Imagine living in a country where private companies need the government’s permission to do business.

Depending on your age, you might think I’m describing Soviet-era Russia — or Russia in the Putin era. You’d certainly think about modern-day China, where the government is an official partner in many private companies, and has unofficial but meaningful influence over most of them.

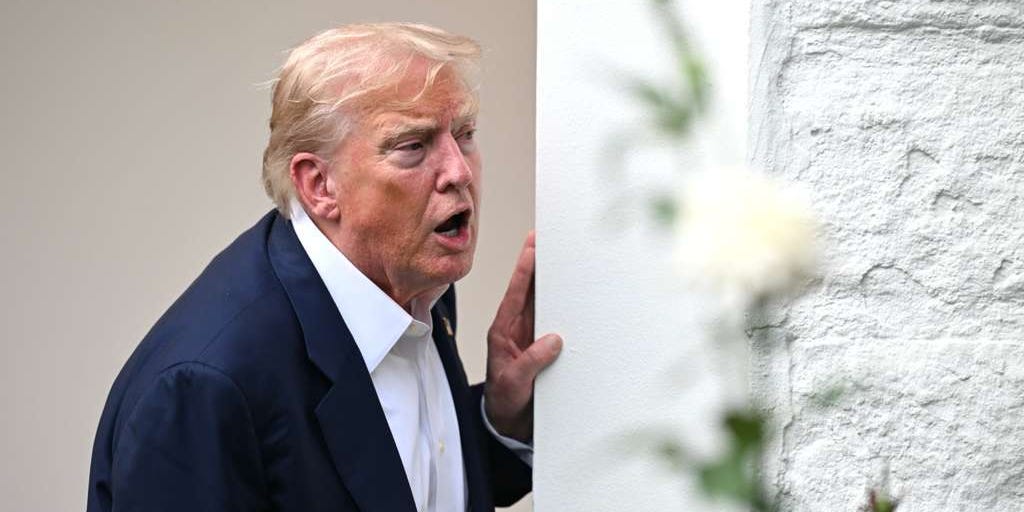

And in 2025, you might also think that’s beginning to describe America in the second Trump administration.

Last week, for instance, Donald Trump called on the CEO of Intel to resign because of his past business connections to China. In June, Trump approved Nippon Steel’s plan to buy US Steel — but only after the US government was granted a “golden share” in the company that gives Washington the ability to approve or veto some actions, like closing plants. In January, Trump floated the idea of having the US government own a portion of TikTok’s US operations.

And now Trump is requiring Nvidia and AMD to hand over 15% of revenue from high-end chip sales to China, as first reported by the Financial Times. (Nvidia has released a statement noting it “follow[s] rules the US government sets for our participation in worldwide markets,” without addressing reports about the deal directly; AMD and the White House have yet to comment.)

You can make arguments for or against any one of these transactions — US chip sales to China have been a particularly divisive issue, even within the Trump administration. But taken together, there’s little question that in Trump 2.0, we should expect the federal government to insert itself into private business.

Call it “state capitalism, a hybrid between socialism and capitalism in which the state guides the decisions of nominally private enterprises,” Wall Street Journal columnist Greg Ip wrote Monday morning. It’s an exceptionally timely piece he appears to have written before the Nvidia/AMD story broke, because it doesn’t contain any reference to it.

Related stories

(You can make the list of Trump’s interventions even longer if you’d like: He personally required former Paramount owner Shari Redstone to pay him $16 million to settle a seemingly specious lawsuit, for instance. And Brendan Carr, the Trump-appointed head of the Federal Communications Commission, has required Paramount’s new owners to promise to “root out the bias that has undermined trust in the national news media.” You could also include the concessions Trump is demanding from some of the nation’s most prestigious universities and law firms.)

The chip story is particularly hard to get your head around, since it inverts the premise of the tariff plans Trump has been pushing this year. Instead of taxing goods made overseas and imported into the US, the US is now taxing goods made by American companies, in America — the thing he supposedly wants to see much more of.

It’s not surprising to see Donald Trump say one thing and do another. And half a year into his second presidency, it’s no longer surprising to see the Republican-controlled Congress let him do just about anything he wants: This is the same Congress that passed a law last year requiring TikTok’s US operations to find a US buyer or shut down — and hasn’t said a word about the fact that Trump has decided to ignore that law, repeatedly.

And again, you might not care about the moves the Trump administration has made to steer companies to date. You might even like them. But the odds are increasing that he’s going to end up involving the federal government in an industry or company you do care about. Maybe one you work in. How are you going to feel about it then?