In a notably quiet week, holiday-thinned liquidity kept ICE Brent range-bound at $65.80–$67.90/bbl despite a steep U.S. stock selloff.

August 22nd, 2025

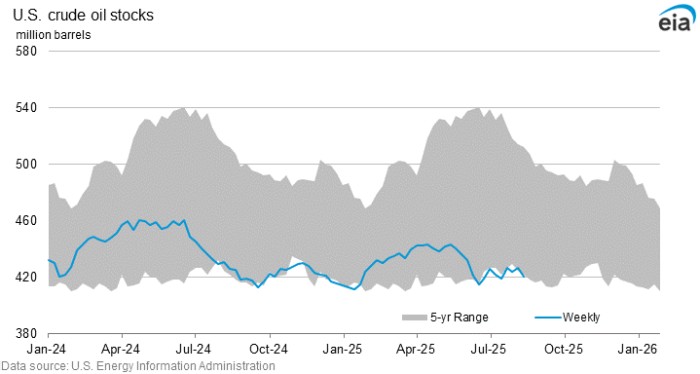

In one of the least eventful trading weeks of 2025, ICE Brent has been trading within a narrow bandwidth of $65.80-67.90 per barrel as the end of summer holidays dragged trading volumes notably lower than usual. The huge drop in US stocks and several refinery upsets across the country (such as the Whiting outage) could’ve triggered a more important pricing reaction, however low liquidity kept daily changes minimal.

Trump Signs Off on New Iran Sanctions. The US Treasury Department added 13 commercial entities in Hong Kong, China and the UAE to its list of Iran-related sanctions, simultaneously banning 8 vessels and two China-based port operators in Qingdao and Yangshan, further tightening its pressure on Iran.

Kazakhstan Eyes Reparations from Oil Majors. Kazakhstan’s Ministry of Environment Protection informed oil companies operating in the country that they have 40 days to pay a $4.4 billion fine for sulphur pollution in the country, mostly coming from the offshore Kashagan field in Atyrau region.

US Probes Wind Turbine Imports. The US Commerce Department opened a national security investigation into the country’s imports of wind turbines and components, gauging the impact of foreign subsidies on the competitiveness of the US wind industry, slapping a 50% tariff on wind turbines earlier this week.

Venezuela Opens the Door for Chinese Investors. Chinese private oil firm Concord Resources has agreed to invest more than $1 billion in two Venezuelan oilfields, aiming to produce 60,000 b/d by the end of next year from the Lago Cinco and Lagunillas Lago projects after years of underinvestment.

Ukraine Targets Russia’s Pipelines. For the second time this week, Ukrainian armed forces have bombed the Unecha pumping station on the Russia-Ukraine border, once again halting transportation along the Druzhba pipeline to Hungary and Slovakia and stranding some 210,000 b/d of exports.

Seoul Forces Petchem Sector to Shrink. Guided by the Seoul government, ten South Korean petrochemical companies have agreed to cut their naphtha-cracking capacity by 25%, equivalent to 3-3.5 million tonnes per year, to improve profitability amidst industry-wide overcapacity and low margins.

Indian Refiners Resume Russian Oil Imports. Whilst India’s private refiners never really stopped importing Russian crude, the South Asian nation’s government-controlled companies resumed purchases after a two-week hiatus, as confirmed by company officials of IOC and Bharat Petroleum.

Iraq Welcomes US Oil Majors Back. The Iraqi government signed an agreement in principle with US oil firm Chevron (NYSE:CVX) on the Nassiriya project, comprising four exploration blocks in the southern province of Dhi Qar as well as several producing oil fields, seeking to reach 600,000 b/d within 7 years.

China Doubles Down on Overcapacity Curbs. China’s Industry Ministry organized another meeting with solar industry representatives to discuss ways to curb overcapacity, saying producers themselves should promote the decommissioning of outdated capacity to avoid ‘low-price disorderly competition’.

Kurdish Production Is Coming Back. Norway’s upstream firm DNO (OSL:DNO) reported that it had restarted oil production at the Tawke and Peshkabir fields in Iraqi Kurdistan, halted a month ago due to repeated drone strikes carried out by Iraqi militias, ramping up output to 55,000 b/d on a test basis.

Conoco Locks in Key LNG Contract. US oil major ConocoPhillips (NYSE:COP) agreed to purchase 4 million tonnes of LNG per year from Sempra’s Port Arthur LNG 2 over a 20-year term on a free on board (FOB) basis, having already bought a 30% stake in Port Arthur 1 with an expected commissioning in 2027.

Syria Marks Full Return to Oil Markets. Syria’s Ministry of Petroleum issued a sell tender for at least one cargo of Syrian Heavy crude, the country’s first official attempt to sell its oil since 2011 as the new government in Damascus seeks to ramp up production from 50,000 b/d, one-sixth of its former output.

Norway Finds Even More Oil. Norway’s largest untapped crude project, the 120,000 b/d Yggdrasil developed by Aker BP, saw the discovery of a huge deposit next to its initial find with the Omega Alfa well tapping into 100-130 MMboe of new hydrocarbon reserves, taking the total to 700 MMboe.

By Tom Kool for Oilprice.com

More Top Reads From Oilprice.com