I’ve been following the oil market closely this year—daily, even hourly at times—and if there’s one thing I can say with confidence, it’s that the surface-level calm belies several meaningful shifts that are underway. To fully grasp those shifts, and the long-term direction of oil prices and markets, one needs to look at some of the big-picture changes taking place. From Asia’s resilient demand to a quiet transformation in the supplier landscape, and now the growing tension between physical tightness and projected oversupply, the contours of the next chapter in oil are becoming clearer. Below are three developments I believe deserve closer attention.

Pay Close Attention to Asia – Not just China

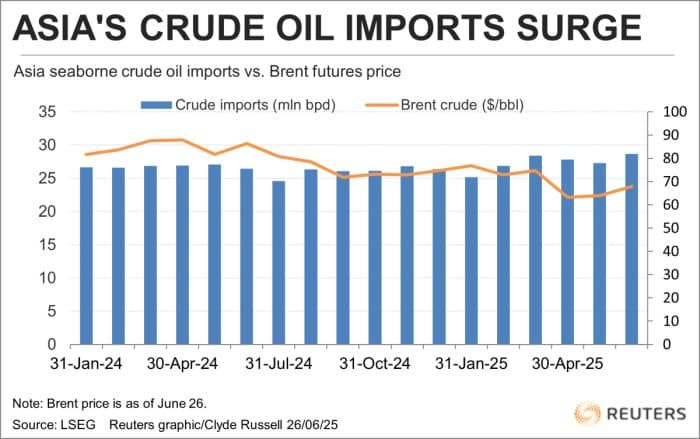

Let’s start with Asian demand. Despite a wave of cautious macro projections, I believe oil consumption across the region remains stronger than acknowledged. Asia’s crude imports in the first half of 2025 came in at 27.25 million barrels per day, according to LSEG data—up 510,000 bpd year-on-year. That’s significant, especially when both OPEC and the IEA are putting out relatively modest near-term growth projections.

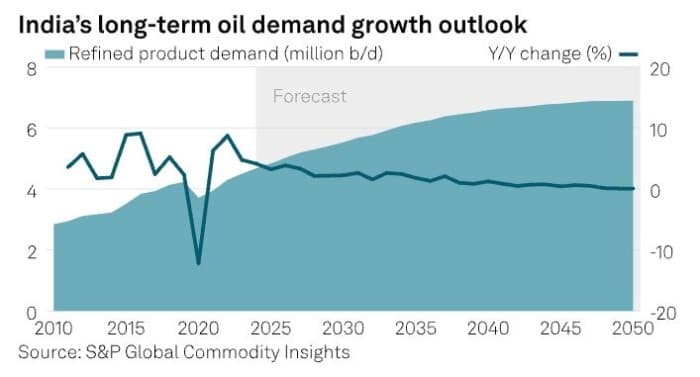

But it’s not just about 2025. Looking ahead toward 2030, the demand profile remains solid. I’ve been following India’s trajectory in particular, where oil consumption is expected to rise by 1 million bpd between 2024 and 2030. That number reflects more than headline growth—it speaks to industrial expansion, a rising middle class, and sustained infrastructure development.

A very important medium-term trend to look at is the rise of so-called Tiger Cub economies—Vietnam, the Philippines, and Indonesia. These markets are not as large individually, but collectively they are becoming more relevant. Non-OECD Asia (excluding China and India) is projected to increase demand by 1.3 million bpd by 2030 from 2024 levels. That’s a material shift. It also helps explain why Asia remains the gravitational center of global crude trade—both now and into the future. Pay close attention to Asia!

China Hedging Suppliers

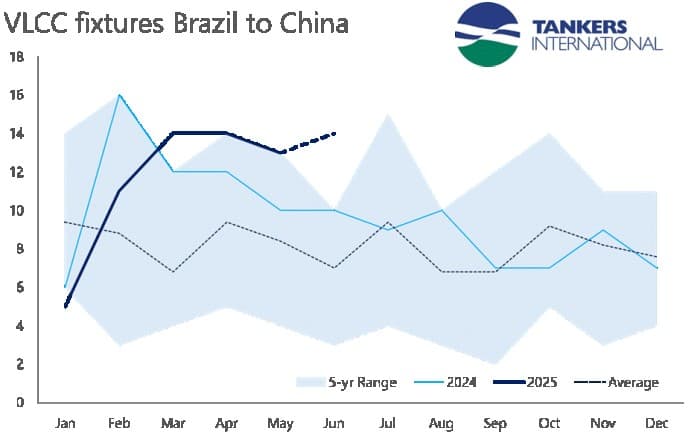

In parallel, another major reorientation in supply relationships is underway—particularly the rise of Brazil as a primary crude supplier to China. In Q2 2025, Brazilian crude shipments to China jumped 60% year-on-year, reaching 93.6 million barrels, with China now absorbing 40% of Brazil’s total exports. This isn’t a blip. Nearly all of it is arriving via VLCCs to ports across North China, with Petrobras increasing output and streamlining export logistics in response. Chinese firms like Unipec and Sinochem are not just buying more—they’re becoming central to Petrobras’ commercial planning.

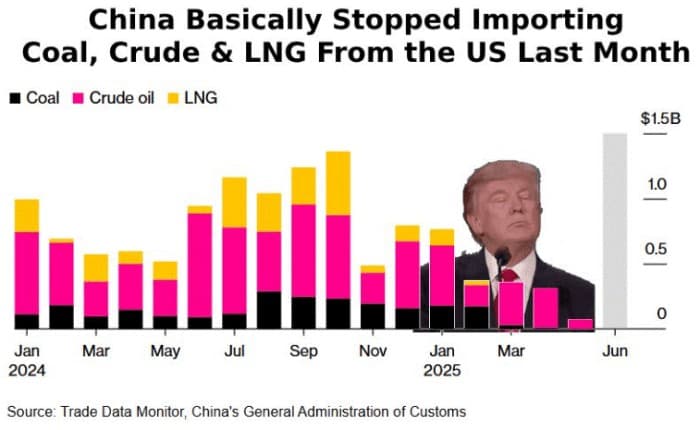

This was expected to happen given the wider changes in the region, especially regarding the BRICS. Brazil is becoming a structural supplier to China, just as China phases out U.S. energy imports. In June 2025, China imported no crude oil, LNG, or coal from the U.S.—the first time in nearly three years. At the same time, U.S.–Brazil energy relations are deteriorating, with Washington threatening 50% tariffs on Brazilian oil. Brazil’s pivot toward Asia is real, and I believe it’s just beginning.

Source: Stephen Stapczynski, LinkedIn

Kazakhstan – the Buckle in the Belt

This development is the most important. It pertains to the cohesion and future of the OPEC+ group. If you read the recently released report of Kazakhstan’s 2025–2040 oil refining development strategy, it aims at refining expansion with the goal to more than double capacity—from 18 million to 39 million tons/year by 2040. With domestic demand growing at 1.5–2% annually, Kazakhstan is also looking outward. Exports to China, India, and Central Asia are becoming core to its strategy. In a world where regional logistics and intra-Asian energy corridors are becoming more valuable, Kazakhstan is worth watching closely. It’s worth considering what might happen if the country continues to be a chronic over-producer. How long will OPEC+ tolerate it? Is it likely to improve its compliance?

Bonus – Global Supplies

Another short-term trend that merits attention is the emerging contradictory picture of demand vs supply. In this regard, one of the biggest questions I’ve been grappling with is: Is the market tight or oversupplied?

Between March and June, OPEC+ increased quotas by 959,000 bpd, but only 543,000 bpd of that materialized. That created a short-term gap, contributing to drawdowns in U.S. crude inventories, which fell by 3.2 million barrels in the week ending July 18. Gulf Coast refinery runs remain strong, and diesel margins are elevated. Barrels are flowing straight into refined products or exports, not into storage.

But this tightness is narrow—and fading. Supply is building underneath. U.S. and Brazilian production are both increasing, and recent Macquarie estimates show a 4.7 million barrel U.S. crude build for the week ending July 25, suggesting that the earlier drawdowns may soon reverse. Primary Vision’s recently released Efracs platform also shows that the Frac Job Count will remain steady moving forward. This means we can expect sustained supply.

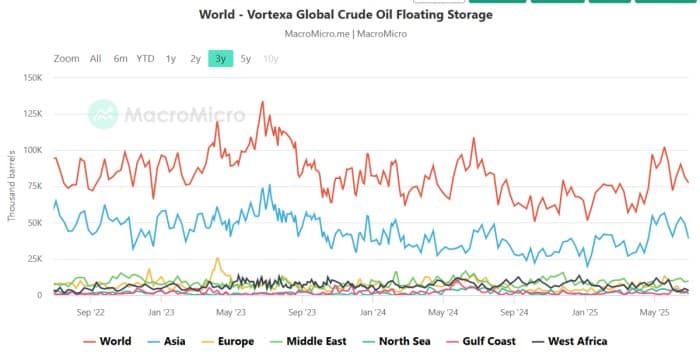

There’s also growing floating storage activity in Asia and the Middle East. Some supply—especially from Russia and Iran—is flowing into less transparent systems, either through blended shipments or non-OECD stockpiles. It hasn’t hit IEA-tracked inventories yet, but it’s in the system.

The way I see it, the current state isn’t tight or oversupplied—it’s in transition. Tight in July. Loosening now. And by early Q4, we could be firmly in oversupply unless consumption surprises or OPEC+ reins things back. I think this is exactly what’s reflected in recent Brent and WTI softness—prices are reacting to forward balances, not current draws.

The point is to learn to differentiate between noise and signals. There is indeed a lot of noise lately, and that is what makes it so hard to track oil prices.

By Osama Rizvi for Oilprice.com

More Top Reads From Oilprice.com