(Oil& Gas 360) – Headlines Continuing To Paint A Bearish Oil & Natural Gas Picture During The Month Of May Are Keeping Steadily-Tightening, Temporarily Hidden.

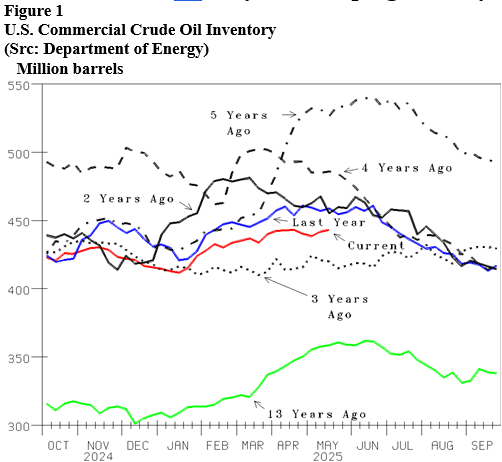

Wednesday’s main oil market headline was that U.S. inventory increased again. The main headline from Wednesday morning’s release of the Department of Energy’s (DOE’s) Weekly Petroleum Status Report was that “U.S. crude oil inventory increased again.” Commercial crude oil inventory increased 1.3 million barrels (mmb) last week to 443.2 (Figure 1, red line) adding to the 3.5 mmb increase the week before. Ignored is that 443.2 is 15.6 mmb less than 458.8 last week last year (blue line).

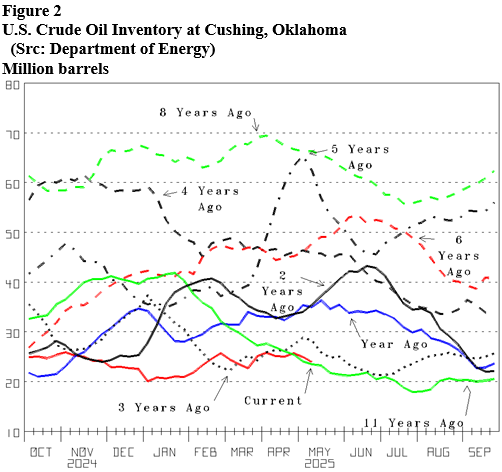

The headline is missing the oil market tightening. Inventory where crude oil futures contracts are delivered has declined and is down at a multi-year low. Crude oil inventory at Cushing Oklahoma, the delivery point for New York Mercantile Exchange (NYMEMX) crude oil futures contracts declined 1.1 mmb two weeks ago and 0.5 last week, That has 23.4 mmb last week’s total (Figure 2, red line). It 12.9 mmb less than last year (blue line) and down at a multi-year low highlights supply/demand firming.

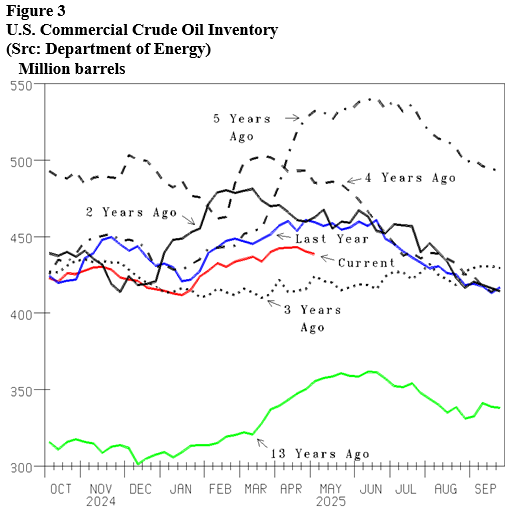

Crude oil inventory at Cushing Oklahoma down at a multi-year low is joined by inventory of the major petroleum products down at a multi-year low. Economic growth needing to be fueled and The Climate Changing to cold has inventory of distillate oil (diesel and heating), gasoline, jet kerosene and residual down at 395.0 last week (Figure 3, red line). That and it 20.5 mmb less than last year (blue line) highlights oil market tightening–a growing economy needing more.

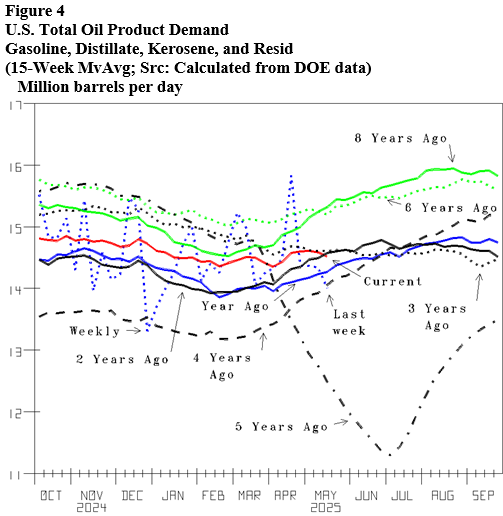

Petroleum product inventory down low is set to next need consensus-beating more. Shipments of the four major petroleum products jumped up to an average of 15.834 mmbd five weeks ago (Figure 4, blue dot). We credit the jump to efforts to minimize Tariff costs. Maximizing then had shipments 1.835 mmbd lower last week. A low to jump up from to fuel Summer’s activity increase.

By oilandgas360.com contributor Michael Smolinksi with Energy Directions

The views expressed in this article are solely those of the author and do not necessarily reflect the opinions of Oil & Gas 360. Please consult with a professional before making any decisions based on the information provided here. The information presented in this article is not intended as financial advice. Contact Energy Directions for the full report. Please conduct your own research before making any investment decisions.