Data-Driven Decarbonization: Partnership enables enterprises to shift from estimated Scope 3 emissions to verified, actionable insights.

Supplier Empowerment: Suppliers gain tools to measure, improve, and showcase carbon performance—driving competitiveness.

Private Equity-Backed Scaling: Backing from Bridgepoint accelerates global rollout and integration of sustainability technologies.

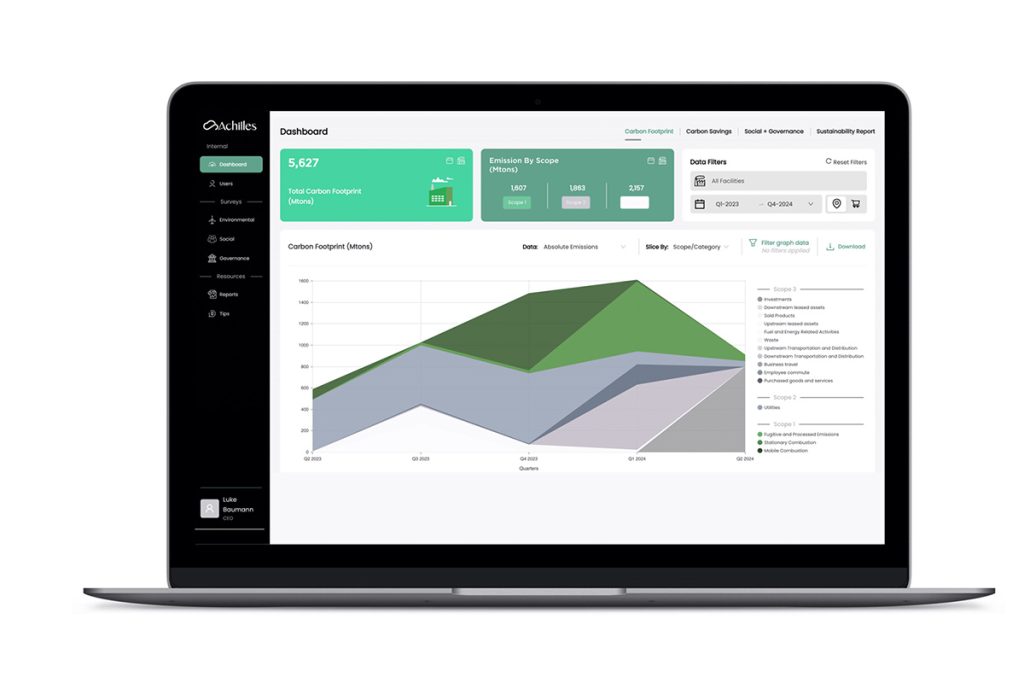

Green Project Technologies and Achilles have announced a strategic partnership designed to simplify and scale Scope 3 emissions management across global supply chains—an area long plagued by fragmented data and assumptions-based estimates.

By integrating Green Project’s carbon accounting and engagement tools with Achilles’ supplier risk and sustainability performance data, corporates will gain a clearer view of their indirect emissions and be better equipped to meet science-based targets.

“This collaboration with Achilles represents a pivotal step forward in our mission to democratize carbon accounting and enhance supply chain sustainability,” said Sam Stark, CEO and Founder of Green Project. “By enabling both corporations and their suppliers to seamlessly integrate emissions measurement into their operations, we are not only fostering transparency but also driving real, scalable environmental action.”

What’s Changing:

Companies can now overlay Achilles’ supplier sustainability scores with Green Project’s verified emissions data, allowing for more informed supplier engagement and emissions reductions strategies. The result: a transition from passive tracking to proactive decarbonization.

RELATED ARTICLE: HowGood Launches Scope 3 Emissions Reporting for Food Brands Globally

For Suppliers:

Suppliers benefit from access to robust measurement tools that can enhance their Achilles sustainability ratings and improve visibility with major buyers. Verified low-carbon performance becomes a market differentiator, opening doors to new contracts and partnerships.

“In many industry sectors, supply chains hold the key to real progress on climate,” said Dr. Paul Stanley, CEO of Achilles. “This new partnership with Green Project enables our customers to go beyond surface-level data and take meaningful, measurable action, building more resilient, transparent, and sustainable supply chains at scale.”

Backed by Bridgepoint:

Both companies are backed by Bridgepoint, a major private equity firm with a proven track record in scaling global ESG and risk management platforms. Bridgepoint invested in Achilles in 2021 and is a minority shareholder in ACT Group, Green Project’s parent company.

With data clarity, supplier enablement, and institutional support in place, the partnership sets a new standard for scalable, supply chain-wide climate action.

Follow ESG News on LinkedIn