API President Mike Sommers

Leaders from both the American Petroleum Institute (API) and National Ocean Industries Association (NOIA) issued statements Monday after the House Energy and Commerce Committee released its proposed markup of the 2025 tax reconciliation bill. The markup includes a 10-year pause of the EPA’s Waste Emissions Charge (WEC) established under the Inflation Reduction Act as well as innovative permitting solutions.

“We applaud the House Energy and Commerce Committee for taking an important first step toward abolishing the ‘methane fee’ while also advancing important progress on permitting for infrastructure and U.S. LNG,” said Mike Sommers, President of the American Petroleum Institute (API). “We look forward to working with the EPA and Congress to ensure a smart regulatory framework for continued American energy development, and we hope that the final package includes the permanent repeal of this punitive tax.”

The WEC rule is redundant and penalizes early adopters of methane-cutting technologies. U.S. oil and natural gas producers are already regulated under EPA methane standards. U.S. methane emissions declined by 42 percent from 2015-23 while production increased by 51 percent, API stated.

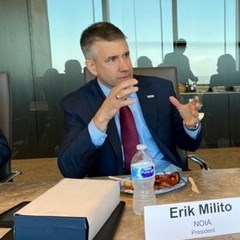

NOIA President Erik Milito

NOIA urged a more conservative approach, however, advising caution against the premature repeal or phase-out of current tax credits.

“Through a long-term lens—spanning a decade or more—American companies have made substantial investments in offshore energy based on the stability of the current tax framework,” said NOIA President Erik Milito. “Sudden changes to the tax code could inject significant uncertainty, jeopardizing capital allocation, project planning, and job creation across the energy sector and the broader economy.