The global energy transition is now “unstoppable” due to “smart economics”, UN general-secretary António Guterres has said in an online speech titled: “A moment of opportunity.”

His comments coincide with two reports released today, one from International Renewable Energy Agency (IRENA) and the other from the UN that utilises the former’s research.

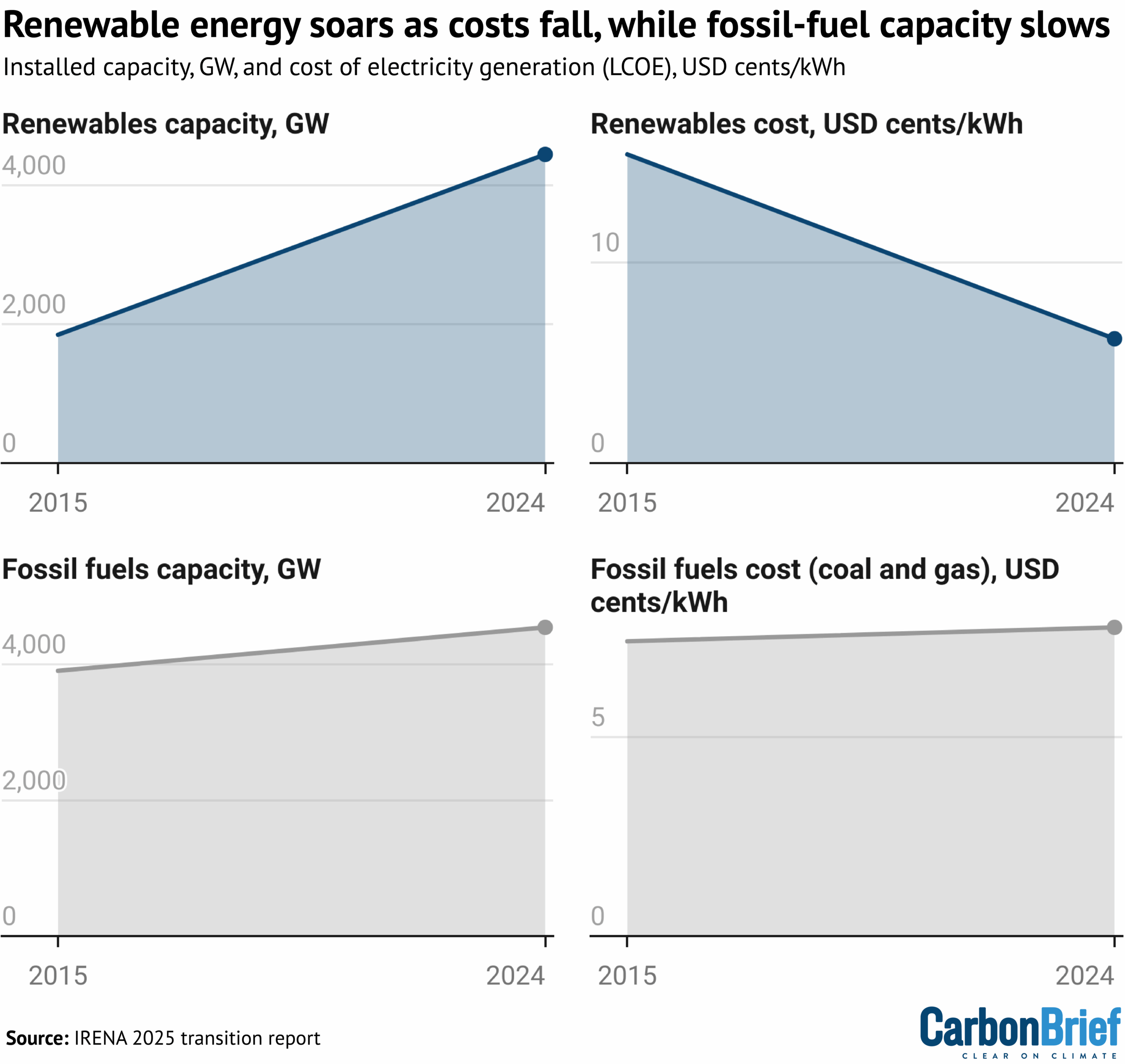

Between them, the reports provide details of how the “plummeting” cost of renewables has helped the sector expand at pace, meaning that renewables now almost match fossil fuels in terms of global installed power capacity.

In 2024, 91% of renewable power projects that were commissioned were more cost effective than any new fossil-fuel alternatives, according to IRENA.

The 582 gigawatts (GW) of renewable energy capacity added to the global energy system in 2024 helped avoid fossil-fuel use valued at about $57bn, with further cost savings expected as the sector continues to grow.

In his speech, Guterres said:

“Throughout history, energy has shaped the destiny of humankind – from mastering fire, to harnessing steam, to splitting the atom. Now, we are on the cusp of a new era. Fossil fuels are running out of road. The sun is rising on a clean-energy age.”

Below, Carbon Brief details five of the key points from the reports and Guterres’ speech.

Renewables are increasing as costs fall

The cost of renewable energy technologies has fallen over the past decade, with 96% of new solar and wind now costing less than new coal and gas plants, according to IRENA.

In 2024, the global average cost of electricity generated by solar photovoltaics (PV) and onshore wind was 41% and 53% cheaper, respectively, than the least-cost new fossil fuel-fired power plant.

The global average cost of solar PV has fallen to $0.43 per kilowatt-hour (kWh) and onshore wind to $0.34/kWh.

There were some small increases in costs between 2023 and 2024 for some technologies, IRENA notes. Solar PV’s levelised cost of electricity (LCOE) increased by 0.6%, onshore wind by 3%, offshore wind by 4% and bioenergy by 13%.

According to BloombergNEF, increases were broadly due to inflation and supply chain pressures. These led to the first jump in the costs of offshore wind in the UK’s renewable energy auctions, for example.

However, IRENA explains that long-term cost reductions are expected to continue, as further technological lessons are “learnt” and supply chains mature.

Alongside this drop in cost, renewable energy capacity has increased significantly over the past decade, growing by around 2,600GW, or 140%, between 2015 and 2024, according to the UN report.

Over the same period, fossil fuels increased by around 640GW, or 16%.

In 2024 alone, renewables made up 92.5% of all new electricity capacity additions, as well as 74% of electricity generation growth.

This means that the share of global installed capacity is now nearly a 1:1 ratio between fossil fuels and renewables, the UN report notes.

Between 2015 and 2024, renewables increased by 81% in terms of global annual electricity generation compared to a 13% increase for fossil fuels.

The global rollout of solar and wind is already having a significant impact on emissions, saving almost the equivalent of the EU’s annual emissions.

Despite the increase in renewable energy capacity to date, lagging investment in expanding and modernising electricity grids is “becoming a bottleneck for the energy transition”, cautions the UN report. There are at least 3,000GW of renewable power projects waiting for a grid connection.

Back to top

Investment in clean energy tips $2bn

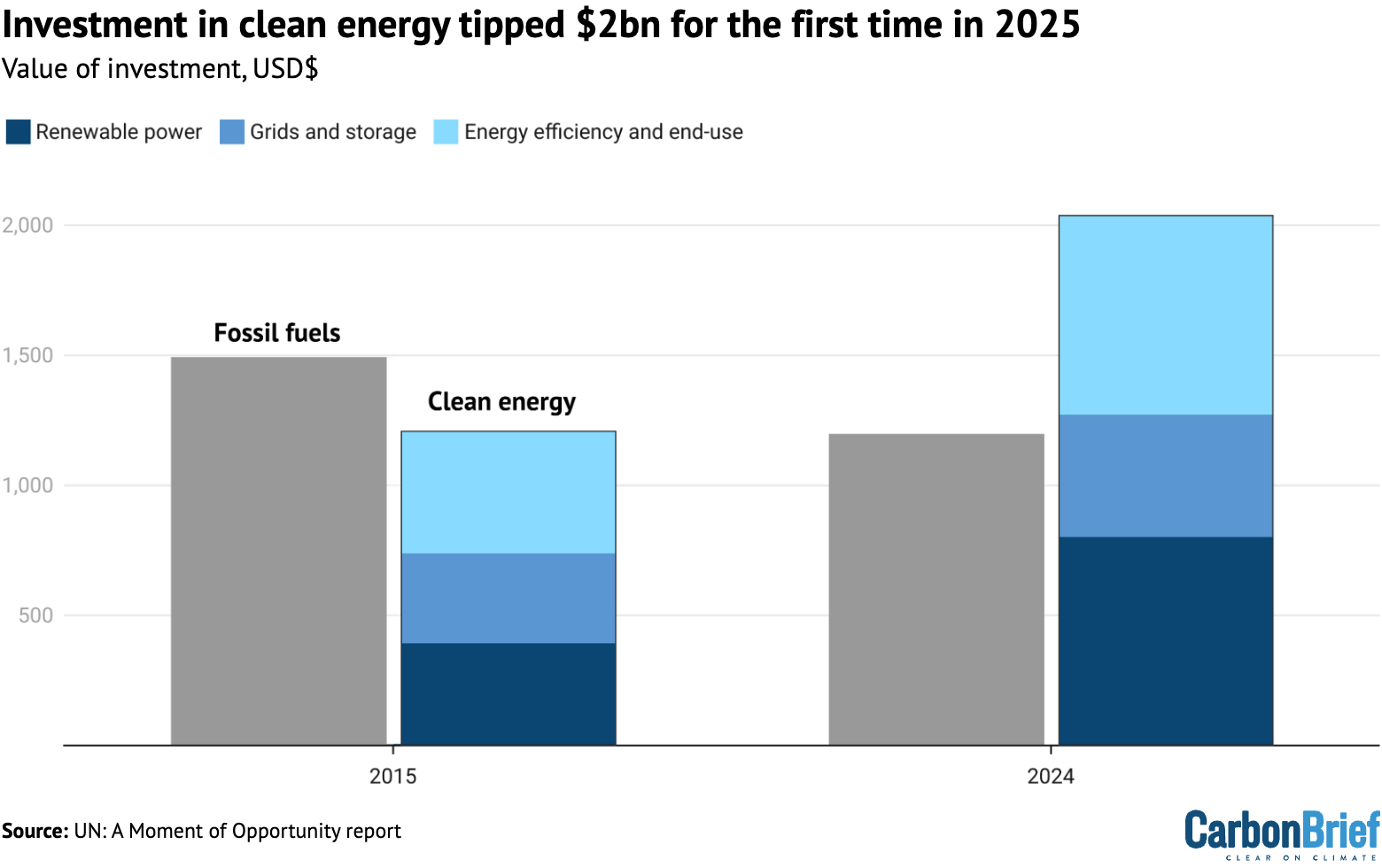

In 2024, global annual clean-energy investments exceeded $2tn for the first time, according to the UN report.

This is $800bn more than fossil-fuel investment, as shown in the chart below, up almost 70% in 10 years. It follows investment in clean energy surpassing fossil-fuel investment in 2016.

Subsequently, the number of jobs in the clean-energy sector has also continued to grow, reaching 34.8m in 2023, of which 16.2n were in the renewables sector.

According to the UN report, in 2023, the clean-energy sector added $320bn to the global economy. This accounted for 10% of GDP growth globally.

Clean energy accounted for an even higher percentage in certain regions, For example, nearly a third of the EU’s GDP came from the sector. It made up 5% in India, 6% in the US and 20% in China.

In his speech, Guterres noted that, despite clean energy increasingly driving economies, there is still “clean market distortion” with fossil fuels benefiting nine-to-one from consumption subsidies globally. He continued:

“Add to that the unaccounted costs of climate damages on people and planet – and the distortion is even greater. Countries that cling to fossil fuels are not protecting their economies – they are sabotaging them. Driving up costs. Undermining competitiveness. Locking-in stranded assets. And missing the greatest economic opportunity of the 21st century.”

The UN report notes that, in 2024, the economic losses from weather-related extreme events were estimated to be $320bn, of which 56% were uninsured.

Under IRENA’s 1.5C scenario for the energy transition, global annual GDP would increase by 1.5% between 2023 and 2050.

Back to top

‘Stability…in a volatile global energy landscape’

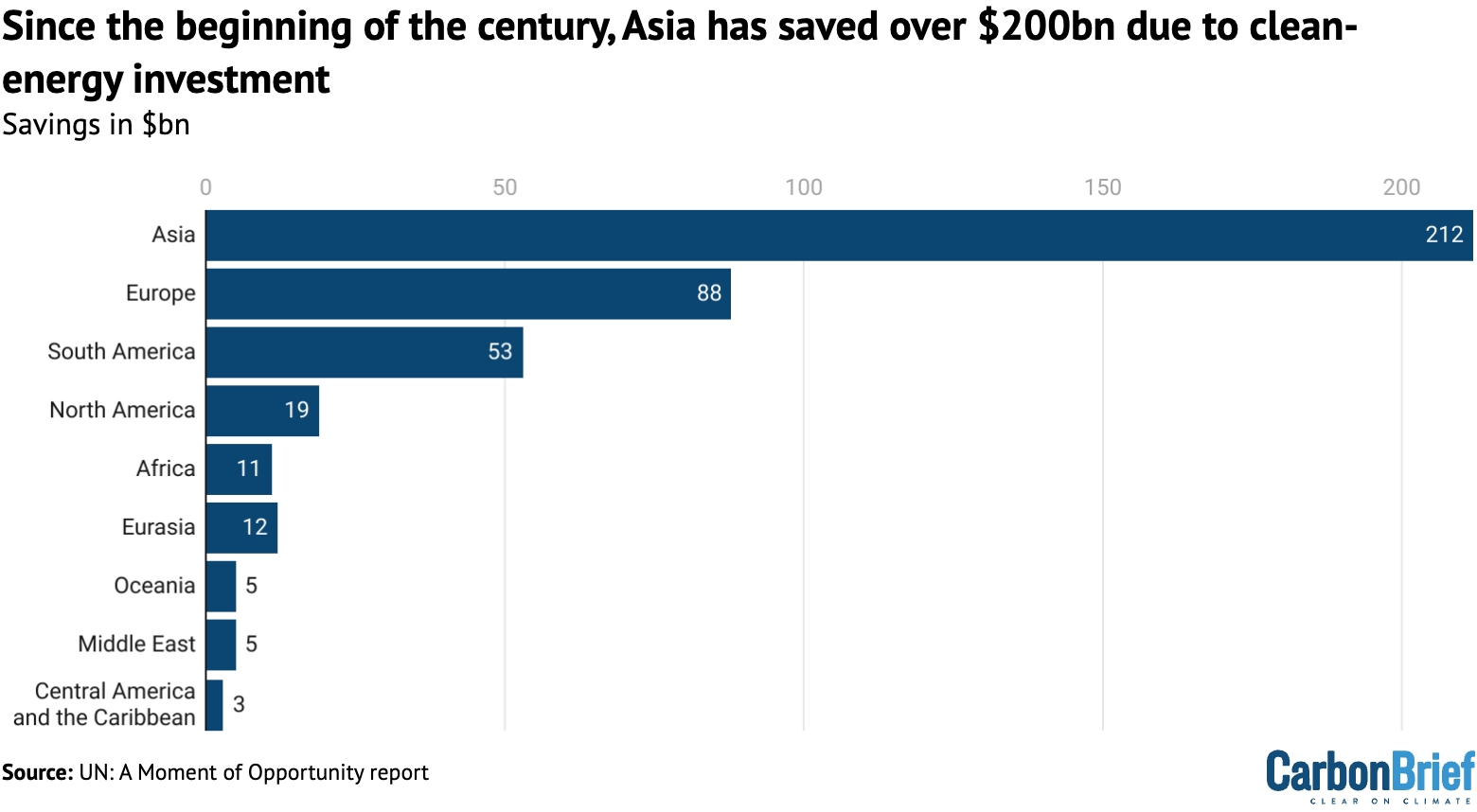

In 2024, renewable energy helped “avoid” $467bn in fossil-fuel costs globally, according to IRENA.

This reinforces renewables’ role as “not only as the lowest-cost source of new power, but also as a key driver of energy security, economic stability and resilience in a volatile global energy landscape”.

Between 2000 and 2023, Asia saw the biggest savings from clean-energy investment, with £212bn avoided, as shown on the chart below.

This was predominantly due to China, where renewable energy is surging, helping to put the country’s emissions “into reverse” for the first time earlier this year, according to Carbon Brief analysis. (The UN report cites two articles published by Carbon Brief this year.)

In a statement released alongside the report, IRENA director-general Francesco La Camera said:

“The cost-competitiveness of renewables is today’s reality. Looking at all renewables currently in operation, the avoided fossil-fuel costs in 2024 reached up to $467bn. New renewable power outcompetes fossil fuels on cost, offering a clear path to affordable, secure and sustainable energy. This achievement is the result of years of innovation, policy direction and growing markets.”

Additionally, the continued expansion of renewable energy technologies can, says the UN report, help to protect people from the impact of geopolitical instability on international energy markets.

Around 74% of the global population lives in a country that is a net importer of fossil fuels, the report notes. As such, when oil and gas prices surge, they are left particularly vulnerable.

For example, following Russia’s invasion of Ukraine in 2022, gas prices reached record highs and oil prices hit their highest level since 2008, the UN report adds.

Consequently, the average energy bill globally was 20% higher than the average over the previous five years. This was more acute in countries that are particularly reliant on gas imports, such as South Korea, which spent $17bn more on gas in 2022 compared to 2021.

Back to top

China dominates deployment…others should now follow

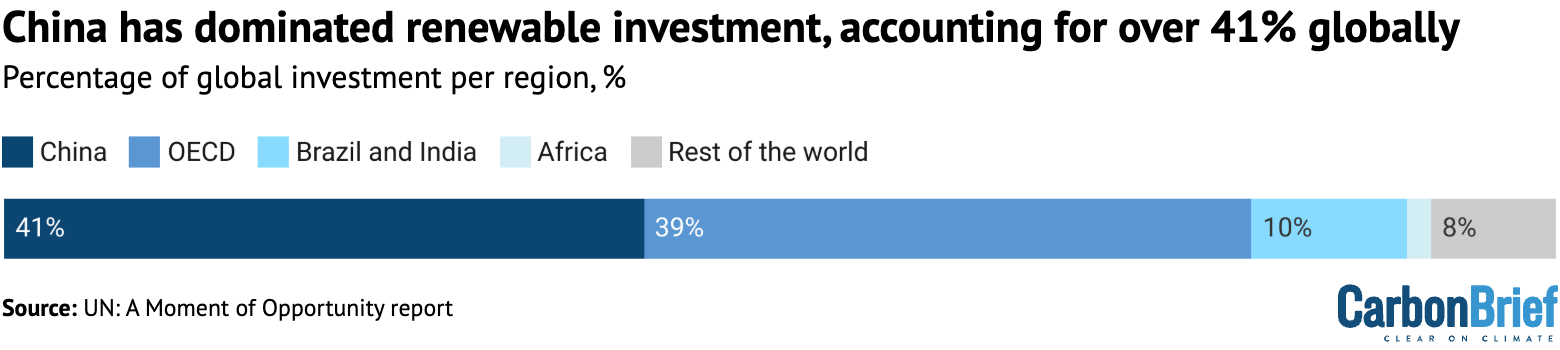

While renewable energy deployment has been increasing around the world, the distribution remains uneven, notes the UN report.

As shown in the chart, of the 4,448GW of total renewable capacity installed globally as of the end of 2024, 41% was in China, 39% in OECD countries and almost half of the remaining 20% in Brazil and India.

Africa made up just 1.5% of the capacity installed by the end of last year, despite accounting for 85% of the global population without electricity access and having a renewable energy resource potential 10 times larger than the continent’s projected electricity demand in 2040.

Since 2016, outside of China, less than one in every five dollars invested in clean energy has gone to emerging markets and developing economies (EMDEs), explains the UN report.

Investment is hampered in part by higher costs in EMDEs – for example, the cost of capital for a large-scale solar PV project in one of these economies is well over twice as high as in advanced economies, adds the UN report.

To keep the Paris Agreement’s 1.5C goal within reach, annual clean-energy spending in EMDEs beyond China will need to increase by around five to seven times from 2022 levels, notes the UN report. This would see investment increase to $1.4-1.9tn a year in 2030 and to more than $2tn a year by 2035.

Back to top

‘Faster and fairer’ for 1.5C

The UN and IRENA reports, along with Gueterres’ speech, highlight that, while progress in transitioning the energy sector away from fossil fuels is underway, “the transition is not yet fast enough or fair enough”.

Since the Paris Agreement came into force almost a decade ago, the collective ratcheting up of global climate ambition and action has meant that “projected global warming has been progressively declining”, the report notes.

It points to the UNEP emissions gap report, which found that warming this century under current policies have fallen from just below 4C to 3.1C. If parties’ conditional climate pledges – known as nationally determined contributions (NDCs) – are fully implemented, warming could fall from 3-3.5C to 2.6C.

This would be lower still, falling to 1.9C, if all net-zero pledges are fully achieved, the UN report notes.

As such, parties need to do more to take advantage of the opportunity presented by the “dawn of a new energy era”, Guterres said, as the “fossil-fuel age is flailing and failing”.

He set out six “opportunity areas”, which include NDCs, meeting surging energy demand with sustainable sources and using trade and investment to “supercharge” the energy transition.

The UN report highlights that at COP28 in Dubai, parties agreed to global targets to triple renewable energy capacity by 2030, double the annual rate of energy efficiency improvement and transition away from fossil fuels in line with global net-zero emissions by 2050.

In his speech, Guterres said “we must drastically speed up the reduction of emissions – and the reach of the clean-energy transition” to reach these goals as the “1.5C limit is in unprecedented peril”.

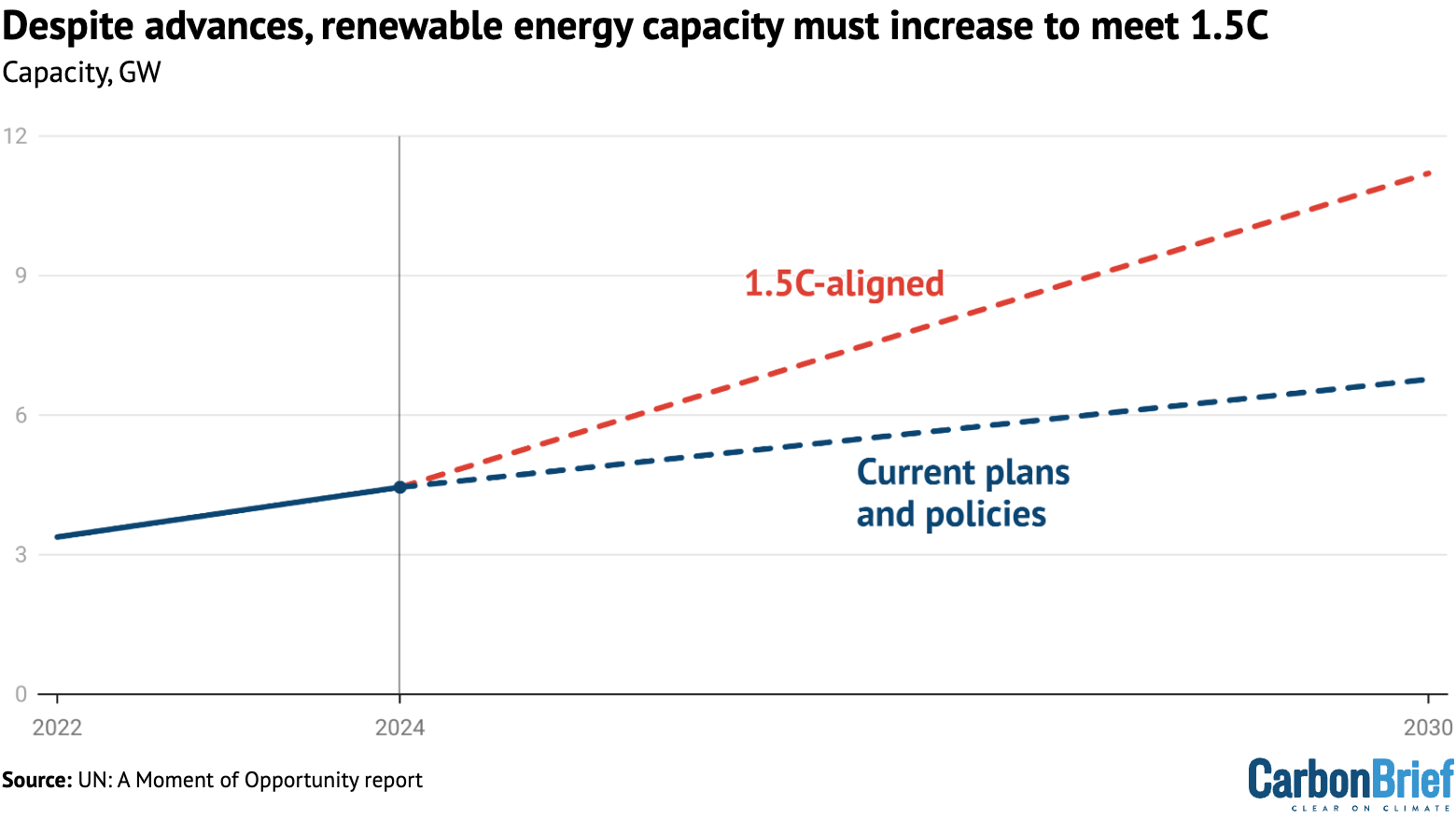

The impact of current plans and policies, in comparison to those needed to align with 1.5C, is shown in the chart below.

In his statement, La Camera welcomed the surge in renewables to date, but added:

“Progress is not guaranteed. Rising geopolitical tensions, trade tariffs and material supply constraints threaten to slow the momentum and drive up costs. To safeguard the gains of the energy transition, we must reinforce international cooperation, secure open and resilient supply chains, and create stable policy and investment frameworks – especially in the global south. The transition to renewables is irreversible, but its pace and fairness depend on the choices we make today.”

Back to top