Oil prices rallied aggressively on the news of a U.S.-China trade deal, with fears of a total economic collapse fading. Despite that development, abundant supply means the upside for prices remains limited.

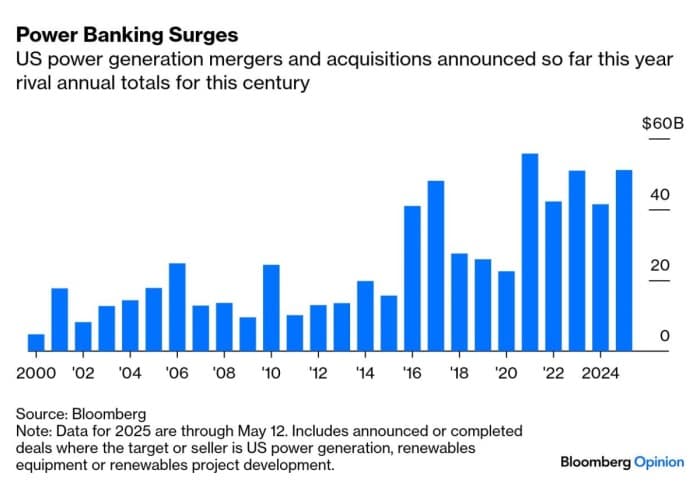

– A string of deals targeting large-cap electricity generation companies across the US has put this year’s to date power sector M&A tally to $51 billion, on track for a new all-time high.

– Up until now, the highest number of US generation mergers and acquisitions took place immediately after COVID-19 hit, when a total of $55.7 billion was spent on corporate takeovers.

– AI’s increasing need for power generation is amplifying the market’s reaction to these deals – NRG Energy’s stock surged a whopping 26% on Monday after it announced its acquisition of LS Power.

– Buying operational generation capacity is significantly cheaper than building new gas-powered plants – the cost of new gas capacity has tripled from $800 per kW to $2400 per kW in less than two years.

Market Movers

– Permian-focused US upstream firm APA (NASDAQ:APA) agreed to divest $608 million worth of assets in the New Mexico portion of the Permian Basin to Permian Resources, located across 13,320 net acres.

– US energy firm NRG Energy (NYSE:NRG) agreed to purchase power generation assets from investment firm LS Power in a deal valued at $12 billion, greatly expanding its natural gas-powered generation.

– US oil major ExxonMobil (NYSE:XOM) is set to invest $1.5 billion into the Usan oil field in deepwater Nigeria, producing since 2012 and seeing output decline to 33,000 b/d of oil this year, down from 45,000 b/d two years ago.

– US asset management giant Blackstone (NYSE:BX) is reportedly in talks to buy New Mexico and Texas-focused utility firm TXNM Energy in a deal that could be valued north of $11 billion, including debt.

Tuesday, May 13, 2025

Even if for the next 90 days, fears of a global economic collapse have eased following US-China talks and subsequent reductions in import tariffs. With OPEC+ still keen to flood the market with oil, the pricing upside was somewhat limited. ICE Brent settled around $66 per barrel with no immediate prospect for a breakout towards $70 per barrel.

US, China Put Trade War on a Pause. The United States and China agreed to cut reciprocal tariffs by 115% on most goods, marking a 90-day trade war pause, with US goods now only triggering a 10% tariff in China, whilst Chinese goods would come with a 30% levy for American importers.

Saudi State Coffers Suffer Amidst Low Prices. Saudi national oil company Saudi Aramco (TADAWUL:2222) reported a 4.6% quarterly drop in its Q1 profits to $26.01 billion, citing lower sales and higher operating costs, but it kept its giant $85.4 billion dividend for this year intact.

US SPRs to Fill Up Again. The US Congress’ Energy and Commerce Committee suggested including $1.5 billion in the 2026 fiscal year budget to replenish and maintain the Strategic Petroleum Reserve, equivalent to 22 million barrels of government purchases and 220 million maintenance costs.

Norway’s Troubled Oilfield Down Again. Following a four-month delay in commissioning, Equinor’s (NYSE:EQNR) 220,000 b/d capacity Johan Castberg oil field in the Arctic Barents Sea halted operations due to an oil leak from a heat exchanger, set to resume pumping by the end of this week.

Oman Wants to Launch a New Gas Bonanza. The government of Oman is seeking to sell a part of its natural gas assets to garner at least $8 billion, offering minority stakes in fields contained in Block 6, the country’s most oil-prolific acreage and some 10.7 TCf of untapped non-associated gas reserves.

French Oil Major to Make Indonesia U-Turn. France’s energy major TotalEnergies (NYSE:TTE) is reportedly negotiating a farm-in to Petronas’ Bobara offshore project in Indonesia, potentially marking its return to the Southeast Asian country seven years after it sold all its assets there.

Resolution Copper Delayed Again. Less than a month after President Trump restarted the land transfer process to launch Rio Tinto’s (NYSE:RIO) giant Resolution Copper mine, the largest deposit of copper ore in the US, a district judge temporarily blocked the move, saying it would irreparably damage the Apache people.

Venezuelan Oil Is Now Disguised as Brazilian. According to Chinese sources, independent refiners across China are now buying Venezuelan crude oil disguised as mixed bitumen from Brazil (which Brazil doesn’t export), with customs-reported data already indicating a total worth of $1.2 billion.

China Opens Taps on Rare Earth Exports. Beijing has issued export permits to at least four rare earth magnet producers, the first such allowance since China’s authorities restricted exports last month, with reports suggesting suppliers of German carmaker Volkswagen (ETR:VOW) received a licence, too.

Better Saudi Prices Keep Asian Demand Robust. After Chinese refiners nominated a one-year high of 48 million barrels of Saudi term supplies in May, next month is set to see the same level of crude exports with private refiners Hengli and Rongsheng maximizing their purchases as long as prices remain low.

Namibia’s Oil Craze Still Years Away. Namibia’s petroleum commissioner, Maggy Shino, said that French major TotalEnergies plans to take an FID on the 150,000 b/d Venus project, potentially the first oil field in the country’s portfolio, only by late 2026, delayed by more than two years.

Supply Discipline Rekindles Bullish Solar Spirit. Solar stocks have jumped by more than 10% on Tuesday amidst widespread speculation that China’s top solar wafer producers Daqo New Energy and Tongwei would jointly curb production, concurrently targeting a new price range that would suit most suppliers.

Vietnam Wants to Double Down on Nuclear. The government of Vietnam wants to add a combined capacity of 6.4 GW between 2030 and 2035, using President To Lam’s visit to Russia to preliminarily agree with Moscow on the construction of a nuclear power plant, simultaneously reaching out to South Korea and France.

By Michael Kern for Oilprice.com

More Top Reads From Oilprice.com