As the Donald Trump administration strongly checks Chinese batteries using tariffs as a weapon, they are strategizing to reclaim market leadership from Chinese companies. Korean companies are expanding ESS production lines in the United States and focusing on cost reduction to minimize the impact of U.S. tariffs.

Among the three battery companies — LG Energy Solution, Samsung SDI, and SK On — which announced their Q1 results by April 30, only LG Energy Solution recorded an operating profit. LG Energy Solution’s Q1 sales increased by 2.2% year-on-year to 6.265 trillion won, while operating profit surged by 138.2%, turning from a loss (-225.5 billion won) in Q4 last year to a profit.

Although the battery market is still constrained by the chasm, LG Energy Solution’s early securing of U.S. production facilities and subsidies contributed to its profit turnaround. In Q1, LG Energy Solution received 457.7 billion won in Advanced Manufacturing Production Credit (AMPC) subsidies under the Inflation Reduction Act (IRA) from the U.S. government. However, excluding this, it would have incurred a loss of 83 billion won.

Samsung SDI and SK On, latecomers compared to LG Energy Solution, could not avoid operating losses in Q1. Samsung SDI recorded an operating loss of 434.1 billion won despite receiving 109.4 billion won in AMPC subsidies. This was due to reduced battery shipments as automakers, their customers, engaged in intensive inventory adjustments following decreased electric vehicle demand.

SK On also recorded an operating loss of 299.3 billion won in Q1. Despite receiving 170.8 billion won in AMPC benefits, it could not avoid a deficit. Both Samsung SDI and SK On have been in the red for two consecutive quarters since Q4 last year.

Korean battery companies predicted that difficult business conditions would continue in Q2 due to the combination of the electric vehicle chasm and U.S. tariff policies. Lee Chang-sil, chief financial officer (CFO) of LG Energy Solution, said in a conference call, “In Q2, due to policies such as tariffs, automakers’ overall inventory management stance is expected to be conservative, making a certain level of sales decline inevitable compared to the previous quarter.”

The ESS market is gaining attention as an escape route for Korean battery companies stuck in a slump. Unlike electric vehicle batteries, the ESS battery market is showing high growth due to the spread of renewable energy and the development of artificial intelligence (AI) industries. According to SNE Research, the global ESS battery market is expected to grow from 300GWh this year to over 610GWh by 2035, with an average annual growth rate of 7.7%. The market size is expected to expand to $39.5 billion (about 57.8 trillion won) by 2030.

The U.S. government’s strengthening checks on Chinese batteries also present an opportunity for Korean battery companies. Chinese companies have dominated the North American ESS battery market, including the U.S., with low prices, but as they become subject to high tariffs, expectations are growing that Korean batteries produced locally in the U.S. will replace them. Last year, out of the 78GWh North American ESS battery demand, Chinese companies like CATL and BYD accounted for 68GWh, or 87% of the share.

However, the situation is expected to change rapidly under the Trump administration. The U.S. has imposed a high tariff of 155.9% on Chinese ESS batteries and plans to further increase it to 173.4% next year. With high tariffs, Chinese batteries will inevitably lose their price competitiveness.

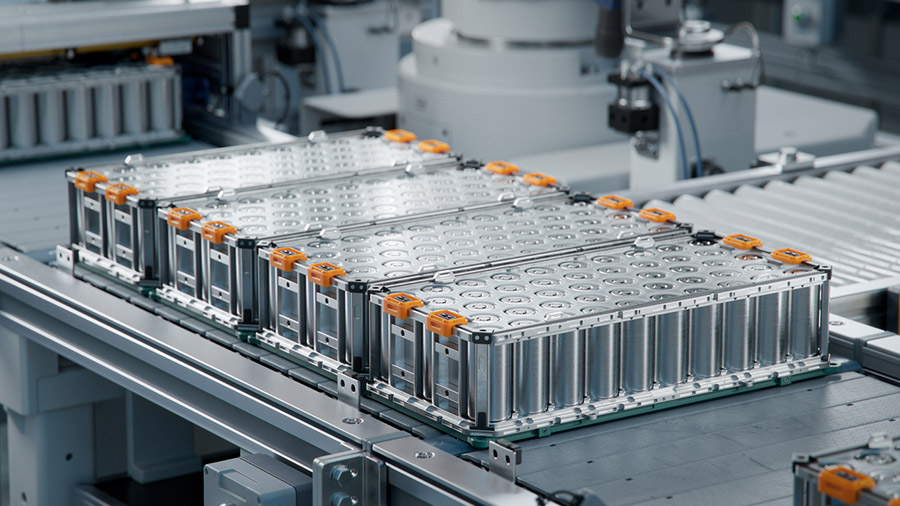

Korean battery companies are speeding up the establishment of ESS production bases, judging that they will benefit from local production in the U.S. LG Energy Solution has halted construction of its ESS factory in Arizona and instead reorganized its supply chain to produce lithium iron phosphate (LFP) batteries for ESS at its Michigan factory. The production line is set to start operations in Q2 this year, about a year earlier than initially planned.

SK On is also considering converting some of its electric vehicle battery production lines in Georgia, USA, to ESS LFP production lines. Samsung SDI is considering setting up ESS battery production lines in the U.S. as well. Kim Yoon-tae, vice president of Samsung SDI’s Management Support Office, said in a conference call on April 25, “ESS batteries have a high sales proportion in the U.S., and currently, we are producing outside the U.S. and exporting to the U.S., so we are inevitably affected by tariffs. We will respond well to this part in consultation with our customers.”

businesskorea.co.kr