A US stake in Intel doesn’t mean that President Donald Trump would put his finger on the scale for the beleaguered chipmaker.

Treasury Secretary Scott Bessent said on Tuesday that while the White House wants to increase US-based production of semiconductors, it would not pressure companies to do business with Intel.

“Yeah, the last thing we’re going to do is put pressure, is to take a stake and then try to drum up business,” Bessent said during an interview on CNBC.

Bessent’s comments come amid reports that the White House is discussing a deal that would give the US a 10% equity stake in Intel, potentially making US taxpayers Intel’s largest shareholder. No announcement has been made, though Trump recently met at the White House with Intel CEO Lip-Bu Tan. Separately on Monday, Intel announced that SoftBank would make a $2 billion investment.

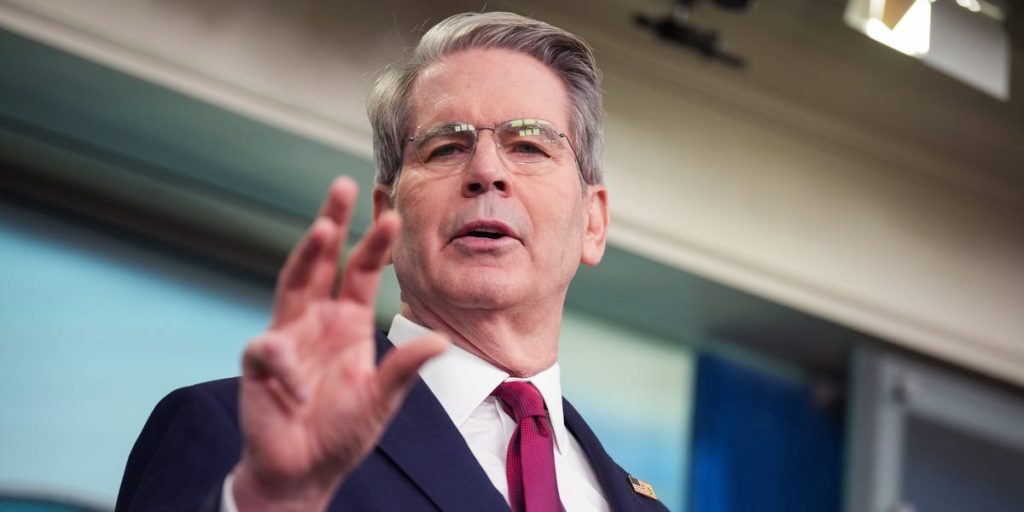

Commerce Secretary Howard Lutnick is “ironing out the details,” White House press secretary Karoline Leavitt told reporters Tuesday afternoon.

“It is a creative idea that has never been done before to ensure we’re both reshoring these critical supply chains while also gaining something for the American taxpayer,” she said.

Earlier Tuesday, Lutnick said if the US were to take a stake, it would not come with voting rights or anything akin to a so-called golden share. Instead, Trump wants to get something in return for the government grants Intel is set to receive.

Related stories

“America should get the benefit of the bargain,” Lutnick said during a separate interview on CNBC. “I mean, that is exactly Donald Trump’s perspective, which is, Why are we giving a company worth $100 billion this kind of money? What is in it for the American taxpayer?’ And the answer Donald Trump has is we should get an equity stake for our money.”

Intel is set to receive roughly $10.9 billion in grants as part of the bipartisan Biden-era CHIPS Act. Trump and his team have been harshly critical of the law’s design while supporting the broader idea of making more chips in the US.

“I would say that the single point of failure for the global economy is that 99% of the advanced chips in the world are made in Taiwan,” Bessent said. “And for national security, we have to stop that single point of failure.”

Asked about The Wall Street Journal editorial board calling the US government taking a stake in Intel “corporate statism,” Lutnick said that the Trump White House simply wants something in return for the billions in grants.

“We were giving away the money,” Lutnick said. “Imagine this, look, the Biden administration was giving Intel money for free, and giving TSMC money for free, and all these companies just giving the money for free. And Donald Trump is saying, ‘Hey, if we are going to give you the money, we want a piece of the action for the American taxpayers.”