Palo Alto Networks has agreed to purchase 10,000 tons of Direct Air Capture (DAC)-enabled carbon removal credits over five years.

The credits will be generated at 1PointFive’s STRATOS facility in Texas, with captured CO₂ permanently stored via saline sequestration.

The agreement reflects growing corporate investment in high-integrity carbon removal solutions to meet long-term climate goals.

1PointFive, a leading carbon capture, utilization, and sequestration (CCUS) company, announced a new carbon removal credit agreement with cybersecurity firm Palo Alto Networks. Under the agreement, Palo Alto Networks will purchase 10,000 tons of carbon dioxide removal (CDR) credits over a five-year period. The credits are enabled by Direct Air Capture (DAC) technology and will support the company’s broader decarbonization strategy.

The CDR credits will be sourced from 1PointFive’s STRATOS facility—its first commercial-scale DAC plant, located in Texas and expected to become operational later this year. The facility captures carbon dioxide directly from ambient air and stores it securely through saline sequestration, ensuring durable and measurable carbon removal.

“We look forward to collaborating with Palo Alto Networks and using Direct Air Capture to help advance their sustainability strategy,” said Michael Avery, President and General Manager of 1PointFive. “This agreement continues to build momentum for high-integrity carbon removal while furthering DAC technology to support energy development in the United States.”

RELATED ARTICLE: Trafigura Partners with 1PointFive for Groundbreaking Carbon Removal Project

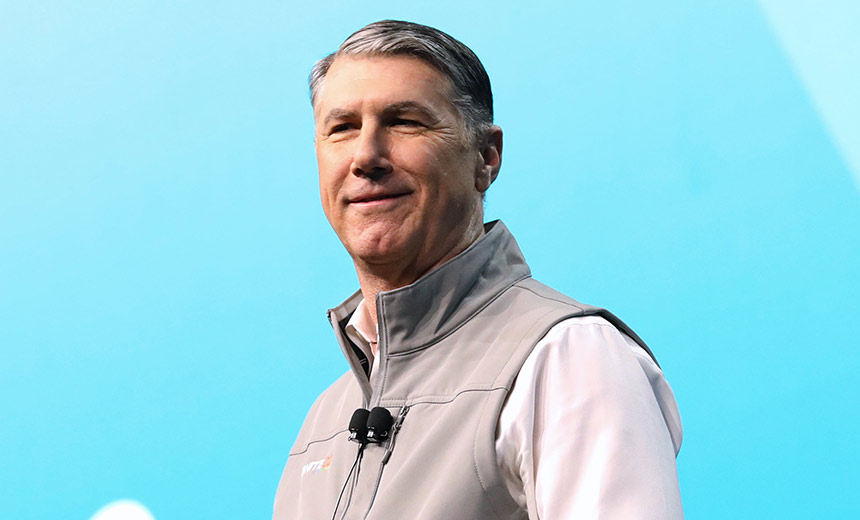

BJ Jenkins, President of Palo Alto Networks, emphasized the company’s forward-looking climate approach:

“Collaborating with 1PointFive in this carbon removal credit agreement highlights our proactive approach toward exploring innovative solutions for a greener future.”

The announcement marks another step in scaling DAC as a viable tool for organizations seeking permanent carbon removal solutions, reflecting rising demand from corporates looking to neutralize hard-to-abate emissions and invest in high-integrity climate strategies.

Follow ESG News on LinkedIn