$47 million in fresh capital strengthens deployment of ethanol-to-jet fuel technology and global SAF expansion.

Investment led by IAG and Shell signals airline and energy sector alignment around scalable SAF pathways.

Governance restructuring and feedstock tolling agreements reduce supply risk and improve bankability of future projects.

LanzaJet has secured $47 million in new capital through the first close of a broader $135 million equity raise, valuing the sustainable fuels developer at $650 million pre-money. The round is co-led by International Airlines Group (IAG) and Shell, with additional investment from Groupe ADP, LanzaTech, and Mitsui, all existing shareholders expanding their stakes.

The funding supports operations and growth at LanzaJet Freedom Pines Fuels in Georgia, the world’s first fully integrated commercial-scale ethanol-to-fuels facility. It also positions the company to accelerate deployment of its alcohol-to-jet (ATJ) technology across a growing pipeline of global projects.

Separately, a grant from the UK Department for Transport’s Advanced Fuels Fund will support Project Speedbird, a planned sustainable aviation fuel biorefinery in Teesside. Combined with the equity raise, the company now has $47 million in near-term capital to advance expansion.

First Commercial-Scale Ethanol SAF Production Achieved

At the end of 2025, Freedom Pines began producing ASTM-certified fuels, marking a milestone for alternative jet fuel pathways.

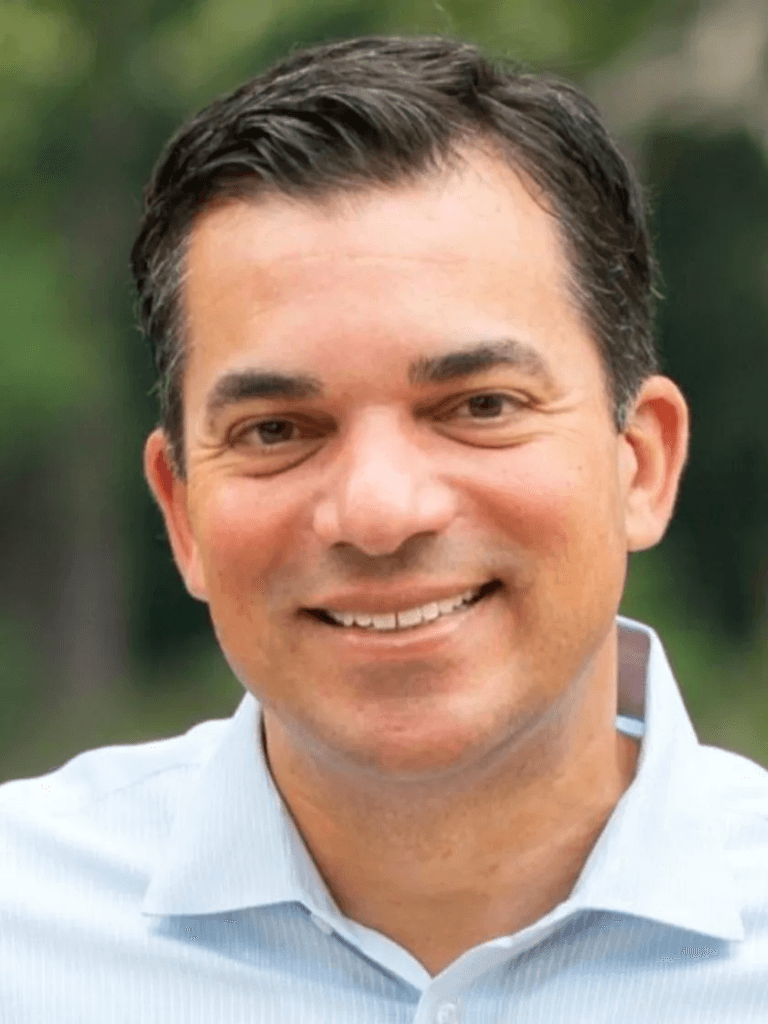

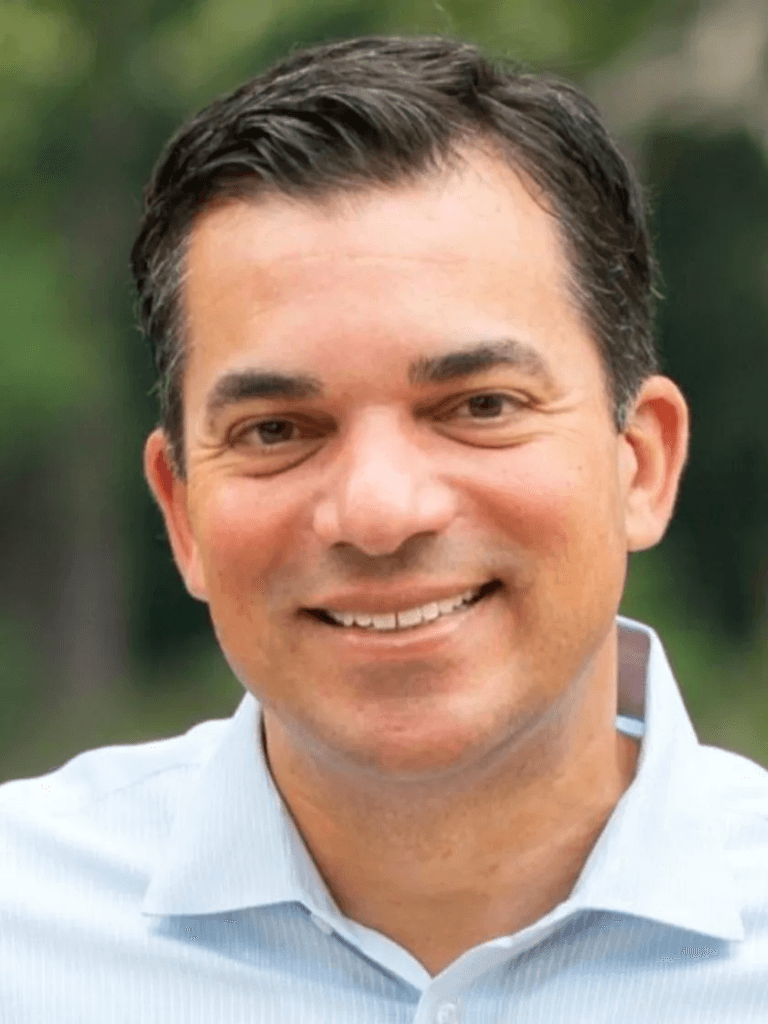

“We’re at a pivotal moment at LanzaJet. At the end of 2025, we announced that we fully operated and produced ASTM on-spec fuels at LanzaJet Freedom Pines Fuels – marking both the world’s first production of jet fuel using ethanol as a feedstock at a commercial-scale plant, and the first non-oil-based scalable renewable solution compatible with today’s aircraft. The decision by our existing investors to lead this fundraising round reaffirms their conviction in our technology and sends a strong signal to the entire industry that LanzaJet is committed to unlocking new value for ethanol, creating opportunity for economic development, and defining the future of fuels for transportation,” said Jimmy Samartzis, Chief Executive Officer of LanzaJet.

The technology converts low-carbon ethanol into SAF and renewable diesel, offering a drop-in fuel compatible with existing aircraft and infrastructure.

Tolling Agreements Secure Feedstock and Offtake

As part of the financing round, LanzaJet is implementing a multi-year tolling structure at Freedom Pines. Under the arrangement, the facility will process low-carbon, waste-based ethanol produced domestically in the United States, alongside renewable natural gas sourced from a regional supplier.

The tolling structure guarantees feedstock supply and secures offtake for all plant production, addressing two major risks that often constrain project finance for emerging fuels infrastructure.

This model strengthens commercial predictability while lowering lifecycle emissions through waste-based inputs.

Strategic Alignment Across Aviation and Energy

The investor mix highlights growing convergence between airlines, energy companies, infrastructure operators, and industrial partners seeking scalable SAF solutions.

IAG’s involvement aligns with airline decarbonization mandates and EU SAF blending requirements. Shell’s participation reflects growing demand for alternative fuels within global fuel supply networks. Groupe ADP’s role underscores airport operator interest in future fuel logistics and supply resilience.

The UK Advanced Fuels Fund grant further illustrates government support for domestic SAF production as part of energy security and industrial policy.

RELATED ARTICLE: LanzaJet Secures $20 Million from Groupe ADP to Advance Sustainable Aviation Fuel Technology

Governance Optimization and Future Investment Readiness

Alongside the capital raise, LanzaJet has streamlined its ownership and governance structure to improve decision-making efficiency and attract future investors. Enhanced governance frameworks are increasingly critical as SAF projects scale and seek institutional capital.

What Executives and Investors Should Watch

The company’s progress arrives as regulators and airlines face tightening decarbonization timelines. SAF remains one of the few viable pathways for reducing aviation emissions at scale.

LanzaJet’s ethanol-based approach offers geographic flexibility, especially in regions with established bioethanol supply chains. The secured feedstock model and guaranteed offtake may also improve financing viability for similar projects globally.

As governments introduce blending mandates and carbon pricing frameworks, scalable SAF technologies with secure supply chains are likely to command increasing strategic value.

LanzaJet’s latest funding and operational milestones reflect rising confidence that alternative fuel pathways can move from demonstration to industrial scale, reshaping aviation’s decarbonization trajectory.

Follow ESG News on LinkedIn