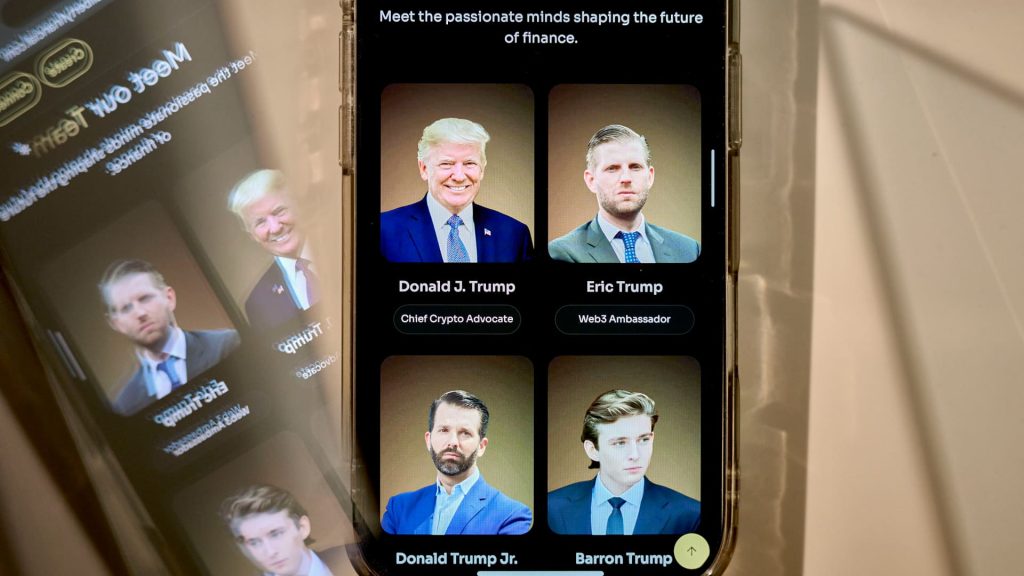

The World Liberty Financial website arranged on a smartphone in New York, US, on Wednesday, Feb. 12, 2025.

Gabby Jones | Bloomberg | Getty Images

The Senate on Tuesday passed the GENIUS Act, a landmark bill that for the first time establishes federal guardrails for U.S. dollar-pegged stablecoins and creates a regulated pathway for private companies to issue digital dollars with the blessing of the federal government.

The bill passed with a 68-30 vote.

It’s a milestone day for the crypto industry and for President Donald Trump’s sprawling digital asset empire.

This is the first legislative victory for the digital asset industry, which put around $250 million in the 2024 cycle to elect what’s now considered to be the most pro-crypto Congress in U.S. history.

The bill still faces hurdles in the Republican-held House, but passage in the Senate signals a turning point — not just for the technology, but for the political clout behind it.

The GENIUS Act, short for the Guiding and Establishing National Innovation for U.S. Stablecoins Act, sets guardrails for the industry, including full reserve backing, monthly audits, and anti-money laundering compliance.

It also opens the door to a broader range of issuers, including banks, fintechs, and major retailers looking to launch their own stablecoins or integrate them into existing payment systems.

The bill grants sweeping authority to Treasury Secretary Scott Bessent, who last week told a Senate appropriations subcommittee in a hearing that the U.S. stablecoin market could grow nearly eightfold to over $2 trillion in the next few years.

“Stablecoin legislation backed by U.S. Treasuries or T-bills will create a market that will expand U.S. dollar usage via these stablecoins all around the world,” Bessent said.

GENIUS now heads to the House, which has its own version of a stablecoin bill dubbed STABLE. Both prohibit yield-bearing consumer stablecoins — but diverge on who regulates what.

The Senate’s version centralizes oversight with Treasury, while the House splits authority between the Federal Reserve, the Comptroller of the Currency, and others. Reconciling the two could take a while, according to Congressional aides.

The GENIUS Act was supposed to be the easiest crypto bill to pass, but took months to reach the Senate floor, failed once, and passed only after fierce negotiations.

“We thought it would be easiest to start with stablecoins,” Sen. Cynthia Lummis, R-Wyo., said on stage in Las Vegas at this year’s Bitcoin 2025 conference, which focused heavily on stablecoins.

“It has been extremely difficult. I had no idea how hard this was going to be,” she said.

At the same event, Sen. Bill Hagerty, R-Tenn., echoed the frustration: “It has been murder to get them there,” he said of the 18 Senate Democrats who ultimately crossed the aisle.

Disrupting legacy rails

Stablecoins are a subset of cryptocurrencies pegged to the value of real-world assets. About 99% of all stablecoins are tethered to the price of the U.S. dollar.

The appeal is simple: Stablecoins offer instant settlement and lower transaction fees, cutting out the middlemen and directly threatening legacy payment rails.

Shopify has already rolled out USDC-powered payments through Coinbase and Stripe. Bank of America‘s CEO said last week at a Morgan Stanley conference that they’re having conversations with the industry and individually exploring stablecoin issuance.

Payment stocks like Visa, Mastercard, PayPal, and Block slid after The Wall Street Journal reported that Amazon and Walmart are exploring their own stablecoins.

That action has helped drive Circle’s blockbuster stock surge, with shares up 400% since its public debut on June 5.

Deutsche Bank found that stablecoin transactions hit $28 trillion last year, surpassing that of Mastercard and Visa, combined.

Still, there are limits. The GENIUS Act restricts non-financial Big Tech companies from directly issuing stablecoins unless they establish or partner with regulated financial entities — a provision meant to blunt monopoly concerns.

JPMorgan, meanwhile, is taking a different route, launching JPMD, a deposit token designed to function like a stablecoin but tightly integrated with the traditional banking system.

Issued on Coinbase’s Base blockchain, JPMD is only available to institutional clients and offers features like 24/7 settlement and interest payments — part of the broader push by legacy finance to adapt to the stablecoin era without ceding ground to crypto-native firms.

Trump’s stake

While Democrats tried to amend the bill to prevent the president from profiting off crypto ventures, the final legislation only bars members of Congress and their families from doing so.

Trump’s first financial disclosure as president, released Friday, revealed he earned at least $57 million in 2024 alone from token sales tied to World Liberty Financial, a crypto platform closely aligned with his political brand.

He holds nearly 16 billion WLFI governance tokens — the crypto equivalent of voting shares — which could be worth close to $1 billion on paper, based on prior private sales.

That’s just one slice of the Trump crypto pie.

The family’s ventures, which include the controversial $TRUMP meme coin, a $2.5 billion bitcoin Treasury and proposed bitcoin and ether ETFs via Truth.Fi, and a newly launched mining firm called American Bitcoin, reflect a full-throttle push into digital finance.

Forbes recently estimated Trump’s crypto holdings at nearly $1 billion, lifting his total net worth to $5.6 billion.