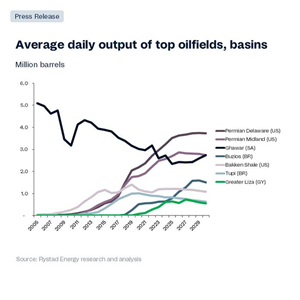

Rystad Energy’s latest research shows the global amount of discovered, recoverable oil resources has increased by 5 billion barrels (bbls) over the past year, even though 30 billion bbls were produced globally in 2024. This net increase was driven primarily by the delineation of upside potential in Argentina’s Vaca Muerta play and the Permian basin in Texas and New Mexico.

Chart from Rystad Energy

Global recoverable oil resources, including estimates for undiscovered fields, stabilized at approximately 1.5 trillion bbls. The most significant revision over the last 10 years has been in yet-to-find resources, where our projection has been reduced by 456 billion bbls. This is due to a steep decline in frontier exploration, unsuccessful shale developments outside the Americas and a doubling in offshore costs over the past five years. According to Rystad Energy, reserve replacements from new conventional oil projects are expected to be less than 30% of production over the next five years, while exploration would replace only about 10%.

A total of 1,572 billion bbls of crude oil were produced historically from 1900 through 2024. Today, the world’s proven oil reserves equal only 14 years of production. If future global oil demand increases, as forecast by OPEC, supply will likely struggle to meet demand, even at attractive, high prices for producers. However, if the energy transition continues to make inroads, future oil demand is expected to fall, particularly with the greater electrification of transport vehicles, as seen in China.

“Full extraction of these oil resources will require oil prices stabilizing at higher levels and further estimate increases will require new technologies to lower production costs,” said Per Magnus Nysveen, Chief Analyst at Rystad Energy. “Over the next decades, the capital needed will likely not be available to meet continuously increasing oil demand, service prices could skyrocket, and there will likely be limited appetite for innovations to sustain such high emissions from oil.”

If oil demand rises over the next few decades, global recoverable resources will not offer the supply needed to meet it, creating a constrained economic environment that wouldn’t be able to compete with less capital-intensive energy sources. As a result, Rystad Energy does not expect oil demand to continue to grow steeply towards 2050, with the company’s analysis concluding that the worst-case warming scenarios evaluated by the Intergovernmental Panel on Climate Change (IPCC) will not materialize. Referring to Rystad Energy’s highest scenario, which leads to a 2.5°C rise in temperature, future CO2 emissions from fossil fuels will be limited to 2,000 gigatons of carbon dioxide (GtCO2), of which 900 Gt will come from coal, 600 Gt from oil, and 500 Gt from natural gas and natural gas liquids (NGLs). This is 500 Gt less CO2 than the IPCC’s mid-scenario, which leads to 2.8°C of warming.

“In a world with flat or growing demand after 2030, another oil super-cycle would be needed,” added Artem Abramov, Deputy Head of Analysis at Rystad Energy. “This scenario would require a substantial increase in frontier exploration and drilling success as well as accelerated deployment of secondary recovery and full-scale development of non-core shale plays in North America and globally.”