Western energy supermajors are faced with an increasingly difficult challenge: either keep their promise of returning ever-higher shareholder returns or risk spurning investors to save their balance sheets. Record cash has been allocated to shareholders, but with recent double-digit dips in oil prices not reversing, these payouts will be increasingly difficult to maintain. Rystad Energy estimates that the majors will likely need to reduce both investment and shareholder payouts to balance their cash flows in the current oil price environment.

“Recent market volatility has left the majors with few economically attractive options that both allow for reinvestment while maintaining a competitive capital returns framework. As companies like Shell and ExxonMobil continue to push ahead with large-scale buyback programs despite shrinking cash inflows, the durability of these strategies is in question. For now, the majors are holding the line. But if oil prices remain depressed, adjustments may be inevitable. Buybacks—typically more flexible than dividends—are likely to be the first lever pulled,” says Espen Erlingsen, Head of Upstream Research, Rystad Energy.

Related: Nigeria Urges Firms to Boost Oil Output to OPEC Quota

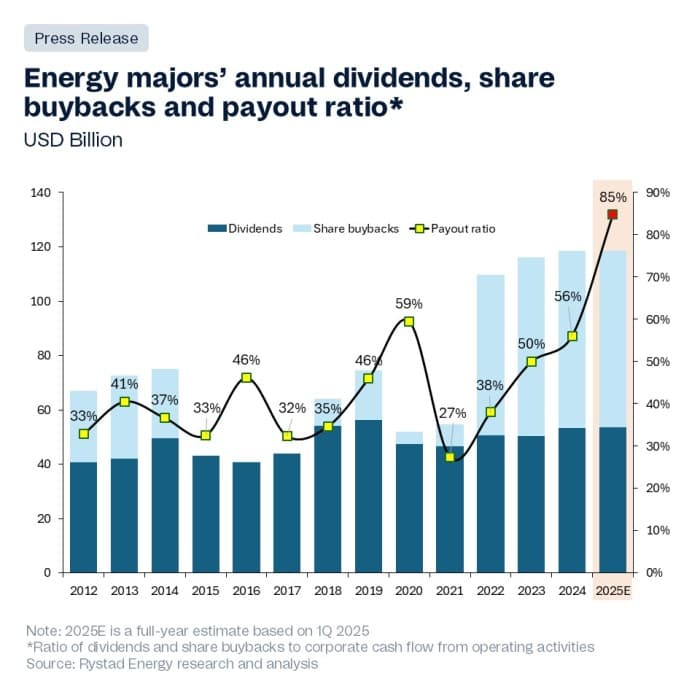

Total shareholder payouts by BP, Chevron, Eni, ExxonMobil, Shell, and TotalEnergies reached $119 billion in 2024, beating the previous record set in 2023. The payout ratio—shareholder payouts as a share of corporate cash flow from operations (CCFO)—climbed to 56%, well above the 30–40% range that was typical from 2012 to 2022. If shareholder payouts remain at 2024 levels throughout 2025, this would imply that companies distribute more than 80% of their cash flow to investors, based on first quarter CCFO as a proxy for full-year performance. This would mark a sharp and highly unsustainable jump from the 56% payout ratio recorded in 2024. However, many firms have established payout targets tied to CCFO, and based on current cash generation levels, shareholder payouts could fall by 20–40% in 2025.

To keep up with this increasing payout ratio, the majors have been sustaining shareholder payouts in part by drawing down cash reserves. Following a peak of nearly $160 billion between the third quarter of 2022 and the first quarter of 2023, aggregate cash reserves have steadily declined, reaching just above $120 billion as of the first quarter of 2025. If current payout levels are sustained throughout the year, total shareholder payouts could again reach $119–$120 billion in 2025, matching the record set in 2024.

There are, however, several downside risks to this estimate. First, maintaining these payout levels would imply that the majors are distributing over 80% of their cash generation, based on first quarter 2025 CCFO as a proxy for full-year performance. Second, the recent decline in oil prices—now hovering around $60 per barrel— could force the majors to make a difficult choice between cutting buybacks, which would be unpopular with investors, or using their balance sheets to support current repurchase levels. Third, several companies have formal payout ratio targets linked to CCFO. For example, BP, Eni, and TotalEnergies have stated targets shareholder returns of 30–40% of CFFO, while Shell targets 40–50%. Applying these payout targets to current cash flow levels, total shareholder payouts could fall by approximately 20% to 40% from $119 billion to around $70 to $95 billion in 2025.

“All the majors have thus far upheld their shareholder payout guidance, despite weakening market fundamentals. Shareholders have been accustomed to a stronger commodity price environment over the last few years, and recent market shocks will undoubtedly have a lasting impact on payout levels and investor expectations. Although the drop in oil prices creates downside risk for shareholder returns, the majors will remain reluctant to scale back their capital returns framework in the near-term,” says Erlingsen.

By Rystad Energy

More Top Reads From Oilprice.com