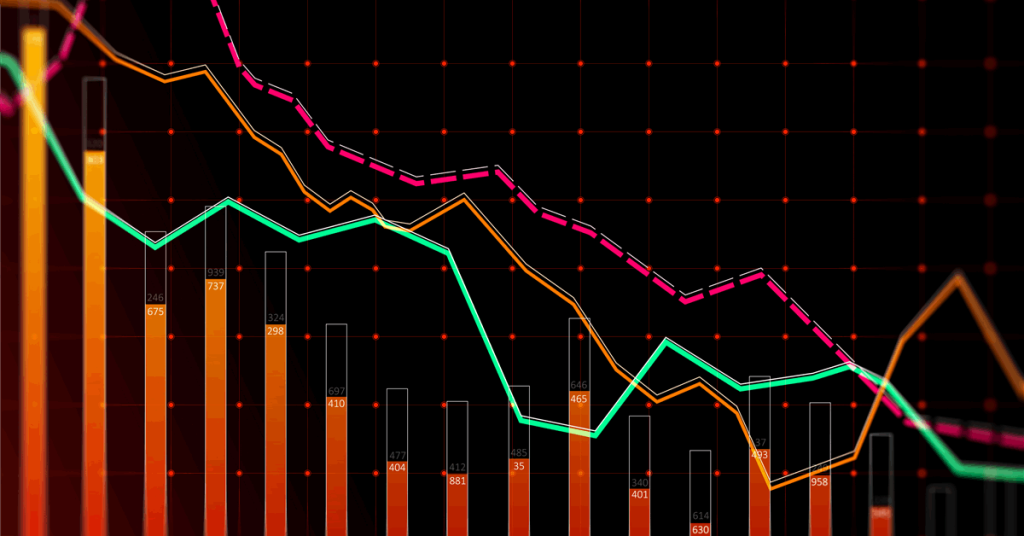

Oil Prices

WTI for October delivery fell 2.4% to settle at $63.25 a barrel in New York.

Brent for October settlement slid 2.3% to settle at $67.22 a barrel.

What do you think? We’d love to hear from you, join the conversation on the

Rigzone Energy Network.

The Rigzone Energy Network is a new social experience created for you and all energy professionals to Speak Up about our industry, share knowledge, connect with peers and industry insiders and engage in a professional community that will empower your career in energy.

element

var scriptTag = document.createElement(‘script’);

scriptTag.src = url;

scriptTag.async = true;

scriptTag.onload = implementationCode;

scriptTag.onreadystatechange = implementationCode;

location.appendChild(scriptTag);

};

var div = document.getElementById(‘rigzonelogo’);

div.innerHTML += ” +

‘‘ +

”;

var initJobSearch = function () {

//console.log(“call back”);

}

var addMetaPixel = function () {

if (-1 > -1 || -1 > -1) {

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

} else if (0 > -1 && 60 > -1)

{

/*Meta Pixel Code*/

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘https://connect.facebook.net/en_US/fbevents.js’);

fbq(‘init’, ‘1517407191885185’);

fbq(‘track’, ‘PageView’);

/*End Meta Pixel Code*/

}

}

// function gtmFunctionForLayout()

// {

//loadJS(“https://www.googletagmanager.com/gtag/js?id=G-K6ZDLWV6VX”, initJobSearch, document.body);

//}

// window.onload = (e => {

// setTimeout(

// function () {

// document.addEventListener(“DOMContentLoaded”, function () {

// // Select all anchor elements with class ‘ui-tabs-anchor’

// const anchors = document.querySelectorAll(‘a .ui-tabs-anchor’);

// // Loop through each anchor and remove the role attribute if it is set to “presentation”

// anchors.forEach(anchor => {

// if (anchor.getAttribute(‘role’) === ‘presentation’) {

// anchor.removeAttribute(‘role’);

// }

// });

// });

// }

// , 200);

//});