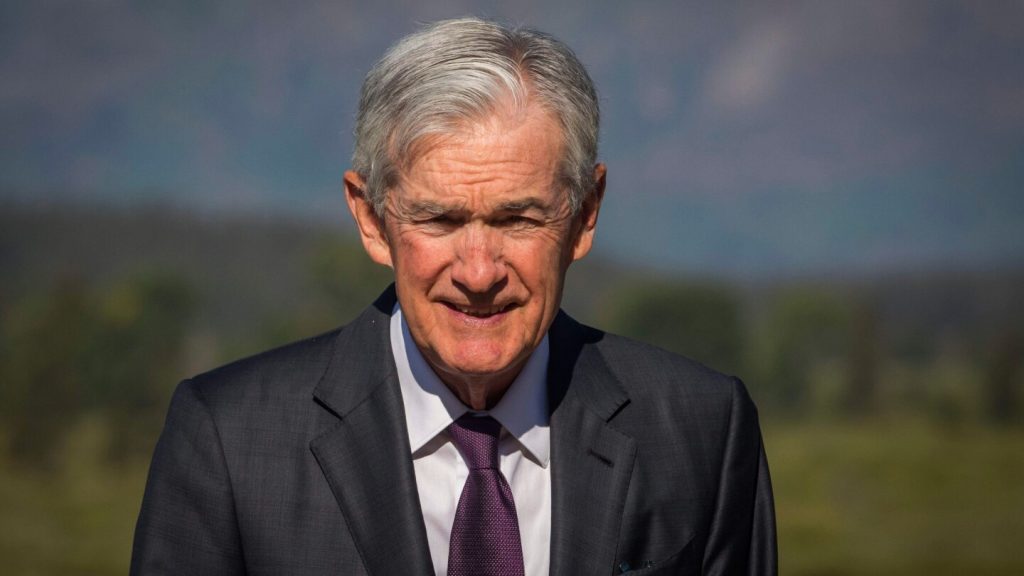

WASHINGTON (AP) — Now that Federal Reserve Chair Jerome Powell has signaled that the central bank could soon cut its key interest rate, he faces a new challenge: how to do it without seeming to cave to the White House’s demands.

For months, Powell has largely ignored President Donald Trump’s constant hectoring that he reduce borrowing costs. Yet on Friday, in a highly-anticipated speech, Powell suggested that the Fed could take such a step as soon as its next meeting in September.

It will be a fraught decision for the Fed, which must weigh it against persistent inflation and an economy that could also improve in the second half of this year. Both trends, if they occur, could make a cut look premature.

Trump has urged Powell to slash rates, arguing there is “no inflation” and saying that a cut would lower the government’s interest payments on its $37 trillion in debt.

Powell, on the other hand, has suggested that a rate cut is likely for reasons quite different than Trump’s: He is worried that the economy is weakening. His remarks on Friday at an economic symposium in Grand Teton National Park in Wyoming also indicated that the Fed will move carefully and cut rates at a much slower pace than Trump wants.

Powell pointed to economic growth that “has slowed notably in the first half of this year,” to an annual rate of 1.2%, down from 2.5% last year. There has also been a “marked slowing” in the demand for workers, he added, which threatens to raise unemployment.

Still, Powell said that tariffs have started to lift the price of goods and could continue to push inflation higher, a possibility Fed officials will closely monitor and that will make them cautious about additional rate cuts.

The Fed’s key short-term interest rate, which influences other borrowing costs for things like mortgages and auto loans, is currently 4.3%. Trump has called for it to be cut as low as 1% — a level no Fed official supports.

However the Fed moves forward, it will likely do so while continuing to assert its longstanding independence. A politically independent central bank is considered by most economists as critical to preventing inflation, because it can take steps — such as raising interest rates to cool the economy and combat inflation — that are harder for elected officials to do.

There are 19 members of the Fed’s interest-rate setting committee, 12 of whom vote on rate decisions. One of them, Beth Hammack, president of the Federal Reserve’s Cleveland branch, said Friday in an interview with The Associated Press that she is committed to the Fed’s independence.

“I’m laser focused … on ensuring that I can deliver good outcomes for the for the public, and I try to tune out all the other noise,” she said.

She remains concerned that the Fed still needs to fight stubborn inflation, a view shared by several colleagues.

“Inflation is too high and it’s been trending in the wrong direction,” Hammack said. “Right now I see us moving away from our goals on the inflation side.”

Powell himself did not discuss the Fed’s independence during his speech in Wyoming, where he received a standing ovation by the assembled academics, economists, and central bank officials from around the world. But Adam Posen, president of the Peterson Institute for International Economics, said that was likely a deliberate choice and intended, ironically, to demonstrate the Fed’s independence.

“The not talking about independence was a way of trying as best they could to signal we’re getting on with the business,” Posen said. “We’re still having a civilized internal discussion about the merits of the issue. And even if it pleases the president, we’re going to make the right call.”

It was against that backdrop that Trump intensified his own pressure campaign against another top Fed official.

Trump said he would fire Fed Governor Lisa Cook if she did not step down from her position. Bill Pulte, a Trump appointee to head the agency that regulates mortgage giants Fannie Mae and Freddie Mac, alleged Wednesday that Cook committed mortgage fraud when she bought two properties in 2021. She has not been charged.

Cook has said she would not be “bullied” into giving up her position. She declined Friday to comment on Trump’s threat.

If Cook is somehow removed, that would give Trump an opportunity to put a loyalist on the Fed’s governing board. Members of the board vote on all interest rate decisions. He has already nominated a top White House economist, Stephen Miran, to replace former governor Adriana Kugler, who stepped down Aug. 1.

Trump had previously threatened to fire Powell, but hasn’t done so. Trump appointed Powell in late 2017. His term as chair ends in about nine months.

Powell is no stranger to Trump’s attacks. Michael Strain, director of economic policy studies at the American Enterprise Institute, noted that the president also went after him in 2018 for raising interest rates, but that didn’t stop Powell.

“The president has a long history of applying pressure to Chairman Powell,” Strain said. “And Chairman Powell has a long history of resisting that pressure. So it would be odd, I think, if on his way out the door, he caved for the first time.”

Still, Strain thinks that Powell is overestimating the risk that the economy will weaken further and push unemployment higher. If inflation worsens while hiring continues, that could force the Fed to potentially reverse course and increase rates again next year.

“That would do further damage to the Fed’s credibility around maintaining low and stable price inflation,” he said.