Tech titans had a Thursday to forget this week.

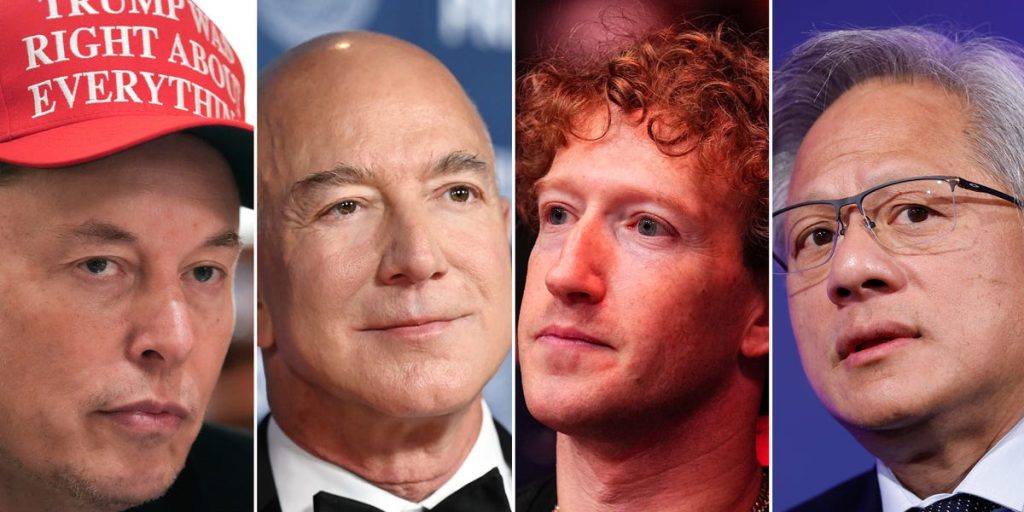

Elon Musk, Mark Zuckerberg, Jeff Bezos, Jensen Huang, and Michael Dell saw a combined $26 billion wiped off their net worths in one day, the Bloomberg Billionaires Index shows.

Their fortunes shrank because their respective stakes in Tesla, Meta, Amazon, Nvidia, and Dell slid in value. The stock prices of those first four companies fell by around 2% on Thursday, as investors grew increasingly concerned about the immense costs of building out AI infrastructure and whether they’d see a return on their spending.

Dell shares tumbled 9% after rival Lenovo warned a memory-chip shortage was driving up costs, raising concerns on Wall Street that other hardware manufacturers would also see their profits contract. The sell-off triggered a $5 billion drop in its founder’s personal fortune to $135 billion.

Musk saw an unmatched $8 billion wealth decline on Thursday. But the Tesla and SpaceX CEO is still up about $57 billion at $676 billion this year, thanks to the soaring valuations of SpaceX and another of his companies, xAI.

Zuckerberg took an almost $7 billion blow to his net worth, fueling a year-to-date decline for the Meta CEO of a little over $3 billion, to $230 billion.

Bezos’ fortune fell by $4 billion, extending the Amazon founder’s wealth decline this year to around $27 billion.

Huang rounded out the tech quintet with a $2.5 billion reduction in the Nvidia CEO’s net worth, according to Bloomberg’s rich list.

Other tech bosses also saw some of their wealth erased. Alphabet cofounders Larry Page and Sergey Brin took roughly $1.5 billion hits to their net worths on Thursday as shares of Google’s parent company slipped by less than 1%.

In contrast, Walmart stock climbed nearly 4% to a record high on Thursday, as fears eased over tariffs and investors rotated out of tech.

The retailer’s stock jump added more than $4 billion to the respective net worths of founder Sam Walton’s three surviving children: Jim, Rob, and Alice.

The trio was worth more than $150 billion each at Thursday’s close. They only trail Musk in wealth gain this year after notching increases of more than $20 billion apiece.

The world’s 10 wealthiest people together grew nearly $600 billion richer last year, catapulting their combined fortunes above $2.5 trillion — more than Amazon is worth.