Up to two million tonnes of ARR carbon removals contracted through 2035 from Uganda

Part of broader framework enabling up to eighteen million tonnes of removals for Microsoft

Project links structured finance with smallholder forestry, restoration, and rural livelihoods

Microsoft has agreed to purchase two million tonnes of nature based carbon removal credits from Rubicon Carbon sourced from Kijani Forestry’s smallholder reforestation project in Northern Uganda. Deliveries will run through 2035 and form the first offtake to progress under a framework that could facilitate up to eighteen million tonnes of removals for the technology company over multiple years.

Structured Finance Meets Nature Based Removals

Rubicon Carbon positions itself as a vertically integrated carbon investment and management firm targeting higher quality removals. Its agreement with Microsoft introduces a structured model designed to accelerate capital deployment and simplify long term contracting in an emerging asset class where verification, permanence, and social co benefits remain central to investor diligence.

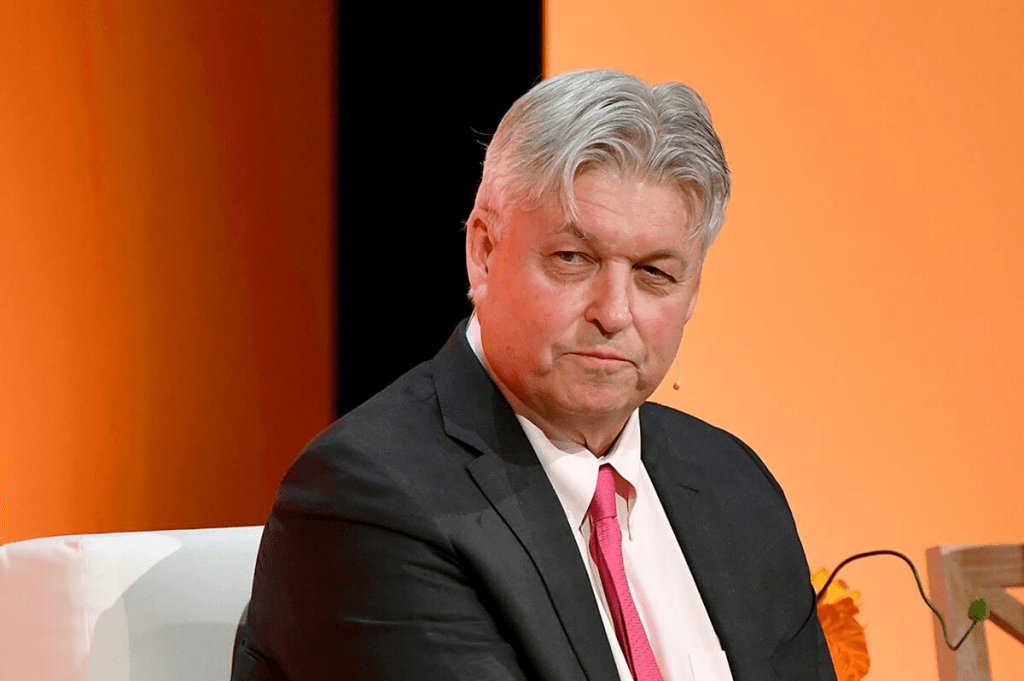

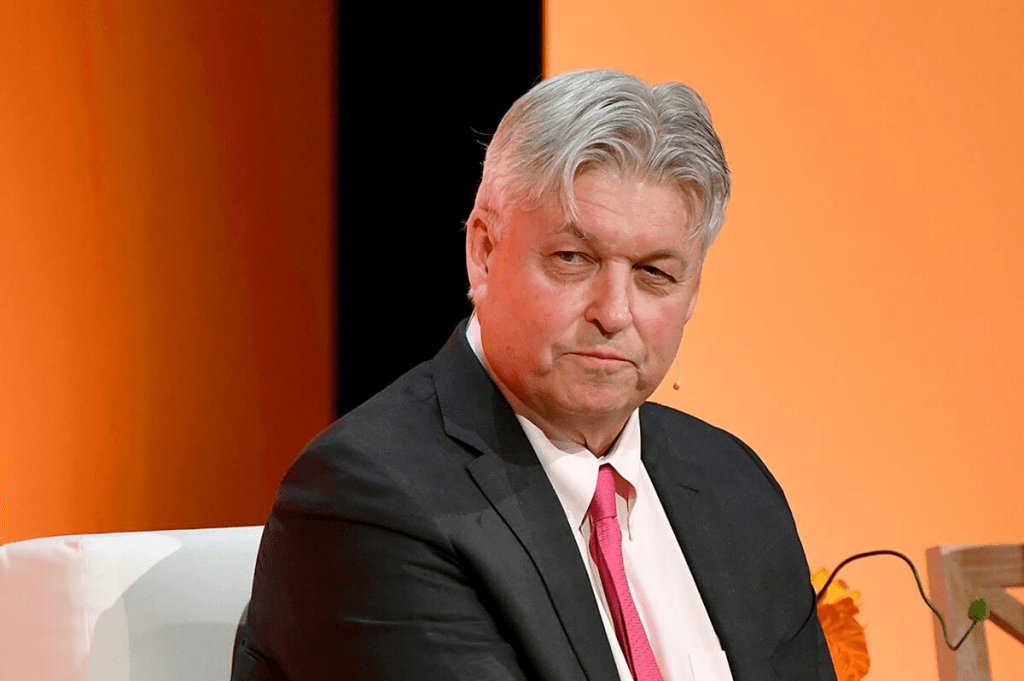

“This project demonstrates how structured finance can unlock scale in nature based removals,” said Tom Montag, CEO of Rubicon Carbon. “By providing long term capital to Kijani Forestry’s project, we’re helping deliver climate impact while expanding economic opportunities for the communities pivotal to building and preserving these ecosystems.”

Uganda’s Regulatory Architecture and Project Approval

The credits will qualify as Afforestation, Reforestation, and Revegetation removals and are among the first projects approved under Uganda’s Climate Change Mechanisms Regulations. The rules create a domestic governance framework for international carbon transactions linked to national restoration priorities. For buyers, regulatory clarity reduces counterparty and policy risk. For hosts, it sets conditions for benefit sharing and sustainable land use aligned with national climate strategies.

Smallholder Forestry and Rural Income

Kijani Forestry works with more than fifty thousand farming households in Northern Uganda to plant fast growing woodlots on degraded land. The company reports more than thirty million trees planted to date and employs over six hundred full time workers. These woodlots are structured as income generating assets. Farmers receive early carbon revenue and later monetize sustainable timber and charcoal, which can reduce pressure on natural forests and restore ecosystem function.

Kijani estimates household incomes could increase by more than six hundred percent per acre planted once the trees reach maturity. The Microsoft offtake has accelerated that pathway by enabling farmers to earn carbon revenue within a year of planting, rather than waiting for trees to reach harvestable scale.

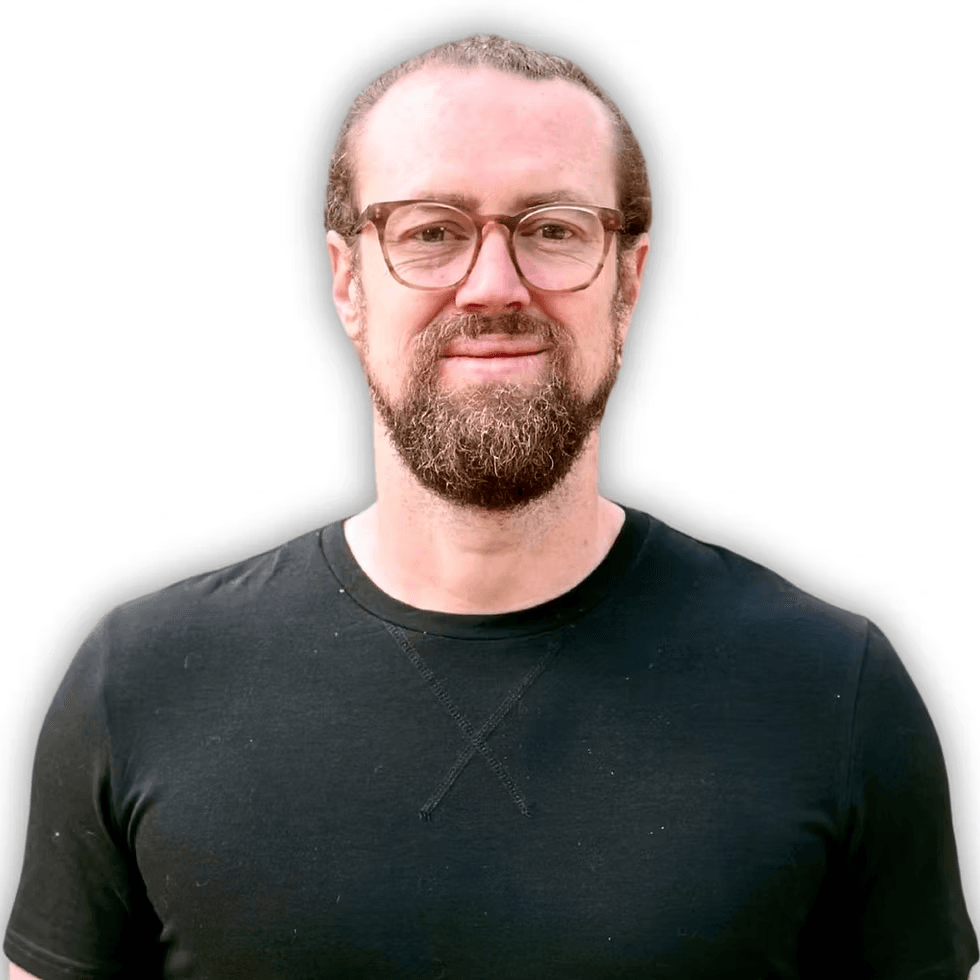

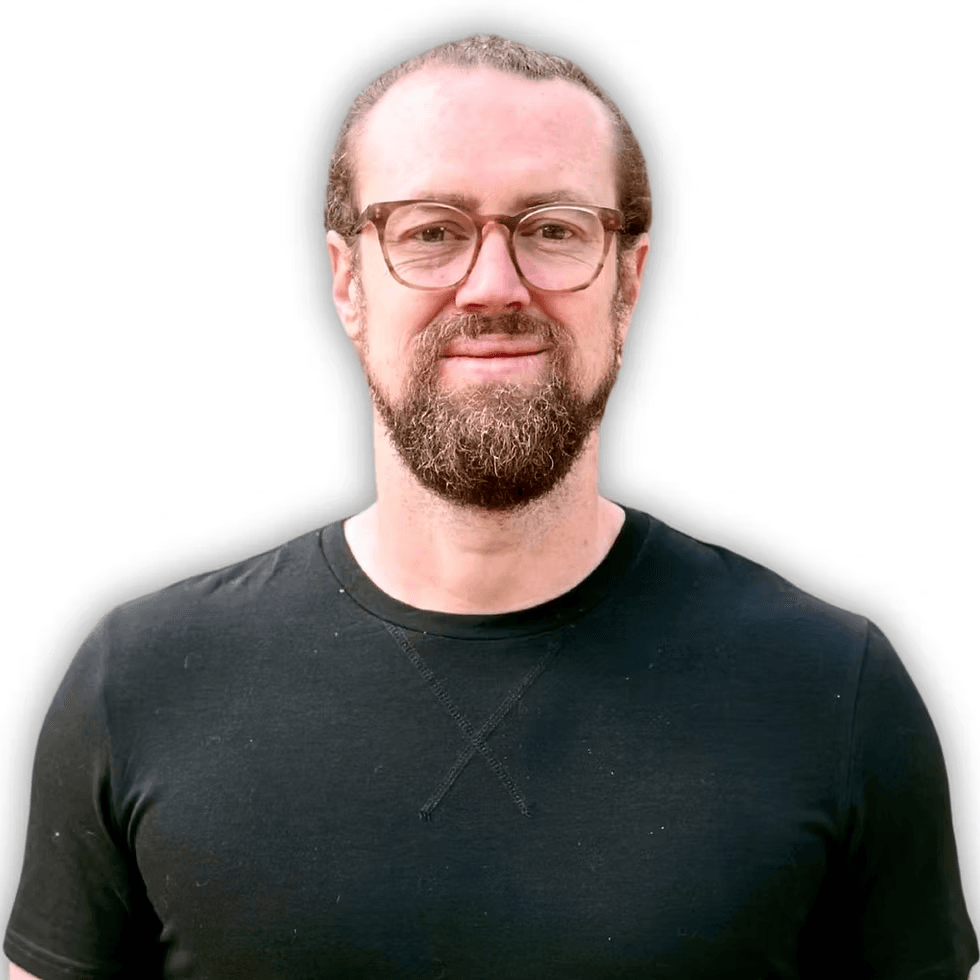

RELATED ARTICLE: Microsoft Invests in Fortera to Scale Low-Carbon Cement Production

“Working with Rubicon Carbon enables us to reach more farmers, restore more land, and accelerate climate impact,” said Quinn Neely, Co Founder and CEO of Kijani Forestry. “This collaboration demonstrates what is possible when multi year finance reaches communities on the frontlines of climate change. We are also grateful for the leadership and continued support of the Ministry of Water and Environment, whose commitment to sustainable land use has helped make this work possible, unlocking benefits for tens of thousands of Ugandans while advancing national restoration goals. We are proud to show how carbon markets can regenerate ecosystems at scale while uplifting livelihoods throughout Ugandan communities.”

Corporate Demand for Nature Based Removals

Microsoft has expanded its carbon removal procurement strategy as part of its climate neutrality objectives and to hedge against long term compliance and voluntary market dynamics linked to artificial intelligence driven data center growth. Nature based removals are appealing for their potential scale and co benefits, though developers must demonstrate durability, monitoring rigor, and host country alignment.

“We are pleased to support Kijani’s work in strengthening farmer livelihoods while restoring ecosystems in Northern Uganda,” said Phillip Goodman, Director of Carbon Removal at Microsoft. “The framework with Rubicon Carbon streamlines the contracting process, while ensuring project quality and unlocking financing for nature based removals.”

Implications for C Suite and Investors

The transaction illustrates how structured finance, regulatory clarity, and long term procurement frameworks can reduce risk for both buyers and project developers in carbon markets that remain fragmented and geographically uneven. It also signals a growing emphasis on supply chain integrity, host country benefit sharing, and alignment with policy frameworks that allow removals to count toward national climate goals without compromising corporate claims.

For host economies, carbon markets are increasingly framed as mechanisms to mobilize investment into rural restoration and land use transition. For corporates, the priority is cost effective decarbonization combined with credible climate accounting as net zero plans move from strategy to execution.

Global Context

Uganda’s move to regulate carbon market participation reflects a broader trend across Africa and Asia where governments are designing architectures for sovereign oversight, benefit allocation, and international verification. As voluntary and compliance markets converge, frameworks that combine social development, ecosystem recovery, and carbon delivery may gain strategic relevance for global buyers seeking diversified, long dated portfolios.

Microsoft’s procurement from Kijani adds to that transition, linking climate finance to reforestation across a region shaped by demographic growth, energy insecurity, and land degradation. The outcome will be watched by investors and policymakers evaluating whether nature based removals can scale while sustaining both environmental integrity and local livelihoods across emerging markets.

Follow ESG News on LinkedIn