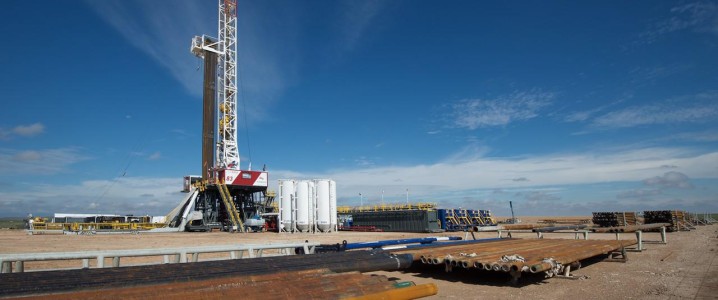

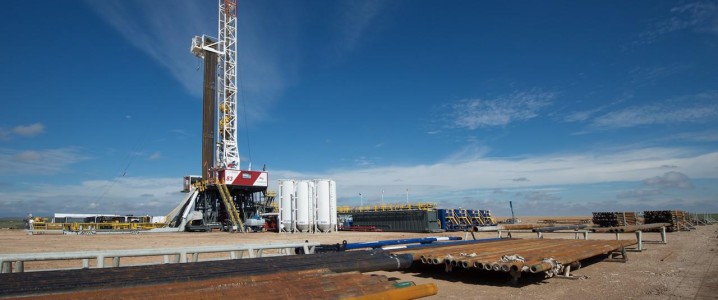

The total number of active drilling rigs for oil and gas in the United States stayed the same this week, according to new data that Baker Hughes published on Friday, keeping the total rig count in the US at 551 this week, down 41 from this same time last year.

The number of active oil rigs stayed at 409 during the latest reporting period, according to the data. This is 79 below this same time last year. The number of gas also held steady at 133, which is 34 more than this time last year. The miscellaneous rig count stayed the same at 9.

The latest EIA data showed that weekly U.S. crude oil production rose again this week, by 22,000 bpd in the week ending February 13, to 13.735 million bpd on average, 127,000 bpd under the all-time high.

Primary Vision’s Frac Spread Count, an estimate of the number of crews completing wells, rose during the week ending February 13 by 8 after losing 3 crews in the week prior.

The number of active drilling rigs in the Permian Basin rose this week by 1, reaching 239, which is 65 rigs under year-ago levels. The count in the Eagle Ford held steady at 40, which is 8 fewer than this same time last year.

Oil prices were trading lower on the day prior to the data release. Brent futures are trading at $71.40 per barrel (-0.36%). WTI was trading down $0.25 per barrel on the day at $66.15, up week over week.

By Julianne Geiger for Oilprice.com

More Top Reads From Oilprice.com

Back to homepage